Academy Trusts: Top 5 audit findings from 23-24

Each year, as part of the statutory external audit, we report the findings of our work in our management letter presented to the Audit Committee or Governing Board. We look back at some of the key audit findings from the 23-24 year.

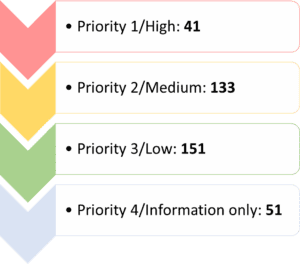

All findings are given a priority rating based on their importance. These findings are then reported to the ESFA as part of the submission of the statutory financial statements.

In the 23-24 year we acted for 63 academy trusts and raised a total of 355 new findings separated as follows:

What were the top 5 audit findings concerning?

- Changes in governance information

- Breach of financial regulations

- Incorrect accounting treatment

- VAT treatment

- Fixed assets

Changes in governance information

The Academy Trust Handbook stipulates that academy trusts must notify the DfE of changes to their governance information via Get Information About Schools (GIAS) within 14 calendar days of the change and must publish on its website, up-to-date details of its governance arrangements. All academy trusts are also required by law to inform Companies House of any changes within 14 days.

Failure to meet these requirements results in one of the most common audit findings we report each year.

Our audit team also raised various findings relating to the register of business interests. As a reminder to all academy trusts, the ESFA Academy Trust Handbook states that;

- The trust must keep a register of any relevant business and financial interests, including governance roles in other educational institutions, for (as a minimum) members, trustees, local governors and senior employees, serving at any point over the past 12 months.

- The register must include their full names, date of appointment, term of office, date they stepped down (where applicable), who appointed them and relevant business and financial interests.

- The register must identify relevant interests from close family relationships between the academy trust’s members, trustees or local governors. It must also identify relevant interests arising from close family relationships between those individuals and employees.

- Trusts should consider whether other interests should be registered, and if in doubt should do so. Boards of trustees must keep their register of interests up-to-date at all times.

See our article here on the detailed requirements for reporting relating to GIAS, Companies House and the academy trust’s website.

Breach of financial regulations

A common deficiency we see year on year is an academy trust not following their own financial regulations or policies. Following appropriate processes and procedures put in place through the trust’s own financial regulations and policies is a key part of compliance and helps to mitigate risks.

Examples of findings raised in 23-24:

“No evidence of a tendering process being conducted despite expenditure exceeding limit per financial regulations.”

“During our review of expenditure, it was noted that purchase orders are not always raised in line with the procurement policy.”

“It was noted that for an instance of expenditure, no quotes were obtained where required per the finance regulations.”

“The majority of Trust finance manuals are significantly out of date and were last issued in December 2020.”

“Upon review of the scheme of delegation and the financial regulations, we noted that orders up to £5,000 must be authorised by the Business Manager. However, from speaking to management this does not occur in practice.”

Importance of financial regulations and scheme of delegation

Trustees and management must maintain robust oversight of the academy trust. The trust must take full responsibility for its financial affairs, and stewardship of assets, and use resources efficiently.

The governing board cannot delegate overall responsibility for the academy trust’s funds. However, it must approve a written scheme of delegation of financial powers that maintains robust internal controls. The scheme of delegation should be reviewed annually, and at the next available board meeting when there has been a change in trust management or organisational structure that would impact the effectiveness of any existing scheme of delegation.

Alcohol:

We reported 3 academy trusts of having instances of alcohol purchase in the 23-24 year and these findings were raised at the highest priority in our management letters. The ESFA guidance is clear on alcohol; “The trust’s funds must not be used to purchase alcohol for consumption, except where it is to be used in religious services.” This includes from unrestricted funds.

Incorrect accounting treatment

“We noted two instances of double counted invoices within our review of accrued expenditure. Both invoices were dated in August 2024 and were already included in trade creditors.”

“It was noted that a large proportion of trip income and expenditure relating to the year was incorrectly deferred.”

“It was noted during our testing that £626k of accruals had not been accounted for. The invoices related to capital works completed over the summer holidays.”

“We have identified an instance during our testing of purchases where the transaction date per the accounting system differs from the invoice date by 31 days.”

“During our review of non-grant income, we noted for 2 samples (out of 43) that the income received had been posted to the wrong nominal code within Sage. All income should be coded to the correct nominal.”

“We have seen that the year-end payroll creditor is not split between the balance due to HMRC and the balance due to pension providers.”

What support is available to me?

We encourage all our academy clients to contact us for support regarding accounting treatment via our free Academy Helpdesk ([email protected]). It is important to us that our clients feel supported throughout the year and not just during the audit period.

VAT

VAT for academies has always been a complex area and we are seeing an increasing amount of academy trusts failing short of the HMRC rules. For a lot of academy trusts we found that a business/non-business apportionment calculation was not being completed and this could give risk to a risk of overclaiming VAT.

Academy trusts who were not VAT registered and instead completing VAT126 forms often believed they were exempt from the need to do an apportionment, which is not the case. Overhead costs attributable to both business and non-business supplies must be apportioned, in a fair and reasonable manner. When completing VAT claim forms, academy trusts cannot recover VAT directly attributable to its business (i.e. trading) supplies whether taxable or exempt and cannot recover VAT relating to the proportion of overheads attributed to business supplies. There is no concept of ‘de minimis’ for this apportionment.

Academy trusts which are VAT registered must adhere to the partial exemption rules.

Academy trusts should always give consideration to the VAT implications of business and non-business supplies. We recommend any trusts who are unsure on the VAT implications to arrange for a bespoke VAT review to be undertaken by our specialist tax team who can offer guidance on the correct treatment. Please contact our Academy Helpdesk ([email protected]) for more information.

Fixed assets

In the 23-24 year we raised a significant number of points relating to the fixed asset register (FAR) not being maintained, the accounting system not agreeing to the FAR and incorrect capitalisation treatment.

It is an Academy Trust Handbook must to manage, oversee assets and maintain a fixed asset register. An academy trust must have its own fixed register and keep it up to date alongside the accounting system.

Last year we ran a free webinar aimed at academy trusts and maintaining the fixed asset register. A recording is available on demand. As a follow up to that session, our team of experts also wrote the following article: Fixed assets, capitalisation & maintaining the fixed asset register which is a recommended read for all our academy trusts.

Further support

If you would like support, advice, or have any further questions regarding this article, you can contact our team using the form below.

Please visit our events page for information on our upcoming regulatory insight sessions for academy trusts.

Read our 22-23 audit findings here:

As Price Bailey’s audit team draw close on another year for the academies sector, we look back at some of the key audit findings from the 22-23 year.

Each year we report the findings of our work in our management letter presented to the Audit Committee or Governing Board. All findings are given a priority rating based on their importance. These findings are then reported to the ESFA as part of the submission of the statutory financial statements.

In the 22-23 year we acted for 65 academy trusts and raised a total 376 findings separated as follows:

What were the top 5 audit findings concerning?

- Related parties

- Fixed assets

- Authorisation

- Documentation

- Changes in governance information

Related parties

Audits are carrying an ever-increasing amount of regulation, especially within public funded organisations. With this in mind, the reporting of related parties is under more scrutiny than ever before and is a key area of focus for auditors and regulatory bodies alike.

In the 22-23 year we found 30% of the high priority 1 points raised were in relation to related parties. These points were either concerning a transaction that had not been correctly reported to the ESFA or business interest and declaration forms not being completed correctly.

As well as complying with the Charity SORP, academy trusts are required by the ESFA Academy Trust Handbook to report in advance all related party transactions using the ESFA’s online form.

Furthermore, ESFA approval (rather than just declaring) is required for contracts and agreements for the supply of goods or services over £40,000 effective from 1 September 2023 (historically £20,000).

We also need Trustees, Members and Key Management Personnel to declare their related parties (including close family/ connected parties) to us as their auditors. This involves the completion of a related party declaration form or access to a register maintained by the academy trust which contains this information. It is important that the names of close family are recorded, even if they do not have any substantial interests or influences. Declarations must be reviewed and updated as soon as any changes are known. All new Trustees and Members should be declaring this information before they are appointed.

Academy trusts must publish on their website, relevant business and financial interests of members, trustees, local governors and accounting officers, in line with ESFA guidance.

See our blog here on why it is important for academies to clearly disclose related parties and what the requirements are.

We host an annual webinar on related party transactions with our next one planned for May 2024. Please see our website for latest events.

Fixed assets

In the 22-23 year we raised a significant number of points pertaining to the fixed asset register not being maintained and no associated year-end adjustments being made in the finance system.

It is an Academy Trust Handbook must to manage, oversee assets and maintain a fixed asset register.

We run a free annual fixed asset training workshop with the next session due in May 2024. This session covers what and when to capitalise, ESFA capital grants, what your register may look like and how to roll it forward from the prior year, journals, disposing of an asset, new school convertors and gifted assets. This is a great opportunity to ask any questions ahead of the next audit season to ensure you do not have any recurring management letter points on maintaining the fixed asset register.

Please contact the Academy Helpdesk ([email protected]) or check our website for further event information.

Authorisation

In the 22-23 year nearly 15% of the findings raised were connected to authorisation of some kind.

Some examples of the type of points raised:

“During our testing of expenditure, it was noted that some purchase invoices did not have any proof of authorisation.”

“During our charge card testing it was found in one instance that the school business manager authorised their own charge card statement.”

“It was identified that three staff mileage claims were not authorised by the Head Teacher as per the Financial Regulations.”

A key part of our testing is ensuring for a sample selected, whether for charge cards, expenditure or expense claims, the processes and authorisation procedures are in line with the academy trust’s financial regulations. We often see this is not the case and thus reported as a deficiency in the academy trust’s internal control environment.

Following appropriate authorisation procedures is vital, a key part of compliance and helps to mitigate risks.

Documentation

A common deficiency we see year on year is the lack of documentation or supporting evidence, so it comes as no surprise one of the top 5 audit findings in the 22-23 year related to this.

This covers a variety of audit areas from staff ID documentation, expense claim receipts and petty cash receipts to goods received notes, purchase orders and value for money considerations.

Documentation provides a formal record of decisions agreed and in the examples above, supports work or services carried out, corroborates expenditure and ensures management are appropriately accountable for decisions made.

Changes in governance information

The Academy Trust Handbook stipulates that academy trusts must notify the DfE of changes to their governance information via Get Information About Schools (GIAS) within 14 calendar days of the change and update their website and Companies House accordingly.

When we see these various databases not being updated in a timely manner it results in an audit finding. This type of finding is one of the most recurrent points we raise each year.

See our blog here on the detailed requirements for reporting on each of these databases.

We can help

Contact us today to find out more about how we can help you

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.