Foreign Direct Investment remains buoyant in the UK

At Price Bailey, our Strategic Corporate Finance team are frequently approached by business owners who have received expressions of interest, or perhaps even an offer, to buy their business from an overseas acquirer. Whilst this can be exciting, it can also often be a confusing time for business owners to understand how to respond and what the appropriate path to take may be.

In light of this experience, we have explored here the trends in overseas investment into UK businesses over the last 10 years. In part two of our article, we will go on to answer the question “What should you do if you are approached by an overseas buyer?”

Overseas investment into UK businesses over the last 10 years

It is fair to say that the last 10 years has been turbulent for the UK M&A and private equity markets. Whilst these markets saw strong recovery following the 2008 financial crisis at the beginning of the decade, the UK’s decision to leave the European Union, the worldwide impact of the pandemic and ongoing domestic and international political instability has led to uncertainty for dealmakers and acquirers.

However, in spite of the economic turmoil, the latest M&A Attractiveness Index published by Bayes Business School has ranked the UK 3rd globally, making it one of the top targets for inbound and domestic investment in Europe, behind the US and Singapore. This represents a four place improvement on the previous year, suggesting that circumstances may not actually be quite as bleak as first feared.

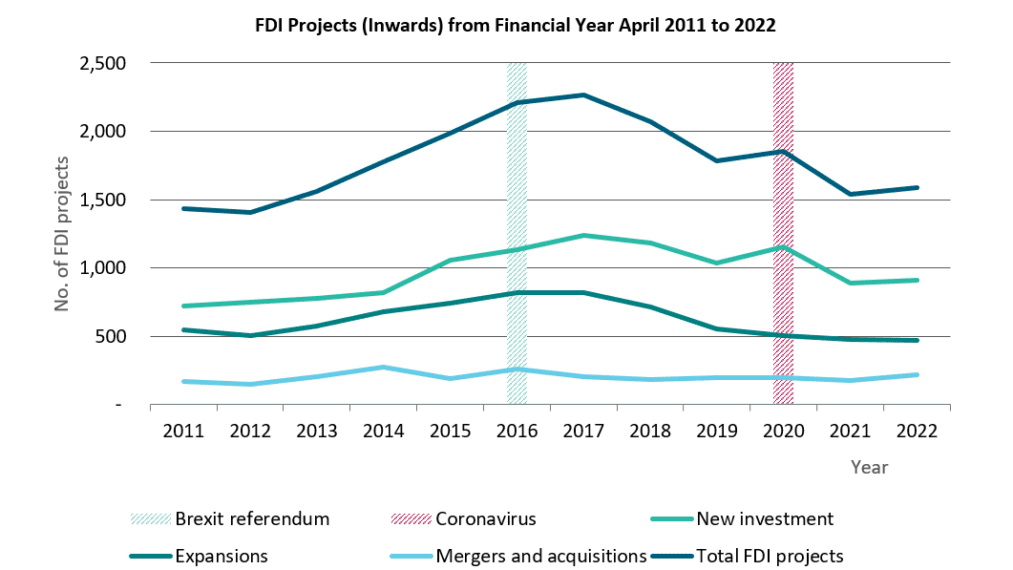

Data published by the Department for International Trade (“DIT”) enables us to examine these trends in further detail. Looking at the inward investment in the UK (defined by the number of Foreign Direct Investment (“FDI”) projects in each financial year), it can be split between three categories:

- New investments

- Expansion of existing investments and

- Mergers and acquisitions.

Whilst not providing data on the actual value of FDI investment in the UK, this is illustrative of the key trends in investment patterns across the decade.

Following a period of strong growth as the UK recovered from the 2008 recession, what is perhaps most interesting to see is the lag in the fall of investment activity following the Brexit referendum. This is a contrast to the dramatic graphs showing the reaction of the currency markets widely reported across broadsheets following the announcement of the referendum results.

Nonetheless, whilst less dramatic, the general trend of the drop-off in investments is clear in the lead-up to the UK exit date on 31 January 2020, driven by the fall in expansionary investments from existing investors. In line with expectations, new investments actually remained fairly consistent across this period, as investors attempted to get a physical presence in the UK prior to the official leaving day.

However, following the UK’s official exit from the EU, new investment in the UK stalled and fell, perhaps compounded by the impact of the pandemic on global investment markets, and resulted in a drop in total FDI projects of 17% in 2021.

Results in the year to April 2022 showed some optimism and recovery in FDI projects, driven by M&A activity from businesses who were able to sustain high levels of retained earnings from the release of pent up demand, lower costs following pandemic reviews on spending, significant Government support and low financing costs. However, from data currently available, it remains unclear what the impact of political instability (both domestic and internationally driven by Russia’s invasion of Ukraine), high borrowing costs and the cost of living crisis and looming recession may have on future investment into the UK.

In recent years, both within Price Bailey’s own deal activity and across our peers, we are seeing strong overseas appetite to acquire UK companies, driven by a number of factors:

- A top European economy – Despite the noise surrounding Brexit, the UK is still one of the biggest economies in Europe, second only to Germany. The UK continues to provide a key gateway to Europe for US and Asian purchasers. For US purchasers, it can also sometimes offer an easier language and cultural fit than other parts of Europe.

- Growth industries – Whilst some markets are experiencing challenging and uncertain conditions; many sectors continue to experience growth that is likely to be sustainable. To take full advantage of this, companies need a physical presence in the UK, and overseas buyers need to acquire established local businesses, increasing their international footprint to benefit from that growth.

- Intellectual property (IP) – The UK is one of the major global creators of IP. In a global market, being the cheapest supplier is not sustainable in the long term. We have seen overseas buyers, particularly those from low-cost markets, look to acquire UK businesses to gain control of IP to safeguard the longevity of their own business.

- Continuation of UK trade – In other instances, the UK’s departure from the EU has caused some overseas corporates to acquire in the UK to continue trading here with fewer restrictions. Interestingly, we are observing the reverse being true with UK businesses acquiring in Europe to enable the continuation of Eurozone trade post Brexit.

- New trading opportunities – A key promise of the Brexit campaign was the freedom of the UK to negotiate new trading agreements with non-EU bodies. Whilst talks with the US, Australia, Mexico and India among others are ongoing (with some skepticism surrounding the success of these), overseas investors are positioning themselves within the UK to benefit from any growth opportunities that may arise from this.

- Foreign Exchange – Over the last ten years the value of the Pound Sterling has depreciated significantly compared to its US Dollar and Euro counterparts. This makes the UK attractive for international investors, who can get more for their money and make the most of the ‘cheap’ deals.

- ‘Cheap’ investments – UK shares are known for trading at a huge discount to US and European peers, with this difference exacerbated since the impact of the COVID-19 pandemic (with financials, energy and real estate sectors trading at a discount of c.40-50%, compared to 12-20% historically). Whilst this may be indicative of a lack of demand and overall pessimism from international investors, this also presents an opportunity to ‘buy cheap’ and benefit from a reversion to normal levels.

Who is investing in UK businesses?

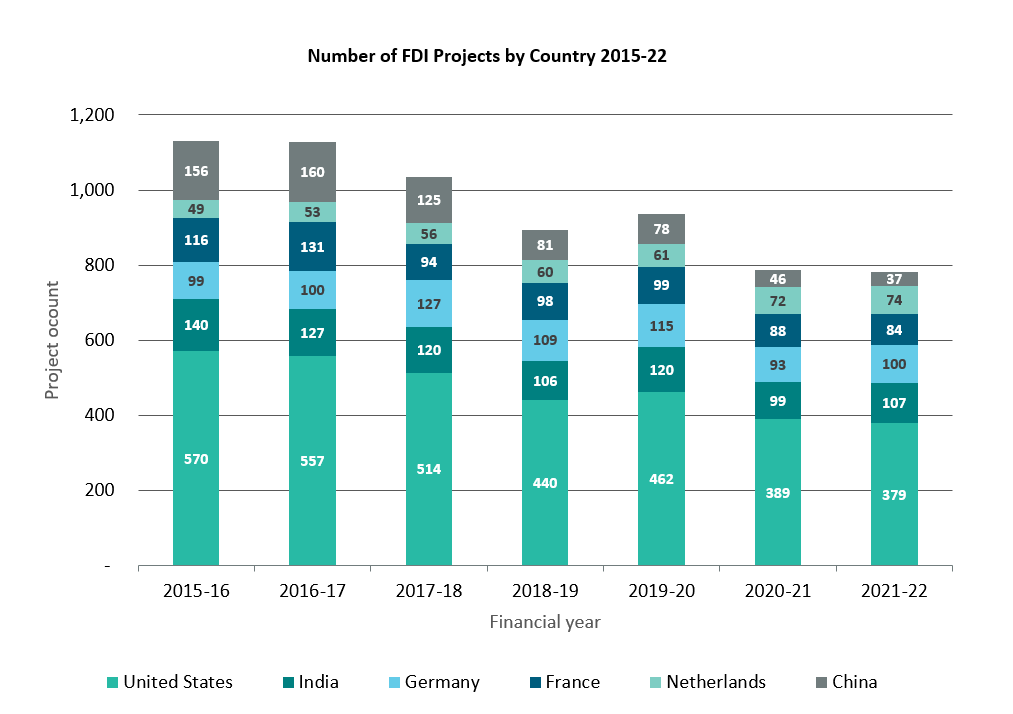

The DTI data provides useful insight over where investment comes from and how this is changing over time.

Unsurprisingly, since 2015, the US has remained the top source of investment into the UK, accounting for ~25% of total FDI projects in each year. In 2022, this was closely followed by India, Germany, France and the Netherlands at an average of 6%, 6%, 5% and 5% respectively. This represents a slight shift from previous years; for example, whilst China held the number 2 and 3 spot from 2015 to 2018, in 2022 they fell to 14th position as a result of tighter internal capital controls in China in recent years. Interestingly (and in contrast to the news headlines of large quantities of personal Russian wealth being held in the UK following the outbreak of the Ukraine war) it appears that Russia’s contribution to FDI projects historically has been limited, ranking 29 and 25th in 2020 and 2019 respectively.

Where are overseas buyers investing?

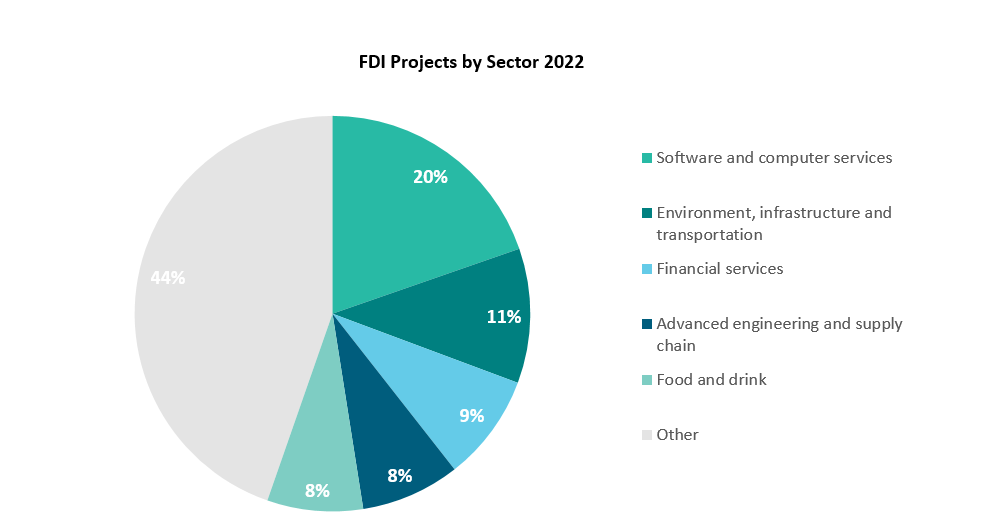

Whilst no one sector dominates the attention of overseas acquirers, one of the UK’s fastest growing and higher value sectors, software and computer services, represents a key driver of FDI investment across all years, accounting for an average of 20% of all projects across the six year period. Environment, infrastructure & transportation, financial services, engineering & supply chain, and food & drink industries as the other four top industries for FDI all account for a similar proportion, as can be seen in the chart below.

What does this mean for you as a UK SME business owner?

Whilst it is clear that overseas investments remain below pre-Brexit, pre-Coronavirus levels and many of the headlines focus on larger scale investments being delayed or dropped, it is clear both from the data and from our own experience that demand for UK SME’s remains buoyant with overseas companies seeking expansion opportunities backed by cheap debt.

However, recent changes in the global economic and political environment is causing investors to be more selective in their due diligence. All of this means UK sellers need to be prepared when going into a sale process, clear on the value they deliver and robust in negotiations.

We are also seeing more complex deal structures with deferred consideration, earn-outs, retained stakes and reinvestment. Understanding the impact on value and tax consequences of these is important when assessing which offer represents the best value. I’ve seen unadvised owners put business plans on hold whilst discussions with a buyer are progressing, not knowing what to do and what not to, with the business stagnating in the meantime and the deal subsequently falling over.

My advice is to continue to do what’s right for the business as the deal may never happen – this comes back to the need for an advisor you can trust who should be able to navigate the difficult challenges and drive the process on your behalf.

If you find yourself in the situation where you would a) like to explore whether your business may be an attractive target for an overseas buyer, or b) you have already been approached by an overseas buyer and want to know what the next steps are, please get in touch with one of the team using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.