10 exciting British CleanTech and ClimateTech businesses ahead of COP28

As the COP28 conference begins in Dubai this week, we look at how British businesses have contributed to the growth of CleanTech and ClimateTech development, and highlight 10 exciting and innovative British companies who are paving the way for a sustainable future.

British CleanTech and ClimateTech investment

In the last seven years to end of October 2023, £12.4bn has been invested into unquoted British CleanTech and ClimateTech businesses through equity fundraising. According to data acquired from Beauhurst and Pitchbook, the market has seen an upwards trend from 2016 to 2022 both in the total investment amount and in the number of deals, with 2022 featuring as a stand-out year where investment increased by 45% in just one 12 month period to £3.4bn.

Data source: Beauhurst

So far in 2023, both the volume and value of deals has experienced decline and there we have witnessed a 43% decline in the valuation of companies receiving equity investment, from an average pre-money valuation of £30m in 2022 to £17m in 2023. This downturn, however, should be interpreted as a reflection of prevailing uncertainties across capital markets currently rather than a diminished appetite for investment in sustainable industries.

Where is investment in CleanTech and ClimateTech coming from?

Data source: Beauhurst

Despite the market’s domestic orientation, with 58% of all fundraisings being British-based, international interest is substantial.

The United States, contributing a significant 42% (£353m) of total international investment between 2016-2023, stands out as a major investor. Japan follows closely with a 29% share, while Germany, Brazil, and Switzerland contribute 7%, 6%, and 5% of total equity capital in British CleanTech and ClimateTech, respectively. Intriguingly, the U.S. and Japan, while wielding considerable investment value, engage in fewer deals, suggesting a strategic focus on quality over quantity.

Venturing beyond the data to understand where investment is going within these two dynamic industries, we delved into the profiles of 10 exciting high-growth businesses in the CleanTech and ClimateTech space; exploring the innovative and pioneering endeavours shaping these industries.

10 exciting British CleanTech and ClimateTech businesses

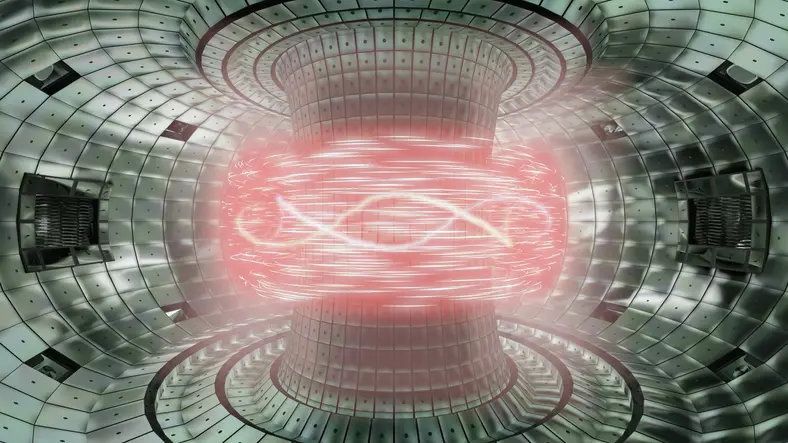

Tokamak Energy

Based in Oxford, Tokamak Energy, a leader in global commercial fusion energy, was incorporated in 2009. A spin out of the Culham Centre for Fusion Energy, their co-founders are Dr David Kingham (a graduate of the University of Cambridge, a trained theoretical physicist, and the Executive Vice Chairman of Tokomak Energy), Dr Mikhail Gryaznevich (who has a PhD in Plasma Physics and Nuclear Fusion, is a leading global authority on tokamaks, and the Chief Scientist of Tokomak Energy), and Alan Sykes (whose tokomak design forms the basis for their next generation of commercially viable fusion technologies).

Tokamak Energy, who are the holders of 32 active patents, are pursuing fusion through the combined development of spherical tokamaks with high temperature superconducting (HTS) magnets. The idea for their technology began with a theoretical study conducted by one of their founders Alan Sykes, where it was revealed that by modifying the shape of the tokamak, the performance would be greatly impacted. A cored apple shaped plasma allows for the plasma to be contained more efficiently, compared to a doughnut shape. Building upon this, Tokomak Energy’s ST40, their compact spherical tokamak, demonstrated a world-first by reaching a plasma temperature of 100 million degrees Celsius in early 2022. This further proved that spherical tokamaks are the optimal route for the delivery of commercial fusion energy.

To date, they have raised £150m in fundraising and their last recorded fundraising received was at the beginning of September 2023 (according to data sourced from PitchBook), from investors including Legal & General Capital, and the UK Innovation & Science Seed Fund (UKI2S). They had a significant fundraising late January 2020 of £67m at a pre-money valuation of £208m (data sourced from Beauhurst).

Their aim is to have commercial fusion power plants deployed in the 2030s. One of these plants can generate electricity for 500,000 homes, or industrial heat for applications such as hydrogen production. They have also completed design work on their next advanced prototype fusion device, which has the potential to de-risk and accelerate the development of multiple technologies required for the delivery of sustainable fusion energy. Scheduled for build completion in the late 2020s, it will also demonstrate multiple advanced technologies required for fusion energy and inform the design of a fusion pilot plant. The fusion pilot plant will demonstrate the capability of delivering electricity into the grid in the 2030s, paving the way for globally deployable 500 megawatt commercial plants. Tokamak Energy’s innovative technologies have the potential to revolutionise the energy landscape, providing sustainable solutions for electricity generation and industrial heat applications in the UK and globally.

Modern Synthesis

Founded in 2019, the initial beginnings of London based Modern Synthesis began during co-founder Jen Keane’s (CEO) Central Saint Martins MA project, This is Grown. Upon being inspired by her previous time working with Adidas and Nike, she decided to re-envision the product design process by growing the upper of an athletic shoe with only bacterial nanocellulose and one continuous yarn. It is during this project where she collaborated closely with scientists from Imperial College London, including Modern Synthesis co-founder Dr Ben Reeve (CTO) (PhD in Bioengineering), who discovered and sequenced the strain of bacteria that they now employ to produce their novel biomaterials today. Their collaboration was both a response to the ongoing plastic crisis and an attempt to prove the profound design and performance possibilities of new biomaterial technologies.

While they are still an early-stage seed company, in a mid-2022 fundraising, they raised £3.3m on an estimated £441m valuation from investors that include UK-based Climate Capital and USA investor AgFunder. The purpose of this fundraising was to grow their team, to build a new facility and to develop their microbial textile platform (according to data acquired from Beauhurst).

By building upon 3.8 billion years of microbial evolution, they are crafting an entirely new class of natural materials that are circular by nature and customisable by design, displacing animal and fossil fuel derived alternatives, such as plastic films and leathers. Their patent-pending biotechnology process combines a biofilm with a natural textile, creating a nonwoven material. Their technology is addressing 5 related challenges; GHG emissions, waste, land use, plastic pollution and animal welfare.

Worn Again Technologies

Worn Again Technologies (formerly Worn Again), based in Nottingham, was born out of a determination to create a business based on solving the global problem of textiles waste. Cyndi Rhoades, a former film maker and now an advocate for textiles circularity, founded Worn Again in 2005 with the aim to reverse manufacture used textiles back into new products. In 2012, they transitioned to chemical solutions for textile waste and, in 2013, the company’s focus changed to technology development in order to accelerate the adoption of chemical recycling.

Now, Worn Again’s innovation puts quality materials back into the supply chain, with their chemical process converting textiles containing polyester and cotton back into circular materials, offsetting CO2 emissions and diverting material away from incinerators and landfill waste. Their plans for the future include the start-up of their demo plant in 2024 that will prevent up to 1,000 tonnes of textiles from being incinerated every year, a 1,000x increase from pilot scale, and, for 2027, the start-up of a first commercial plant that will convert up to 50,000 tons of used textiles into polyester and cellulose for use within a new circular supply chain.

Across 8 fundraisings, they have raised a total of £43.9m (according to data sourced from Beauhurst). Their latest fundraising in late 2022 raised a total of £27.6m on a valuation of £34m. Notable investors for this company include H&M Group Ventures, Directex, Future Tech Lab, Sulzer Chemtech, and Himes Corporation.

While the UK manufacturing industry is experiencing significant economic challenges and meeting evolving requirements to advance innovation, both Modern Synthesis and Worn Again Technologies are responding to both challenges while also demonstrating that it does not need have to be done at the cost of sustainability and responsible sourcing.

Power Roll

Power Roll’s (formerly Big Solar Ltd) journey began with Dr. Alexander John Topping (co-founder and Chief Scientist) inventing microgroove architecture and filing for their first patent, in 2011. Soon after, the Durham-based company was founded by Dr. John Topping and Saul Joicey, in 2012, in order to commercialise microgroove technology.

To date, they have raised £23m across their various fundraisings, with their latest fundraising occurring in early July 2023 (according to data sourced from Beauhurst). They have received funding from investors such as the UK government, Maven Capital, and Green Angel Syndicate.

Power Roll’s mission is to dramatically increase the worldwide uptake of solar power. They are a developer of a solar technology designed to reinvent solar in order to generate energy anywhere in the world, while ensuring minimal impact to the world and keeping costs down. The company’s technology makes ultra-thin flexible solar photovoltaic films in continuous rolls using a rapid low cost process that can be enabled for a wide range of new and improved functions that enhance automotive and smart grid performance, safety, and functionality. This all enables clients to produce clean, renewable energy at a fraction of the cost of any other source. This technology is protected by 21 separate patent families in 70+ countries to date.

While the growth and development of solar energy has been widely documented, Power Roll are a particularly exciting company in this space as they seek to tackle the cost intensive nature of both the production process and the onward cost to their clients, in doing so improving the accessibility of sustainable energy sources in the UK and globally.

Carbon Clean

With their headquarters in London, Carbon Clean, an innovation leader in carbon dioxide recovery technology, was founded in 2009, when the growth rate of atmospheric carbon was starting to soar. Their co-founders, Aniruddha Sharma (Chair and CEO) and Prateek Bumb (CTO), both graduated from the Indian Institute of Technology, Kharagpur; Aniruddha Sharma with a BSc and MSc of Statistics and Informatics, and Prateek Bumb with a BSc and MSc of Engineering. Through the technology and the services their company provides, as of July 2023, they have removed over 1.9 million metric tonnes of carbon from 49 facilities across the world.

Across 5 fundraisings, they have raised £151m. Their latest fundraising in March of last year stands out the most, raising £123m at a pre-money valuation of £400m (data sourced from Beauhurst). Some of their notable investors include The Human Energy Company, Investment Managers, and ICOS Capital.

Their patented carbon capture technology involves capturing carbon dioxide using proprietary regenerable advanced solvent combined with improved energy integration CO2 capture process. Their main mission is to help industries engage in carbon reduction, and provide all the services needed to achieve net zero, including technology licence and solvent supply, a full process design package (PDP) and proprietary equipment, and end-to-end systems — including design, build, financing and operation. Innovations like Carbon Clean’s are vital in the UK’s pursuit of achieving net zero targets by 2050.

Marine Power Systems

Swansea based Marine Power Systems (MPS) are on a mission to create a better future based on clean, affordable, renewable energy using the power of oceans. Founded in 2008, their co-founders are Dr Gareth Stockman, a qualified mechanical engineer with a MEng in Marine Renewables and a PhD from Swansea University, and Dr Graham Foster, a qualified mechanical engineer with a PhD also from Swansea University. Dr Gareth Stockman, the CEO, has achieved significant grant funding and private investment since the company’s inception for the delivery of the company’s development pathway. As CEO, he has overseen MPS through the feasibility, proof of concept, medium scale prototype development stages and now working at grid-connect megawatt scale ahead of commercialisation. Dr Graham Foster, the CTO, has a track record of financing high value start-up companies, having raised multi-million grants and venture funding to date. He also has the ability to create elegant solutions to highly challenging problems, creating sector leading IP in the process.

Their fundraising history is impressive, raising £5.5m in June of 2014 – comprising of a £3.5m grant from European Regional Development Funds (ERDF) plus a £2m equity investment, receiving £12.8m European Regional Development Funds by the Welsh Government and an additional equity funding of £2.3m in June 2020. In December of 2021, they received equity funding of £4.5m alongside a £3.5m UK Government FLOW grant (according to data sourced from Beauhurst).

MPS has developed a flexible modular technology that provides the most efficient pathway for delivering floating offshore wind at scale and accelerating cost reduction. Their floating platform technology, called PelaFlex, supports the rapid deployment of industrial scale floating offshore wind whilst maximising local content delivery through existing supply chain. They currently have 6 projects in various location across the world including Basque Country (Spain), The Celtic Sea, Northern Ireland, Japan, Viana Do Castelo (Portugal), and Orkney (Scotland).

Floating offshore wind is experiencing increasing demand as it enables wind energy to be harvested in offshore locations that are not feasible for bottom-fixed solutions; MPS’ technology provides a scalable, cost-efficient and environmentally friendly solution to increase our wind energy harvesting capacity.

Mura Technology

Mura Technology are aiming to become the world’s leading producer of recycled hydrocarbons from waste plastics. Based in London, their founders were conducting R&D into the application of HydroPRSTM core technology to end-of-life plastics when the company was founded. Mura Technology was officially established in 2016, along with the creation of the exclusive technology license for HydroPRSTM. They have two main missions; globally scaling HydroPRS™ to divert waste plastic away from incineration and, in doing so, reduce carbon emissions and prevent millions of tonnes of plastic from entering the environment, and to partner with the entire plastic recycling value chain worldwide to feed a sustainable, circular plastics economy in the next decade.

Their core technology, HydroPRS™, utilises supercritical water to convert waste plastics, including flexible and multi-layered materials, into high yields of stable hydrocarbon products for use in the manufacture of new plastics and other materials. They are 3 main advantages for this process:

- It is inherently scalable due to the use of supercritical water.

- It offers a wide scope for recycling all major types of plastic, flexible and rigid multi-layered materials included. The process is insensitive to organic contaminants, such as paper and food residue, resulting in a wide range of suitable waste plastic feedstocks.

- It contributes to high yields of valuable fossil replacement hydrocarbon products.

Mura Technology’s 2025 Annual Capacity Ambition is to have one million tonnes of recycling capacity in operation and they expect that this will continue to grow and expand as they form new partnerships. Their first commercial scale HydroPRS™ site located in Teeside, UK and named ReNew ELP was awarded a £4.4m grant from Innovate UK in 2020 (according to data sourced from Beauhurst). Construction for the site began in 2021 and in October 2023 Mura Technology announced that the site had opened, with their first hydrocarbon projects expected to be delivered to clients in 2024.

As Mura Technology begin commissioning this year, it is an exciting time for the UK’s contribution to reducing reliance on non-recyclable or reusable plastics.

Plastic Energy

Plastic Energy, one of the world’s leading chemical recycling companies and who are aiming to play a significant role in solving the global plastic problem, was founded in 2011 and has their headquarters in London. Their CEO and founder, Carlos Monreal, is a trained engineer and has been a serial entrepreneur for more than 35 years, with a focus on developing disruptive technologies and innovative solutions in the sustainability sector. He is also the founder and President/CEO for two other companies; Green Dot Global and Greenland Capital.

Plastic Energy’s recycling process converts end-of-life plastic into feedstock, which is used to replace fossil oils in the production of new plastics, while diverting plastic waste from landfill and incineration. Their patented TAC™ process involves plastics being heated in the absence of oxygen in order to form hydrocarbon vapours. These vapours are then condensed into a recycled oil, called TACOIL™, which is stored for sale to Plastic Energy’s petrochemical partner. They have an aim to process up to 5 million tonnes of plastic waste per year across Europe, Asia and the US by 2030.

They had a successful fundraise in November 2021, in which they raised capital of around £123m from three investors LetterOne, Axens and M&G (according to data sourced from Beauhurst). These funds were raised in order to accelerate Plastic Energy’s growth, and enable it to expand its technology and global portfolio of recycling plants.

The availability of suitable technology, such as that developed by both Mura Technology above and Plastic Energy, addresses one of the fundamental economic barriers to an effective circular plastics economy. As more businesses are able to access technologies like theirs, we should in time see the cost of sustainable choices become more equitable as a result.

ARI Global Technologies

Headquartered in Essex, ARI Global Technologies’ global gamer changer thermochemical conversion technology was developed and patented by ARI Technologies Inc. in the US and was granted a National Operating Permit by the US Environmental Protection Agency (EPA). UK waste-management specialists, Windsor Integrated Services Group (WISG) purchased the exclusive global rights to this technology through the newly founded company ARI Global Technologies, in 2014. Founded by Tony Windsor, WISG is a market leader in the asbestos disposal industry and since their purchase of the technology rights, ARI Global Technologies has continued to make it their mission to deploy this technology throughout the world.

Their patented Thermochemical Conversion Technology, or TCCT, destroys asbestos fibres and produces a non-hazardous product that can be recycled in many construction applications, providing an alternative sustainable and commercially viable solution for managing asbestos waste. They have been recognised for their efforts:

- Designated the ‘Best Available Technology’ for destruction of nuclear-derived asbestos by BNG America

- TCCT were shortlisted by the UK’s LLW Repository Ltd. on behalf of the Nuclear Decommissioning Authority, as a preferred technology for treatment of low-level radioactive waste in its LAW Asbestos and Asbestos Containing Waste Gate B (Preferred Options) Study, in 2016

- In 2017, they were awarded the European Asbestos Forum’s prestigious International Recognition Award for their “commitment towards the more sustainable management of asbestos waste through its Thermal Chemical Conversion Technology”.

- In the same year they received their International Recognition Award, they also secured Australian based EnviroMaster as the exclusive territory licensee for the Australasian region. Together, they have received two big grants from the Australian government, $5.5m in late-2019 and a further $8.8m in early-2021.

Going beyond the safe disposal of harmful chemicals and waste, such as that found in asbestos, ARI Global’s technology is unmatched in its capacity to remove and dispose of asbestos while ensuring that the process for recycling it is both safe and sustainable, and that a useful bi-product is produced as a result.

Mocean Energy

Based in Scotland and founded in 2015, Mocean Energy, with their expert team, are combining scientific principles and real-world experience to develop new technologies that can harness wave power while being both viable and cost effective, in order to accelerate the transition to a zero-carbon world. Mocean Energy was founded by two individuals; Cameron McNatt, the Managing Director, an experienced innovator in ocean energy with a 15-year track record of business success and academic excellence, and Chris Retzler, the Technical Director, who has unique experience in the design, development and deployment of wave energy machines.

Mocean Energy are developing two wave energy technologies, which are both based off the same concept of a hinged raft with a unique geometry, which has an improved performance of up to 300%, compared to traditional hinged rafts and increases survivability, due to its ability to dive through the largest waves. The first of these technologies is the Blue Star, a wave energy converter that will provide reliable and renewable power for a range of subsea applications, such as control systems, ROVs (remotely operated vehicles), and fully autonomous underwater vehicles. It has a compact design that fits into 40 foot shipping containers, and it is able to provide continual power by using magnetic geared power to charge the on-board batteries. The second is the Blue Horizon, a utility-scale machine that is a much larger hinged raft wave energy converter, which has been designed for deployment in wave farms off the coast in order to supply reliable and green energy to transmission networks around the world.

The company also has a prototype model, called the Blue X, which is used for extensive testing in real sea conditions. The Blue X was deployed to the European Marine Energy Centre (EMEC) in Orkney, in spring of 2021, and was installed at EMEC’s Scapa Flow test site. This prototype is generating power, and is also providing data on machine performance and operation.

According to data sourced from Beauhurst, Mocean Energy were awarded £3.3m by Wave Energy Scotland, at the beginning of 2019, as their design of the Blue X was selected by Wave Energy Scotland as one of the industry’s most promising concepts. Recently, they have also secured £2.2m of new equity alongside a £500k grant with the purpose of advancing their technology to a commercial scale through the first orders of the Blue Star. Equity Gap, Scottish Enterprise and Old College Capital are the existing investors that contributed to this round, with new investors including Katapult Ocean, Norwegian impact investors, and MOL PLUS, the venture capital arm of Japanese shipping conglomerate MOL. Low Carbon Manufacturing Challenge Fund are the ones who provided the £500k grant.

The ocean has been recognised for some time as a vast untapped source of green energy and harnessing just one percent of the wave power that this resource creates could power more than 50 million homes, and save more than 50 million tonnes of CO2 annually. Mocean’s ongoing product development, collaborations with industry leaders and members of their broader supply chain, and vision for the economic and environmental realities that wave energy can create are what makes this company exciting to watch.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you