Planning opportunities for trading groups with property

We know that the Chancellor’s plans to raise tax revenues through restricting Agricultural Property Relief (APR) and Business Property Relief (BPR) are unlikely to change significantly following publication of the draft legislation [1] in July 2025.

This article focuses on shareholders of trading groups that own property and the options for improving their BPR position. Those options will depend on the specific facts of each case, but the examples below set out various scenarios for when a group’s BPR status can be improved and the key takeaways to consider.

Summary of the proposed changes

Budget 2024 outlined that, from 6 April 2026, the 100% relief would be limited to the first £1m of combined agricultural and business property. However, in December 2025, the Government announced the allowance would increase from £1m to £2.5m. Any qualifying agricultural or business property above this threshold will attract 50% relief.

How does BPR currently apply to shares in unlisted companies?

BPR offers 100% relief on the transfer of qualifying business assets, including shares in unlisted trading companies. This means that, at the time of death, the transfer of such qualifying assets to an individual’s beneficiaries are outside the 40% IHT charge.

Broadly speaking, to qualify for the relief, the shares must be in an unlisted company that is not wholly or mainly (i.e. more than 50%) an investment company (including dealing in land and buildings). Put another way, the company must be wholly or mainly a trading company. HMRC typically applies the 50% test based on turnover, asset base, management time and overall context of the business.

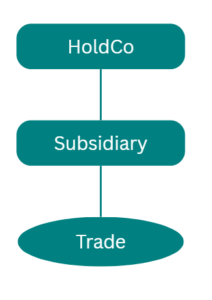

Holding companies

A holding company (HoldCo) holding only shares in its subsidiaries would ordinarily be an investment company but the BPR rules allow shares in HoldCo to qualify for relief provided its business is wholly or mainly holding shares in subsidiaries that qualify for BPR. Companies Act definitions apply to the terms ‘holding company’ and subsidiary’, meaning HoldCo must control its subsidiaries e.g. by voting rights.

Simple groups

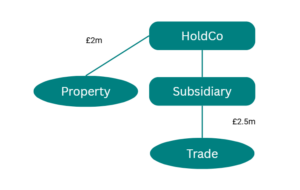

2-company groups exist for a variety of reasons, including buying out legacy shareholdings, sheltering property from trading risks and post-demerger structures.

The HoldCo shares in the above group would qualify for BPR, as the subsidiary has no investment business. HoldCo’s business is mainly that of a holding company of a trading group.

If the above was a 45% holding of ordinary shares in a trading company it would be treated as an investment and not qualify (as it would not be a subsidiary).

In the above example, if the Subsidiary or HoldCo owned a property from which the trade was carried on, the HoldCo shares would still qualify for BPR. If the property was instead let to a third-party trading company, it would be an investment and the 50% test would apply to:

- the rental income / profit vs trading income / profit,

- value of the property vs value of the trade,

- time devoted by the group’s management between the property business and the trade.

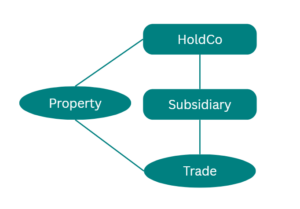

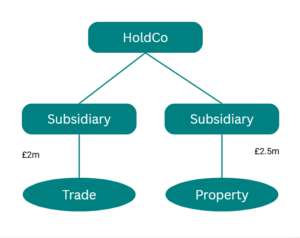

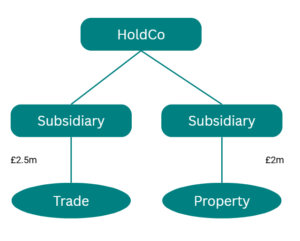

Mix of trading and property investment

Groups can often grow organically over time and can, in the absence of effective planning, lose their BPR status, for example due to an increasing investment property portfolio.

The above group would not qualify, due to HoldCo being wholly or mainly the holding company of property investments. It may be possible to demerge the property investment company to improve the overall BPR position for HoldCo.

A change in the values affects the treatment significantly. In the above case, HoldCo is now mainly the holding company of a trading group, except in this case the rules deny relief for the value of any subsidiary whose business is wholly or mainly investment. BPR would therefore be restricted to the value of the trading subsidiary.

HoldCo in the above example is wholly or mainly the holding company of a trading group, despite owning £2m of investment property. BPR should be available on the full value of the HoldCo shares provided the property is run as a business (and HMRC do not view it as an ‘excepted asset’ – see below).

Larger groups

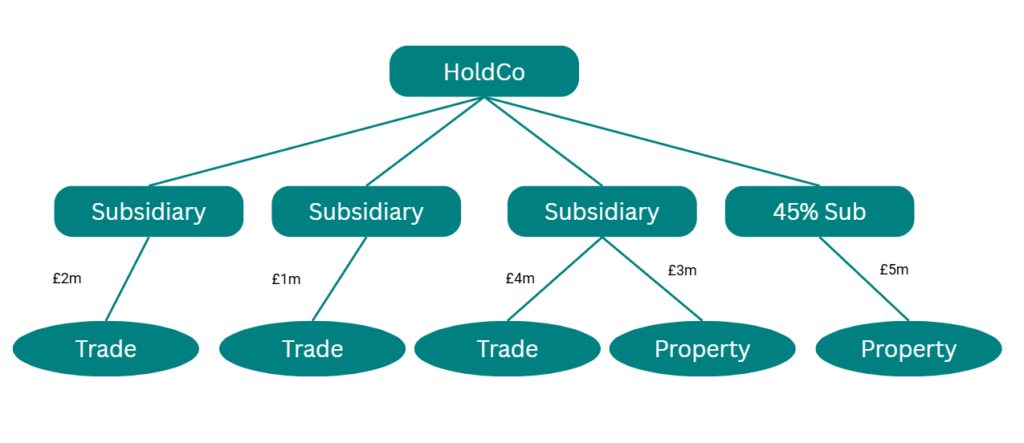

The following example covers a common scenario of a larger group that has grown both organically and via a series of acquisitions and joint ventures. All properties are held as investments.

To summarise the above position, the group’s combined value of £15m is apportioned £7m trading and £8m property investment. HoldCo is wholly or mainly a holding company of a trading group (£10m vs £5m), but the 45% holding is not a controlled subsidiary and is excluded. BPR should apply to HoldCo’s shares in this example, despite the value of total investments exceeding trading values.

Cash as an ‘Excepted Asset’

One final point to note is cash that builds up in a trading group over time can be excluded for BPR as an ‘excepted asset’, even if the company(ies) holding the cash qualify for BPR. Other assets can be treated as ‘excepted’ but this article deals only with cash, being the most common scenario.

Excepted assets are neither:

- used wholly or mainly for the purposes of the business concerned throughout the last two years before the transfer, nor

- required at the time of the transfer for the future use of the business.

If the company cannot demonstrate that the cash is required for future business use, HMRC are likely to subject it to IHT on death. Options for preserving BPR status should therefore be considered by business owners regarding how the cash is to be utilised, either earmarking it for a new trading venture or to acquire capital assets within the business. Evidence of such an intention would be required upon a claim for BPR.

Our Tax Team are available to review your property ownership within the existing business structure and how your IHT position can be improved in the light of the pending changes from April 2026.

Footnotes:

[1] gov.uk/government/publications/reforms-to-agricultural-property-relief-and-business-property-relief ↩︎

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a questions? Ask the Tax team....

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

We can help

Contact us today to find out more about how we can help you