Over half of remaining UK domestic energy suppliers technically insolvent

Over half of the UK’s remaining domestic electricity and gas suppliers are technically insolvent and at imminent risk of collapse, according to an analysis of financial data by Price Bailey, the Top 30 accountants.

-

Analysis of Delphi credit scores and balance sheet data

-

Price caps, rising wholesale energy costs and green tariffs squeezing margins in the electricity trade sector

Price Bailey checked the credit risk scores and balance sheet information of all domestic electricity and gas licensees registered with Ofgem, the regulator for electricity and gas markets. It found that of the 22 remaining suppliers (excludes the Big Six and two businesses with suppressed risk scores) of electricity and gas to UK homes, 12 (55%) have negative assets on their balance sheets. A business with negative net balance sheet assets is deemed to be technically insolvent. These businesses are vulnerable to going bust (cash flow insolvent), which occurs when businesses are unable to make payments to suppliers or lenders.

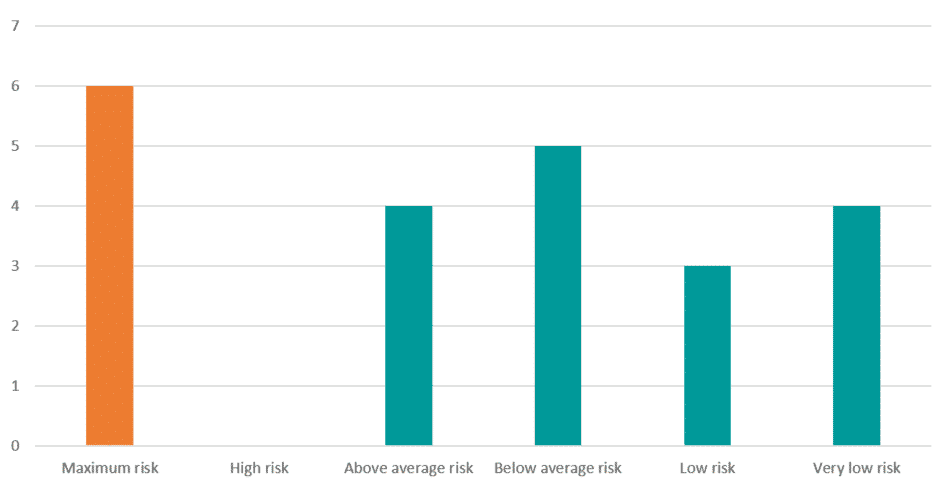

Of the 12 suppliers which are technically insolvent 10 have a Delphi Risk score of Above Average or higher, and six are in the Maximum Risk category. Businesses deemed Maximum Risk find it difficult to access funding without personal guarantees from directors and are highly likely to be subject to winding up petitions or intention to dissolve notices in the next 12 months.

Approximately 70 energy companies were supplying energy to UK households at the start of 2021. Price Bailey first looked at the credit risk scores of domestic energy suppliers in November 2021. Since then, another seven suppliers have become insolvent – Bluegreen Energy, Entice Energy, Neon Reef, Omni Energy, Orbit Energy, Social Energy Supply and Together Energy. Bulb Energy has entered special administration but continues to trade.

Price Bailey says that while the customers of failed suppliers have been transferred to surviving suppliers, many of the surviving suppliers are on the verge of collapse which means that many customers face the inconvenience of being transferred multiple times and significantly higher bills as a result.

Matt Howard, Partner at Price Bailey, comments: “The winter of discontent for the energy supply sector is unlikely to end soon. Around half of suppliers have already gone bust and at least another half are technically insolvent and at imminent risk of collapse. These businesses will find it almost impossible to access extra funding unless directors provide personal guarantees, and few are likely to do so in the current climate.”

“We are seeing a domino effect. Every time a small energy retailer goes bust, that increases the financial strain on the rest of the ecosystem, making those businesses more vulnerable to collapse. Customers are passed on to surviving suppliers but exposure to those customers won’t have been hedged, meaning very often they are being taken on at a loss. It is possible that only one or two of the challenger brands will be left standing alongside the big six this time next year.”

“The business models of many of the small suppliers are not sustainable in an era of rising wholesale prices. Aggressively undercutting to gain market share when prices are low is a risky strategy. Many of the smaller businesses which are going bust are failing precisely because they did not buy energy in advance, opting instead to buy wholesale energy on the “spot” market.”

Delphi Risk Score of electricity and gas suppliers

He adds: “The larger, more established suppliers were less motivated to undercut the market to gain customers, which means that their profit margins are often a bit fatter, so they are better positioned to absorb increases in wholesale prices while remaining profitable. They also tend to be more diversified businesses. Very often they are supplying gas and electricity and some also have energy generation businesses and operate across multiple markets.”

According to Price Bailey, small energy retailers have been squeezed by a “perfect storm” of rising wholesale costs, the energy price cap and their renewable power obligations. The renewable power obligations are particularly onerous because if one supplier collapses, the cost of their unmet obligations is mutualised across the rest of the market, thereby leading to higher costs and a greater risk of further insolvencies.

Matt Howard explains: “When a supplier cannot meet its obligations, that cost is passed on to other suppliers. Ofgem wants a competitive energy market but by forcing struggling businesses to pay the debts of failed suppliers and pushing some towards insolvency, the renewable obligation scheme is undermining that aim.”

He adds: “The big six energy companies are well-capitalised and have much better hedging positions than challenger suppliers, which means that they are better placed to manage high wholesale prices. The businesses most at risk tend to have negative net assets, which means that the value of their assets is less than their total liabilities. They tend to focus on the domestic as opposed to the B2B market and are unable to benefit from the economies of scale of the Big six.”

– Ends –

NOTES TO EDITORS

For more press information, visit our media and press enquiries page

About Price Bailey

Price Bailey is a top 30 accountancy practice specialising in providing accountancy and business advice to enable the growth of regional, national and international businesses. In addition to traditional accounting services, the firm has a range of specialists in many areas, which combine to provide a complete, integrated business offering. These include tax consultancy, corporate finance, strategic planning, insolvency & recovery and employment law.

We can help

Contact us today to find out more about how we can help you