What is an indirect statutory demerger and how can you use it?

For those that meet the required conditions of a statutory demerger, they can be highly effective. They’re often more straightforward than other types of demergers that involve reducing a company’s capital or liquidating companies and are generally more cost effective too.

However, in practice statutory demergers are rarely used. This is mainly due to the strict conditions that must be met, and failing to meet these conditions can lead to tax inefficiencies. It is important to seek professional advice before proceeding with any demerger.

There are two types of statutory demergers: direct and indirect. This blog will focus on indirect statutory demergers.

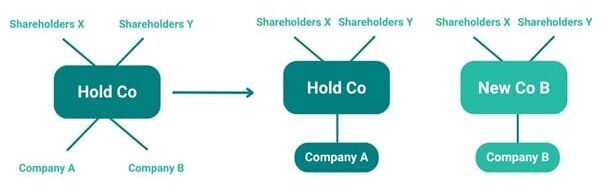

Example of an indirect statutory demerger

In our example of how this type of demerger works, Company A and Company B are both trading companies, owned by a holding company (Hold Co), which is in turn owned by Shareholders X and Y. To begin the demerger process, Shareholders X and Y incorporate a new company (New Co B). In the next step, a ‘scheme of reconstruction’ is implemented, where Company B is transferred to New Co B. In consideration, New Co B issues new shares to Shareholders X and Y. Once this step is completed, Shareholders X and Y will own Hold Co, which owns Company A and New Co B, which owns Company B.

What criteria needs to be met in order to do an indirect demerger?

- Hold Co must be a holding company of a trading group or a trading company, and remain so after the demerger. Companies A and B must be a trading companies or a member of a trading group at the time of the distribution.

- Each company must be resident in the UK or an EU member state at the time of the distribution.

- The demerger must involve the transfer of shares in a 75%+ subsidiary to the shareholders.

- The demerger must be for the benefit of the trade(s).

- The demerger must not be in anticipation of cessation or sale of one of the trades.

There are other strict requirements that must be met for the demerger to be exempt from Income Tax and Corporation Tax.

One important step is obtaining advance clearance from HMRC to confirm that they are satisfied the distribution will be exempt. We strongly recommend seeking this clearance before proceeding with any demerger transaction.

Once HMRC clearance is obtained and the demerger process is complete, a return must be submitted to HMRC within 30 days, providing full details of the transaction undertaken. Furthermore, directors and shareholders need to be mindful of potential chargeable payments that may arise within the following five years. If any chargeable payment occurs, a return must also be submitted to HMRC within 30 days of the payment being made.

What happens if the conditions aren’t met?

Failure to meet the required conditions for a statutory demerger does not necessarily prevent the demerger from taking place, provided there are sufficient distributable reserves. However, failing to meet these conditions can lead to significant tax implications. Specifically, an Income Tax charge will arise for the shareholders on the shares distributed as part of the demerger and a Corporation Tax charge could arise for Hold Co.

Are there any other charges to be aware of?

The main taxes to consider following an indirect statutory demerger are:

- Income Tax (the shareholders have received a distribution)

- Corporation Tax (Hold Co has disposed of shares)

- Chargeable Payments (see below)

As with the other types of demergers e.g. Section 110 or a reduction of capital, additional taxes such as Capital Gains Tax, Stamp Duty Land Tax (SDLT), Inheritance Tax and VAT may also need to be considered.

Chargeable payments

The concept of chargeable payments is designed to prevent shareholders from using a demerger to extract cash from the company in the form of capital rather than income. Essentially, chargeable payments ensure that the demerger process is not used to gain tax advantages by converting income into capital.

For more information on chargeable payments, please refer to our direct statutory demerger blog.

Why consider an indirect demerger over a direct demerger?

One of the main reasons to consider an indirect statutory demerger over a direct statutory demerger is due to the Substantial Shareholdings Exemption (SSE). The SSE provides tax relief when a company disposes of shares in a subsidiary, automatically eliminating any tax charge if the conditions are met.

With a direct statutory demerger, if the SSE conditions are not met (e.g. because Company B has not been owned by Hold Co for long enough), a Corporation Tax charge could arise when Company B is demerged from the group. With an indirect statutory demerger, SSE you do not need to rely on the availability of SSE because the ‘scheme of reconstruction’ rules apply.

Broadly speaking, a scheme of reconstruction involves transferring assets to be demerged from the original company to another new company, in exchange for the issue of shares to the shareholders of the original company. As a result, an indirect demerger can help avoid potential tax charges that could arise in a direct demerger.

How is a partition demerger different?

A partition demerger is a variation of the standard indirect statutory demerger.

It enables the shareholders to split the assets between them, so that one set of shareholders end up with Company A, and the other shareholders end up with Company B.

While the basic principles remain the same, a partition demerger typically requires some preliminary steps. These steps often include the reclassification of shares, as well as the creation of an additional New Company. These additional actions help facilitate the separation of assets and ensure the demerger meets the necessary requirements.

It should generally be expected that a charge to stamp duty, at a rate of 0.5% of the value of the company being demerged, would arise on a partition demerger.

What about degrouping charges?

In the example provided, Corporation Tax degrouping charges should not arise. These charges typically occur when a company leaves a group and has been transferred an asset from another company within the group in the last six years, and still holds that asset at the time it exits the group.

However, where a scheme of reconstruction has been undertaken, any degrouping charges that would otherwise arise should generally not apply.

Closing thoughts

For those who meet the criteria, indirect statutory demergers offer the potential for significant advantages, particularly when compared to direct statutory demergers. As well as meeting the statutory demerger conditions, careful consideration of factors such as the SSE, degrouping charges, and chargeable payments is necessary to ensure the demerger is structured correctly. Additionally, understanding the implications of transferring assets and ensuring compliance with HMRC requirements can help avoid unexpected tax liabilities.

Ultimately, while indirect statutory demergers can be beneficial in the right circumstances, it is important to assess whether this option is the most suitable for your business. Consulting with tax and legal professionals can help ensure that the process is handled efficiently and in accordance with the relevant regulations.

How can Price Bailey help?

Charlotte has extensive experience working on a range of complex advisory projects, including various types of demergers. This includes advising on demergers in diverse situations such as pre-sale, separating trades for greater efficiency and risk mitigation, as well as handling divorce settlements and disputes – to name a few!

Depending on the type and purpose of the demerger, our Tax team works closely with the SCF team when company valuations are needed, and with our Insolvency team for liquidation (Section 110) demergers. Should you be considering a demerger, our Tax team will provide you with a detailed tax report outlining each step and its tax implications for all parties involved. We will also draft the HMRC clearance application in line with your commercial rationale.

At Price Bailey, we dedicate time to fully understand your concerns, obstacles and opportunities prior to engagement – time we don’t charge you for.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about demergers? Ask our team here...

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

We can help

Contact us today to find out more about how we can help you