Academy Helpdesk review

Every quarter, our Academies team will publish the most important and frequently asked helpdesk queries. You can download our 2024 quarterly updates here.

Welcome to Price Bailey

Every quarter, our Academies team will publish the most important and frequently asked helpdesk queries. You can download our 2024 quarterly updates here.

Our healthcare expert provides a clear breakdown of the 2026/27 GP contract changes.

Tax Investigations Partner, Andrew Park, provides a round up of the most recent and significant contentious tax news. Read more here...

HMRC can provide valuable data to import businesses, however these services are often overlooked. Read our article detailing what new services are available to you.

With International Women’s Day approaching, we take a closer look at the characteristics of women-founded businesses and then explore the profile of six UK businesses founded by women.

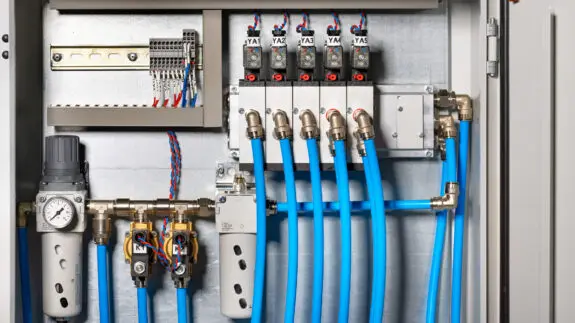

The transaction represents another successful sale in the industrial and engineering services sector and demonstrates Price Bailey’s experience in advising owner managed businesses on achieving the right outcome with the right long-term partner.

Read our report on how retailers are adapting operations, stores and technology to meet omnichannel expectations.

Download our summary of the 2026 Spring Statement, which contains all the key points you need to know, in one place. Download here.

The Competition and Markets Authority (CMA) has proposed reforms to improve transparency and pricing clarity in the UK veterinary sector - here’s a quick summary of the changes and how your practice can start preparing ahead of the expected 2026 decision.

This guide offers a practical, non-lawyer’s perspective on the legal considerations for UK companies considering acquisitions...

Safeguarding has become a major area of regulatory focus for payment services and e-money firms, particularly as the FCA prepares to introduce a strengthened safeguarding regime. Find out how your firm can prepare here...

In our series of VAT Myths, we debunk some of the most common VAT myths once and for all.