Saffron Academy Trust

Price Bailey's Audit & Assurance team support a nine school Multi Academy Trust (MAT). Over the years, we've focused on delivering consistent and reliable service, with a stable team and clear communication

Welcome to Price Bailey

Price Bailey's Audit & Assurance team support a nine school Multi Academy Trust (MAT). Over the years, we've focused on delivering consistent and reliable service, with a stable team and clear communication

The UK Government has published the Draft Commonhold and Leasehold Reform Bill, a major overhaul of leasehold law targeted at residential properties in England and Wales. Read our Quick Read to find out more about how this will impact developers...

For many businesses, an MBO is the only way for owners to exit – usually because there are no external buyers for the business. Click to read more

A practical guide for companies and groups falling outside the audit threshold. We outline the key risks, alternatives and considerations for future audit planning....

Protect your business from costly HMRC enquiries with our Tax Investigation Service.

Amidst the upcoming changes, our updated IHT guide will help you understand the complex world of Inheritance Tax.

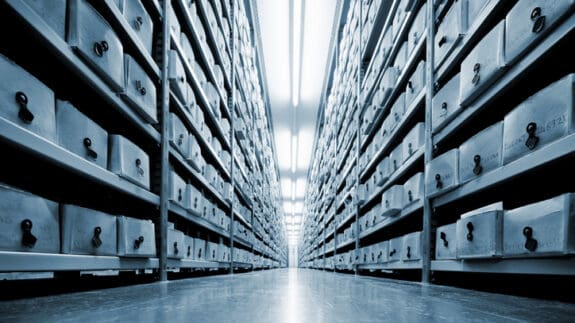

Price Bailey’s news archives present a timeline of our Press Releases over recent years.

The Government has announced a major revision to its planned inheritance tax changes, increasing the threshold for both Business Property Relief (BPR) and Agricultural Property Relief (APR) from £1 million to £2.5 million, just in time for Christmas.

Managing the risks that academies are facing in today's environment shouldn't be a tick box exercise, but a key component to ensure the success of the academy trust.

Price Bailey announces the appointment of Pete Bardell as Business Development Director for Essex and Suffolk, strengthening regional growth and client engagement across all service lines.

A practical guide for business owners to improve their lending arrangements

A strategically significant transaction for Minster Fine Foods, combining strong growth prospects with complex legal and financial considerations...