Contentious Tax Bulletin

Tax Investigations Partner, Andrew Park, provides a round up of the most recent and significant contentious tax news. Read more here...

A sector full of opportunities, and we want to help you make the most of them

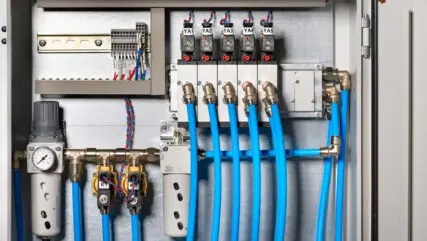

From research and development through to manufacturing and distribution – no matter the activity your company specialises in within the chemical industry, our expert team of accountants and financial and tax advisers are here to support you.

We have seen the chemicals industry change significantly over the last few years. Both demand and supply have changed dramatically, creating many opportunities and challenges. The long-term changing relationship with crude oil, significant industry growth rate, and breadth of innovation are all contributing to a vibrant changing environment.

Our specialists can offer a range of business services focused specifically on the needs of chemical companies.

Contact us today to find out more about how we can help you

Tax Investigations Partner, Andrew Park, provides a round up of the most recent and significant contentious tax news. Read more here...

HMRC can provide valuable data to import businesses, however these services are often overlooked. Read our article detailing what new services are available to you.

With International Women’s Day approaching, we take a closer look at the characteristics of women-founded businesses and then explore the profile of six UK businesses founded by women.

The transaction represents another successful sale in the industrial and engineering services sector and demonstrates Price Bailey’s experience in advising owner managed businesses on achieving the right outcome with the right long-term partner.