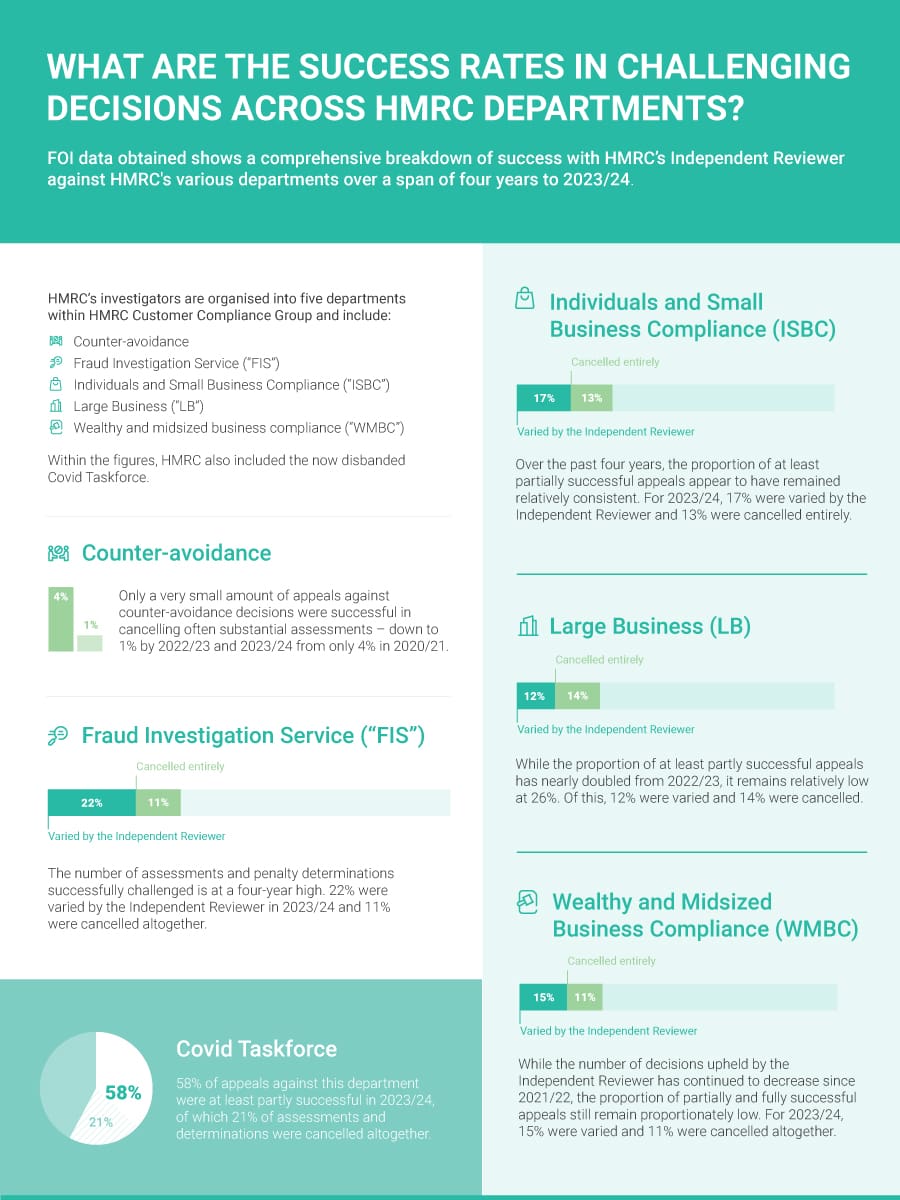

What are the success rates in challenging decisions across HMRC departments?

Most decisions made by HMRC against taxpayers can be appealed in the first instance to HMRC’s Independent Reviewer. However, information on taxpayers’ success rates in these appeals has historically been limited.

A misconception has arisen that appealing investigation matters to the Independent Reviewer is almost always futile, as they rarely overturn or vary decisions made by HMRC officers. This notion is incorrect. However, success in more technical appeals has typically hinged on presenting new elements for the Independent Reviewer to consider, such as additional relevant facts or further legal arguments.

For the first time, newly obtained data provides a detailed breakdown of success rates across HMRC’s various departments over the four years leading up to 2023/24.

This data should give heart to taxpayers that unfounded HMRC decisions can often be successfully challenged without needing to resort to the Tax Tribunal.

Andrew Park, Tax Partner

Please note that this data was obtained by Andrew Park, our Tax Investigations Partner for the Contentious Tax Group, of which he is a committee member. The Contentious Tax Group is a collaborative multi-firm group of tax and legal professionals specialising in dealing with tax disputes. They seek to uphold professional and HMRC standards and regularly hold discussions with senior figures at HMRC and other interested parties such as MPs.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Ask our team...

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

We can help

Contact us today to find out more about how we can help you