How much are companies worth?

Here is our advice based on valuing around 55 companies a year.

What matters when determining the value of a business?

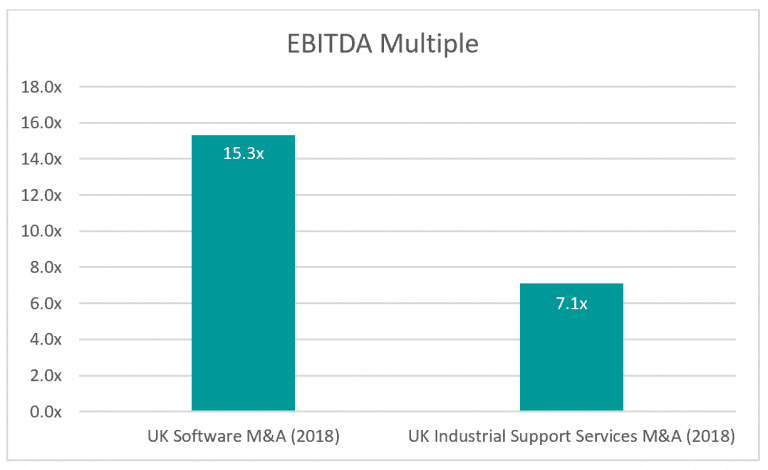

Two transactions happened within a few weeks of each other earlier this year – UK Platforms, an industrial support services company specialising in the provision of power access equipment that generates profits* of £10.7 million; and Tax Systems, a provider of tax compliance software, which reported profits* of £6 million. Despite boasting considerably larger earnings, UK platforms attracted a lower price than Tax Systems.

Why? At the risk of gross oversimplification, the value of a business is determined by the ‘profit’ multiplied by the ‘profit multiple’ – in this case, the multiple applied to the profits of UK platforms by its acquirer was lower than the multiple that the buyer of Tax Systems was prepared to pay.

How to value a business – the formula:

Most businesses are valued on a multiple of Earnings Before Interest, Tax, Depreciation & Amortisation (EBITDA). EBITDA is a good proxy for the underlying profitability of a company as it strips out non-cash items and, usually, exceptional and non-recurring items.

PROFIT x PROFIT MULTIPLE = BUSINESS VALUE

* For the purposes of this article, profits are EBITDA.

The most appropriate multiple to attach to the company’s EBITDA is one that is derived by reference to comparable companies that have undergone an exit. The best comparables are the businesses that most closely match your company in both trading activity (the sector) and size; the valuer should also consider when the transaction happened (the cycle). Why do these things matter?

Sector

Take sector – different industries tend to attract different multiples of profits due to perceived or real differences in the quality of those profits – do long-term contracts underpin them? Is there a scarcity value to the product or service being sold? Is the market in which the business operates growing quickly? Positive responses to these questions tend to drive high multiples in, for example, the software industry but lower multiples in the industrial support services sector. In 2018, the average UK Software multiple was 15.3x; in industrial support services, this multiple was 7.1x.

In 2018 UK software companies sold for an average premium of 115% over industrial support service companies

Source: MarktoMarket

What about the size?

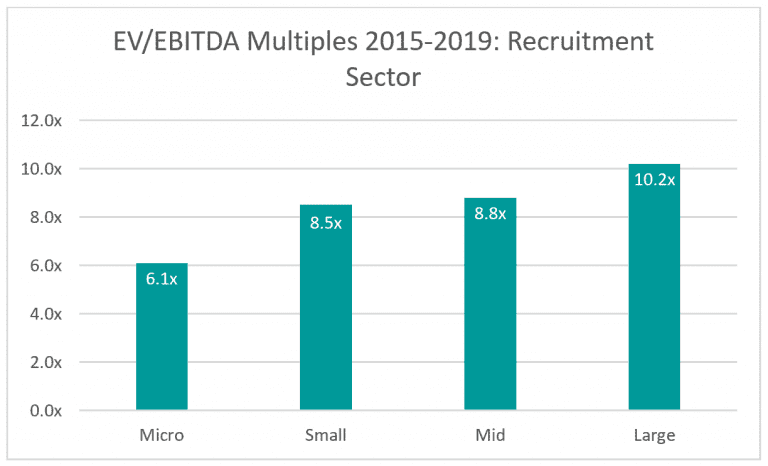

Size is a material determinant in valuing businesses. Larger businesses are perceived to be more diversified and, therefore, more robust and immune to sudden downturns and shocks. Shareholders in the Royal Bank of Scotland in 2008 may take issue with this statement. There is something of a paradox here in that smaller businesses tend to exhibit higher growth rates, which may attract a higher multiple but this is for another day.

To look at how size impacts multiples, let’s take another sector which has seen high levels of M&A activity – recruitment. In the last five years, the average EBITDA multiple paid for recruitment companies valued at between zero and £2.5 million was 6.1x; the average paid for companies valued at between £2.5 million and £10 million was 8.5x, a 39% premium. This premium continues to build as the business size grows – for ‘large’ recruitment companies (those with enterprise values over £50 million) the average EBITDA multiple was 10.2x over the past five years.

Over the past five years, small recruitment businesses (£2.5-10 million in value) have sold for an average 39% premium to micro recruitment businesses (above £2.5 million in value).

Source: MarktoMarket

Cycle

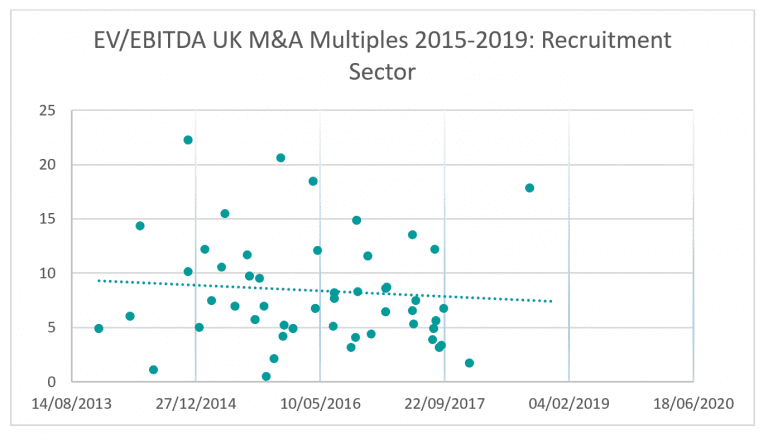

Finally, consider time. Multiples closest to the present should have the highest relevance as will offer the best indication of market health and sentiment.

Sticking to the recruitment sector, the chart below illustrates how pricing has been trending lower in the industry over the past five years. This decline should be taken into account when benchmarking against comparable transactions from previous years.

Source: MarktoMarket

So, sector, size and cycle time all have to be taken into account. Ultimately, other factors will come into play – growth characteristics, quality of management team, the strength of brand, reputation – but a valuation approach backed by data that can be evidenced and compared gives a robust starting point.

Alternatively, contact Doug Lawson or use the form below.

MarktoMarket, Codebase, 38 Castle Terrace, Edinburgh, Scotland, EH3 9SJ

T: +44 (0) 131 357 6441

E: [email protected]

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.