Academy Trusts: Top 5 audit findings from the 22-23 year

As Price Bailey’s audit team draw close on another year for the academies sector, we look back at some of the key audit findings from the 22-23 year.

Each year we report the findings of our work in our management letter presented to the Audit Committee or Governing Board. All findings are given a priority rating based on their importance. These findings are then reported to the ESFA as part of the submission of the statutory financial statements.

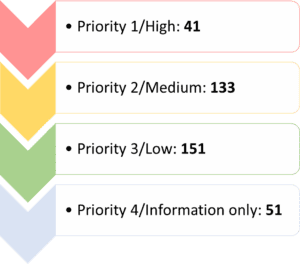

In the 22-23 year we acted for 65 academy trusts and raised a total 376 findings separated as follows:

What were the top 5 audit findings concerning?

- Related parties

- Fixed assets

- Authorisation

- Documentation

- Changes in governance information

Related parties

Audits are carrying an ever-increasing amount of regulation, especially within public funded organisations. With this in mind, the reporting of related parties is under more scrutiny than ever before and is a key area of focus for auditors and regulatory bodies alike.

In the 22-23 year we found 30% of the high priority 1 points raised were in relation to related parties. These points were either concerning a transaction that had not been correctly reported to the ESFA or business interest and declaration forms not being completed correctly.

As well as complying with the Charity SORP, academy trusts are required by the ESFA Academy Trust Handbook to report in advance all related party transactions using the ESFA’s online form.

Furthermore, ESFA approval (rather than just declaring) is required for contracts and agreements for the supply of goods or services over £40,000 effective from 1 September 2023 (historically £20,000).

We also need Trustees, Members and Key Management Personnel to declare their related parties (including close family/ connected parties) to us as their auditors. This involves the completion of a related party declaration form or access to a register maintained by the academy trust which contains this information. It is important that the names of close family are recorded, even if they do not have any substantial interests or influences. Declarations must be reviewed and updated as soon as any changes are known. All new Trustees and Members should be declaring this information before they are appointed.

Academy trusts must publish on their website, relevant business and financial interests of members, trustees, local governors and accounting officers, in line with ESFA guidance.

See our blog here on why it is important for academies to clearly disclose related parties and what the requirements are.

We host an annual webinar on related party transactions with our next one planned for May 2024. Please see our website for latest events.

Fixed assets

In the 22-23 year we raised a significant number of points pertaining to the fixed asset register not being maintained and no associated year-end adjustments being made in the finance system.

It is an Academy Trust Handbook must to manage, oversee assets and maintain a fixed asset register.

We run a free annual fixed asset training workshop with the next session due in May 2024. This session covers what and when to capitalise, ESFA capital grants, what your register may look like and how to roll it forward from the prior year, journals, disposing of an asset, new school convertors and gifted assets. This is a great opportunity to ask any questions ahead of the next audit season to ensure you do not have any recurring management letter points on maintaining the fixed asset register.

Please contact the Academy Helpdesk ([email protected]) or check our website for further event information.

Authorisation

In the 22-23 year nearly 15% of the findings raised were connected to authorisation of some kind.

Some examples of the type of points raised:

“During our testing of expenditure, it was noted that some purchase invoices did not have any proof of authorisation.”

“During our charge card testing it was found in one instance that the school business manager authorised their own charge card statement.”

“It was identified that three staff mileage claims were not authorised by the Head Teacher as per the Financial Regulations.”

A key part of our testing is ensuring for a sample selected, whether for charge cards, expenditure or expense claims, the processes and authorisation procedures are in line with the academy trust’s financial regulations. We often see this is not the case and thus reported as a deficiency in the academy trust’s internal control environment.

Following appropriate authorisation procedures is vital, a key part of compliance and helps to mitigate risks.

Documentation

A common deficiency we see year on year is the lack of documentation or supporting evidence, so it comes as no surprise one of the top 5 audit findings in the 22-23 year related to this.

This covers a variety of audit areas from staff ID documentation, expense claim receipts and petty cash receipts to goods received notes, purchase orders and value for money considerations.

Documentation provides a formal record of decisions agreed and in the examples above, supports work or services carried out, corroborates expenditure and ensures management are appropriately accountable for decisions made.

Changes in governance information

The Academy Trust Handbook stipulates that academy trusts must notify the DfE of changes to their governance information via Get Information About Schools (GIAS) within 14 calendar days of the change and update their website and Companies House accordingly.

When we see these various databases not being updated in a timely manner it results in an audit finding. This type of finding is one of the most recurrent points we raise each year.

See our blog here on the detailed requirements for reporting on each of these databases.

Further support

If you would like support, advice, or have any further questions regarding this article, you can contact our team using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Ask our team…

We can help

Contact us today to find out more about how we can help you