Anticipating inflation – how should you be preparing?

August 2021 saw inflation rates of 3.2% compared to 0.2% in August 2020. With the high levels of debt that the Government is acquiring, it is possible that if inflation persists then the Bank of England may be forced to take action to increase interest rates – despite remaining hesitant over the last year.

At foremost, we discuss the elusive and sometimes overlooked causes of inflation, speak with two business leaders with regards to the challenges that inflation presents first-hand on different industries, and how businesses can best adapt their business models to prepare for inflation.

What is causing inflation 2021?

As things stand, inflation is relatively low compared to what it has been historically. With inflation being intrinsically linked to supply and demand, we are seeing multiple businesses in different sectors who are facing problems regarding raw material shortages, issues across supply chains, and a shortage of people in recent months. Ongoing issues with people shortages are being seen in particular in the services and hospitality industries, with the government attempting to tackle these shortages.These supply shortages are occurring for numerous reasons and is resulting in inflated labour rates and salary. By August 2021, there were 1,034,000 job vacancies available in the UK, however the ONS have stated that employment levels are still below pre-Covid levels in the three months to July. Reasons for a shortage of people include, but are not limited to; a lack of job security, poor pay and Brexit. Other reasons that are often not discussed and should be taken into account include;

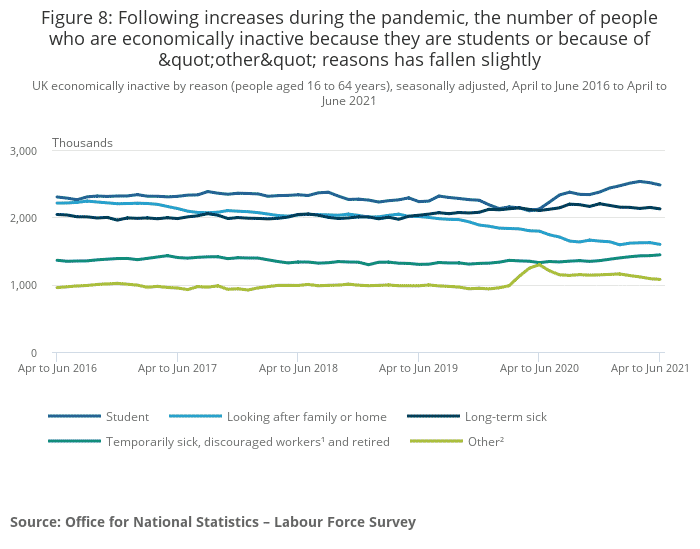

- Economic inactivity

The rate of economic inactivity has generally been decreasing since comparable records began in 1971; however, the COVID-19 pandemic has resulted in a temporary increase. This particularly relates to the temporarily sick, discouraged workers and retired. Many discouraged workers are not actively seeking vacancies because they believe little or suitable jobs are available. Perhaps a lack of job security and poor pay in some service industries contribute to workers becoming discouraged. Other prominent reasons for economic inactivity include those awaiting the outcome of a job application, those who are not looking for work and those who do not require or desire employment.

- Furlough

At the start of August 2021 there were 1.6 million people fully or partly furloughed, however, with furlough ending on 30 September 2021 and over one million jobs available, many people believe this will not make a vast difference to the improvement of unemployment or number of jobs available. Although unemployment remains at 4.6% (0.6% higher than before the pandemic), and Chancellor Rishi Sunak is claiming that the government are encouraging people to get back into work, Rishi Sunak hasn’t ruled out unemployment rising further as result of furlough ending. It seems that job vacancies are prevalent in low wage sectors, including tourism, the arts and hospitality, yet these sectors are not yet fully recovered – meaning that many people may choose to keep searching for jobs and remain temporarily unemployed, or wait until the working conditions in these sectors are more stable.

For businesses, a shortage of people highlights the importance of creating an attractive employment package to attract an appropriate talent pool. For those currently recruiting, then it may be beneficial if the application process is a streamlined as possible to prevent workers from becoming discouraged.

What challenges do businesses face as a result of inflation, and how do they overcome these?

To get a better perspective on how inflation is affecting different businesses in different markets, we interviewed Dr Bharat Bhardwaj, founder and general manager of chemical distribution firm, Noah’s Ark Chemicals, and Chris Davies, founder and CEO of the innovative vertical farm, Harvest London, to provide us with some insight.

Have you had to overcome any challenges regarding the recruitment and retaining of staff as a result of inflation?

Chris Davies, founder and CEO of Harvest London

“Not really. Harvest London is in quite a trendy industry, an industry that appears to be in quite high demand. We are attracting a ‘new type of farmer’. The average age of a farmer in the UK is 55. There are five farmers in my company, we’re all under the age of 35. So the interesting part of the industry has made up for this. We’ve been a very sustainable organisation from the beginning and we’re in the middle ground between sustainability, food and technology. Three things which are of interest to people of a certain age.”

Dr Bharat Bhardwaj, founder and general manager of Noah’s Ark Chemicals

“Right now we are only a company of 15 people and we’ve got two vacancies, and we just can’t find enough people. I think Brexit may have also had an impact as we don’t have the staff in this country to fill a lot of positions. Prices are increasing, inflation is running away because the demand is there for these commodities and products and there’s a finite resource of staff to match the expectation and increased demand.”

It is worth mentioning that sector, brand, vision and the appeal of the direction of the business/sector all matter when seeking new talent, however, when it comes to increased prices businesses need to have an agile business model in order to cope with the pressures of staff shortages and increased demand.

The impact of inflation on the supply side is likely to be a relatively long-lasting matter, due to the ongoing concerns of Brexit and the Coronavirus pandemic which is currently causing many adversities for businesses, including the global breaking down of supply chains. It is, however, important to note that inflation does provide opportunities for many organisations and that these opportunities allow businesses to focus on the right choices in long-run.

Given the current business environment at the moment, how are you going about protecting and securing your supply chain?

Chris Davies, founder and CEO of Harvest London

“Take Brexit for example, more of our capital is locked into inventory. Everything costs more and we’re buying more stuff that we’re having to hold in inventory before we get to use them. So one way is buying in greater quantities rather than going through the hassle of paying multiple rounds of import fees. There’s an argument to be had that we are actually helping our customers secure and protect their supply chains. Because they are having the same problems we are in terms of our inputs, and their inputs are what we grow. Because we are reducing the need for importing food, we’re helping them solve this very problem.”

Dr Bharat Bhardwaj, founder and general manager of Noah’s Ark Chemicals

“Paying higher prices. You’ve just got to pay the higher prices. If you try and negotiate hard you are going to lose your position. There is nothing worse than losing your supply positions in a market that is tight. You’ve got to be careful not to have too much inventory, because a lot of people buy and then sell, but as prices increase just wait for the crash – because what goes up will eventually come down. It’s all well and good to say “yes, business is growing and therefore inventory is increasing”. But one day that value of that inventory is going to crash, so you’ve got to be very careful and prudent all the time to not let it get away from you.”

It’s interesting to note how different businesses go about protecting and securing their supply chains is a personal decision to make, and what works for one organisation may not work for another. Industries respond to supply chain pressures differently, so you should protect your supply chain in a way that will work for you, protect your position, and secure competitive advantage.

How can business owners prepare for inflation?

For younger and newer business owners, they are less likely to have faced the effects of inflation compared to more experienced business owners who are more likely to have dealt with it in the past. This alone brings its’ own challenges, and some younger business owners’ automatic response to the potential of inflationary pressures may be to increase the prices of their products/services or put cash reserves in place to serve as a buffer. Whilst these are legitimate and effective ways to prepare when done right, there are other preparations that businesses can do in addition to this to minimise the impact of inflation and gain a competitive edge.

- Being tough on your business model

It may be time to re-evaluate how sustainable your business model is, and front-runners in this change tend to create both a sustainable and long-term competitive advantage. In this model, businesses could aim to triple the rate of inflation in production gains which could result in improved structural efficiencies.

Harvest London have a very progressive product mix and sustainable business model, and in preparation of inflation in the future do you envisage yourself making any changes to this?

Chris Davies, founder and CEO of Harvest London

“Unfortunately, sustainability in food is currently undervalued, with lots of people not really understanding the environmental impact of the food they eat. This can be a real problem for growers, because consumers are really price sensitive on food. If inflation squeezes their budgets, the idea of buying things like higher-welfare or organic can fall by the wayside. It’s part of our plan anyway, but it makes even more sense if inflation is going up to diversify our customers, focussing on those which require a steady supply of higher value ingredients. This means foods which are imported from a long way away, or harder to source, such as Thai Basil, and moving into sectors beyond food that require plant extracts, like beauty and wellness.”

2. Being forward thinking about your product and marketing mix

Many businesses tend to be fairly passive regarding developments to their product and marketing mix, however disruptive firms are constantly reviewing and improving theirs. For example, you could look at selling higher margin products through channels that sell faster. Nevertheless, try to resist the urge to implement spontaneous and sudden changes to your product mix, and instead adopt a balanced approach taking into account short-term and long-term goals. The time to do this is when inflation is low in order to counteract it when it increases.

3. Consider amending your employment package

This is a factor to take into account given the staff supply shortages currently. Many people’s relationship with their work is changing, from creating a more meaningful relationship with their work to understanding the value the job offers. Given uncertainty in the economy at the moment, some may be willing to jump ship given a better offer – if cash allows, a pay rise will show your appreciation for them and help to retain staff. Whilst monetary incentives do not work for everyone, offering flexible working and job enrichment may also incentivise employees. The right mix will vary by company – but ensure you’re actively listening to what your employees need in order to work effectively, communicate with them on how the company is performing and where it is heading and adapt reward packages in a way that motivates them but is also balanced with your company’s goals.

What advice would you give to an SME – with limited resources – on how to prepare for inflation?

Dr Bharat Bhardwaj, founder and general manager of Noah’s Ark Chemicals

“Make sure your business is credit insured because there will be companies out there which will buy cargos from you at high prices and happily walk away, therefore you have to be prepared to not put all your eggs in one basket. Spread you risk with different customers, because there will be customers that will default when prices start coming down”

Parry Jackson, a director in Price Bailey’s business team and SME specialist, has provided an additional perspective on how SMEs with limited resources can best prepare for inflation.

“In preparing for inflation I think it is important for SMEs to proactively engage with their profit and loss account. They need to consider whether their pricing is still appropriate, in line with the market and is sufficient to maintain profitability. Businesses also need to ensure they continually monitor costs and maximise productivity. The last 18 months have shown that the cost base of some businesses can be considerably reduced with little effect on productivity and lessons learned are absoluteley relevant for periods of inflation”.

What will happen regarding inflation and the autumn budget announcement 2021?

With the autumn budget announcement 2021 soon approaching, there is much speculation as to whether the government will step in and take action to prevent inflation from rising further. The new chief economist for the BoE – Huw Pill – has suggested that the ‘magnitude and duration’ of inflation is greater than expected and that it may persist for longer than originally anticipated.

Chand Chudasama, a Partner in Price Bailey’s SCF team has provided a comment about the issues the Chancellor may choose to address in his announcement.

“It is likely that the Chancellor, Rishi Sunak, will aim to strengthen the economy by addressing gaps in supply chains – which are driving inflation-over anything that will drastically improve inflation through easing demand. The question remains over whether the Chancellor will have enough time to put measures in place before the government step in and increase interest rates.”

Key takeaways

- Issues with global supply chains, which is contributing to inflation, are currently causing a severe shortage of people in a range of industries, particularly those in some service and hospitality industries. Although, poor working conditions and poor pay also contributes to the unwillingness for some people to start jobs, an increase in discouraged workers is perhaps due to the belief that there aren’t enough jobs available.

- To enable you to have the best possible head-start against inflation you should be;

- forward-thinking about your product and marketing mix

- tough on your business model

- reward your staff

- proactively engaged with your profit and loss account

- start investing early and decisively

3. Whilst you can increase your prices, you should only do this when you are selling an improved product/service, to a better market, through better channels.

This article was written by Chand Chudasama and Fiona Jobson, with contributions from Chris Davies, Dr Bharat Bhardwaj, and Parry Jackson. For any further information on the appropriate steps your business can make with regards to inflation preparation then please contact the Strategic Corporate Finance team at Price Bailey LLP.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question? Ask our team...

We can help

Contact us today to find out more about how we can help you