Crown preference in insolvencies

We revisit the Crown preference changes and what they mean for insolvencies.

On 22 July 2020, the Finance Act 2020 received Royal Assent. The Act reintroduced preferential status for certain HMRC debts in insolvencies from 1 December 2020 after being removed in 2002. Now, a couple of years later, we revisit the Crown preference changes and what they mean for insolvencies.

What is Crown preference?

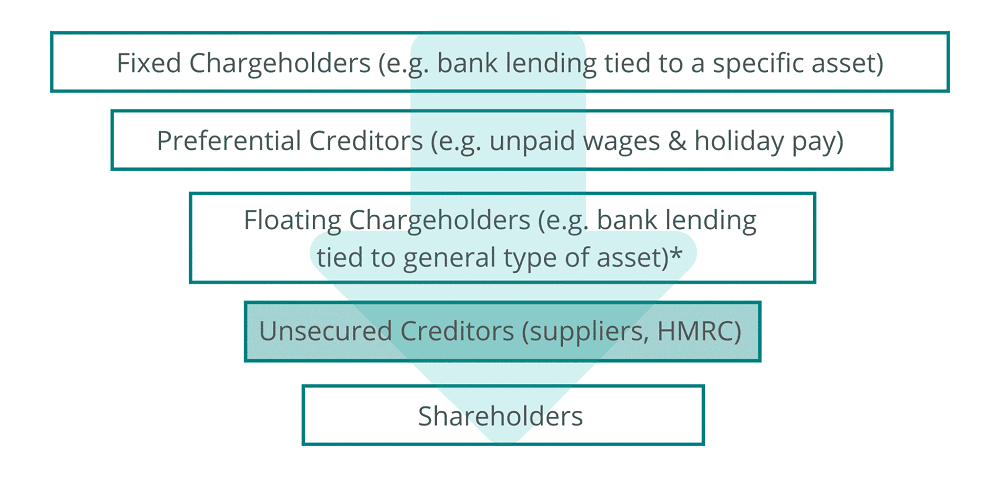

In an insolvency process, such as administration or liquidation, money from asset realisations is paid to creditors in accordance with “the order of priority”, from fixed charge holders (first-ranking) down to company shareholders (lowest ranking).

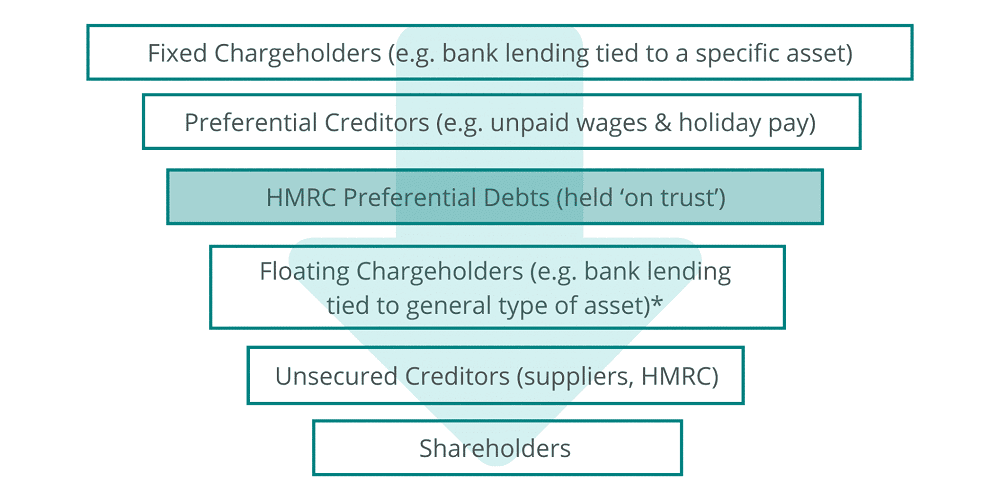

Cash realised cascades from one level to the next, only being available to the next, if the level above is full. From 1 December 2020, certain HMRC debts were ‘leapfrogged’ up the ranking, but prior to this the order of priority stood at:

*Funds otherwise payable to floating charge creditors may, in certain circumstances, be subject to a deduction of fund of up to £800k, known as the “Prescribed Part”, which is paid to unsecured creditors. The subject is not specifically covered here.

Since 2002, HMRC has ranked equally alongside all other non-preferential unsecured creditors for all debts, often receiving little or no return in an insolvency event. From 1 December 2020, HMRC ranked as a secondary preferential creditor for certain debts.

What classes as a preferential debt?

HMRC is often described as an involuntary creditor – due to having no choice in whether to deal with a business.

Due to its current ranking alongside other unsecured creditors, in 2020 the Government estimated the financial loss to the Treasury at c £185m per year, which it hoped would be significantly reduced by moving itself up the priority list.

Preferential status only applies to certain debts which are seen as paid to the Company “on trust” to HMRC. The debts are as follows:

- VAT

- PAYE

- Employee National Insurance Contributions

- Student Loan deductions

- Construction Industry Scheme deductions

The following debts will still rank as unsecured creditors:

- Corporation tax

- Employer National Insurance contributions

Knock-on effect

In the event of an insolvency, there is likely to be even less cash available for floating chargeholders, unsecured creditors and shareholders; who after November 2020 ranked below HMRC preferential debts and fixed chargeholders. In many cases, these stakeholders may have provided funding, trade credit or other support to the Company before these changes and/or any arrears accruing with HMRC.

The lack of restriction on age and level of HMRC arrears which will rank as preferential claims means the value of security held by lenders could vastly reduce overnight. Another concern for floating chargeholders is that the VAT deferral and Time to Pay schemes were a key government support mechanism in protecting businesses during the pandemic. This could see arrears being much higher than they would normally expect.

Three possible consequences for SMEs

- By reducing the security value available to floating chargeholders, there may be an adverse impact on both the cost and availability of finance for businesses. We would advise planning for the medium-term (12 -24 months) to better understand any funding requirements, and ensure funding is in place in good time;

- Borrowers may find themselves being asked for additional security, possibly personal guarantees, in order to cover a potential security shortfall. They may also be asked for a more detailed suite of management information, which could include a breakdown of amounts owing to HMRC;

- Given there will be less “in the pot” for trade creditors, B2B businesses may want to consider carrying out heightened due diligence on new or business-critical clients, and suppliers. Another way to mitigate this risk may be to take out trade credit insurance.

These three consequences do not provide an exhaustive list. The restructuring and finance industry has repeatedly voiced concerns that the change will increase the risk and cost of lending to UK SMEs, particularly for funders who rely on floating charge realisations in their security cover, such as asset-based lenders. The Government stated it believes the change will “not have a significant impact on the SME lending market”.

We hope the Government is correct, but as we progress through a recession where liquidity is likely to be a challenge for many, it seems anomalous that the Government have chosen to implement a policy which could make it harder for SMEs to access much-needed finance.

If you would like to talk to one of our team about the Finance Act 2020 and how this might impact you, then please feel free to get in touch with your usual PB contact, or Matt Howard from our Insolvency and Recovery team.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question? Ask the team...

We can help

Contact us today to find out more about how we can help you