Enterprise Value vs Equity Value

Whether you are making an acquisition or selling your business, sometimes the jargon used for how your business has been valued can be confusing. The two key terms used in any sale and purchase agreement in M&A transactions are Enterprise Value and Equity Value.

What is Enterprise Value?

Enterprise Value is the total value paid by the buyer for the future profits of the target in an acquisition. It is the value of business inclusive of all its stakeholders including all forms of debt and equity. This headline value is intended to reflect the future earning potential of the target and is commonly calculated by multiplying a normalised measure of profit such as EBIT or EBITDA (Earnings before interest, tax, depreciation and amortisation and exclusive of non-recurring expenses) by a chosen pricing multiple. Unsurprisingly the choice of pricing multiple is highly subjective and can be influenced by many factors including potential risks, expected growth and/or anticipated synergies so the actual multiple applied to a specific business can fluctuate far from average multiple values taken from aggregators. Equally, it is important to understand the detail and nuances behind the deals included in generating the multiple, as they may not be representative to your particular deal. Nonetheless, multiples when used correctly are incredibly valued and utilised widely in valuation methodologies.

At the time of the acquisition, the target is likely to have cash at the bank, outstanding debts and other working capital items in their balance sheet. Naturally the buyer will not want to inherit any debts in making the acquisition and, at the same time, the target will not want to leave any cash in the business in a sale. In order to realise these items as part of a deal, it is commonly agreed by both parties that the acquisition will be carried out on a cash-free and debt-free basis, i.e. the buyer will not inherit any cash or debts in the balance sheet at deal completion. A second assumption also commonly included in the deal structure is that a business will be acquired with a normal level of working capital; once again the choice of a ‘normal level’ of working capital can be highly contentious.

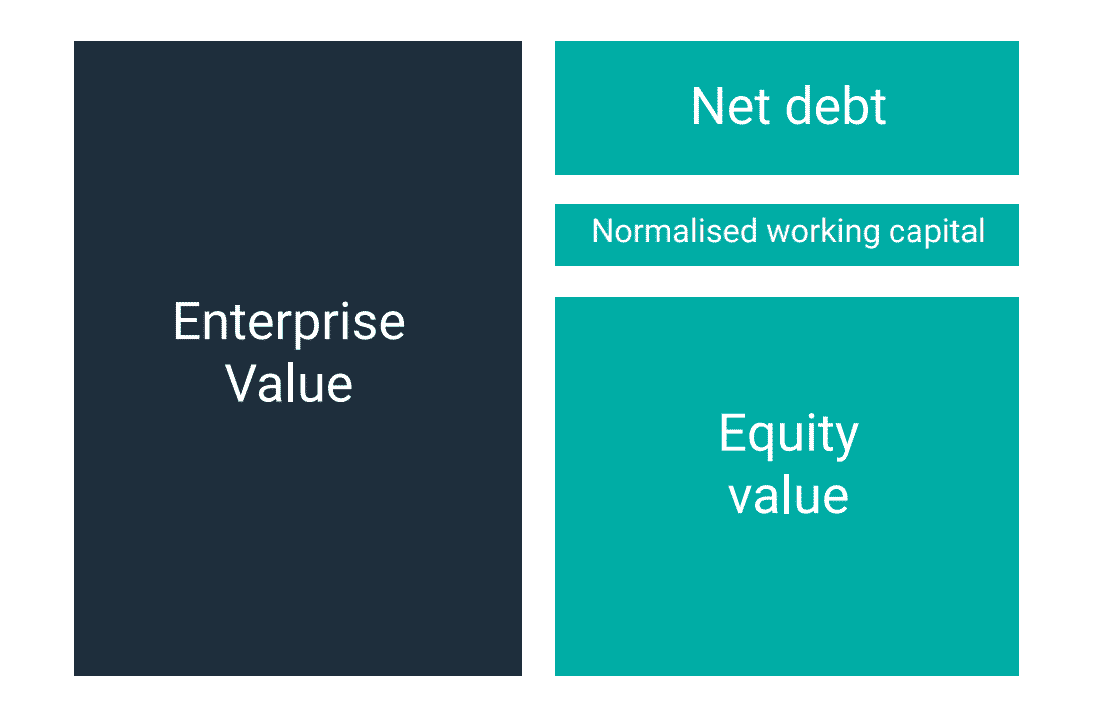

Enterprise Value will therefore be subject to several adjustments in order to reflect the balance sheet positon of the target at completion. Once these adjustments have been made, we arrive at the Equity Value.

What is Equity Value?

Equity Value is the total value received by the target in a sale:

Enterprise value to equity value bridge (based on a February or April completion)

| Enterprise value (£4m of normalised EBITDA x 8 multiple | £32m | |

| Plus cash and cash like items | £1m | |

| Les debt and debt like items | (£5m) | |

| Plus actual working capital | £6m | |

| Less normal working capital | (£7m) | |

| Working capital adjustment | (£1m) | |

| Equity value | (£27m) |

On completion conflicts can arise between the buyer and the seller concerning whether certain items should be classified as ‘debt-like’ or ‘cash-like’ not. Some debt-like and cash-like items include:

Cash like |

Debt like |

| Financial Investment (non-core) | Invoice discounting |

| Cash from exercised share options | Deferred income |

| Deposits (that will be repaid) | Minority interests |

| Tax losses | Deferred consideration |

| Underspent CAPEX |

Deferred Income is often one of the most contentious of all items in deals. Whilst it’s in the buyer’s interest to classify deferred income as debt-like and so deduct the amount from enterprise value (in essence ‘leave behind’ as a debt), it’s in the seller’s interest to classify deferred income as working capital. As with many items like deferred income, there’s no right or wrong way to classify on completion; the treatment will depend on the nature of each specific item and requires careful analysis. The final classification can also be dictated by the relative bargaining power of each party in a deal.

Reaching the final Equity Value can be a difficult and lengthy process (note: this can be mitigated if the appropriate completion mechanism is used: ‘Completion Accounts’ or ‘Locked Box’). If there are relatively high levels of cash/low levels of debt in a business, a deal can become significantly more profitable for shareholders of the selling party. This is because net cash in the business is released to shareholders in addition to the enterprise value received. However, if there are relatively high levels of debt in the business, the value changing hands in a deal can be largely reduced.

Nonetheless, it is fundamentally important for business leaders involved in deals to truly understand the difference between Enterprise Value and Equity Value, as in most deals, the value paid by the buyer and the value received by the selling shareholders are different amounts.

It’s important to understand the structure and terms used in a deal before you proceed. Ask your advisor, they should always be happy to explain terms and concepts to you, that’s part of our job.

For more information contact Simon Blake, Strategic Corporate Finance Partner at Price Bailey using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Ask our team…

We can help

Contact us today to find out more about how we can help you