How long does it take to get EIS Advance Assurance?

One of the most frequent questions we are asked by clients when advising them on applications for EIS and SEIS clearance is ‘how long will it take?’

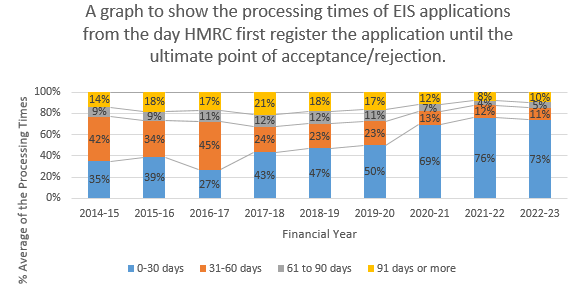

In this article, we seek to provide businesses with clarity on the time that should be allowed when preparing for and submitting their EIS (and SEIS) Advance Assurance Requests (AARs). Using HMRC data on application processing times we share our advice on the application process to hopefully support in reducing unnecessary delays.

We analysed this data for the first time in 2020, and the 2018-2019 findings showed that whilst there was an improvement regarding processing times of EIS applications year-on-year, more than 50% of applications were still taking 30+ days to resolve. However, in the years since, new data from HMRC has revealed that there has been a significant improvement in the processing speed with only 26% of applications taking more than 30 days to resolve during the course of the last tax year, 2022-2023.

How did the COVID-19 pandemic affect EIS and SEIS applications?

- In 2020-2021, EIS funding declined by 12%, but still amounted to £1.66bn for 3,755 start-ups, a 300% increase from 10 years ago.

- First-time start-ups raised less, with a 24% decline in funding and a 10% decrease in the number of companies.

- The tech sectors remained stable, while accommodation and food funding declined by 54%.

- Scotland, Wales, and London saw 20% declines in total raised, but the East of England only decreased by 11%.

- EIS applications in 2021-2022 were back to 2019-2020 levels, showing a normalisation back to pre-COVID levels, which is encouraging for early-stage high growth businesses looking to take advantage of the scheme.

Business leaders must, however, continue to seek support on EIS and SEIS early; the rules have become increasingly detailed and Advance Assurance acceptance in the past was, and still is, frequently not an indicator of acceptance in the future.

The U-turn on EIS AND SEIS

In October 2022, Chancellor Jeremy Hunt delivered his Emergency Statement which included a complete U-turn on many of the reforms announced by his predecessor just a few days earlier. The Government could decide to discontinue the schemes beyond 2025, however the clause which enabled this has been scrapped meaning this is no longer the case. This reconfirms the current Government’s commitment to fuelling innovation and entrepreneurship within the UK.

From our own experience, we have seen many AARs succeed very quickly. However, for those 26% of applications (2022-2023) that are currently waiting 30+ days, in our experience it is likely to be caused, at least in part, by one of the following reasons :

- Founders have been poorly advised and the applications missing key detail and understanding of what HMRC expect to see and how they appraise AARs

- Additional complexity in deal structures – in particular, driven by the emerging divisions between EIS focussed institutional investors and incumbent or new angel investors

- The misunderstanding of risk to capital conditions – we explain this further below

Risk to capital conditions

The introduction of the risk to capital conditions, without comprehensive guidance on how they would be applied, has meant business and advisers are experiencing difficulty in understanding how strict these rules are. The ‘risk to capital’ rules means that entrepreneurs must demonstrate to HMRC and investors that there is a “significant risk” of a capital loss on their shares exceeding the “net investment return”.

The introduction of the rules was as a consequence of HMRC’s concern that too many EIS investments were being made with capital preservation in mind when the EIS tax reliefs aimed to incentivise investment into risk assets.

Our advice to businesses seeking to apply for Advance Assurance

While it is not mandatory to seek Advance Assurance before submitting an EIS Compliance statement on completion of funding, it is highly recommended for two reasons.

- The quantum of information which must be submitted together with an EIS compliance statement when seeking Advance Assurance means that, once investments have been made and shares issued, the process is to providing investors with the proof of EIS qualification and the time associated is significantly reduced

- Many sophisticated investors are unlikely to invest without such assurance already in place.

Therefore, our advice to any business owners hoping to make use of EIS in an upcoming fundraise is:

- Ensure you meet the requirements – It sounds obvious, but, we have experienced several business leaders who believe that they should qualify simply based on being an early-stage business. There are several requirements and tests that a company must meet to be eligible for EIS.

Some of the requirements are relatively straight forward, such as sector and age of the business. However, the interpretation of the requirements can be a time-consuming process depending on the specific circumstances of both the business and its existing ownership structure. It is much better to invest that time early on, and we advise that you seek assistance from a tax adviser who can support in understanding whether you meet the requirements.

- This isn’t a box-ticking exercise; have the value creation strategy and investment thesis to support your application – One of the AAR requirements is that you can demonstrate how the investment will be used for growth and development. Therefore, ensuring that you have allowed adequate time to develop a robust growth strategy that clearly demonstrates what you will be doing and how value will be created in the business (ideally for 3-5 year, and detailed for the first 1-2 years), backed up by market data is paramount.

You should be doing this anyway as investors will expect it when conducting their own due diligence! Find out more about developing your value creation strategy.

- Have the investors ready – Up until a few years ago; you would be able to make an EIS AA application in advance of raising funds. Unfortunately, that resulted in a large number of businesses applying for assurance on a ‘just in case’ basis which put significant weight on HMRC resources and increased the length of time in processing applications. Consequently, HMRC will grant advance assurance where the company specifies the individual(s), fund manager(s), or other funder(s) who are anticipated to make the investment.

HMRC does not require investment offers to be formalised at the time of application (as many are likely contingent on obtaining advance assurance). However, the company is expected to be in negotiations with potential investors and able to present details of the expected investment upon receiving the advance assurance. Encouragingly, these changes have significantly reduced the processing time for applications to just a couple of weeks in most instances.

- Incorporate your EIS AA application into your fundraising plan – Timing with this, as you can see from the data above, can be everything. Begin the application too soon, and you may not have identified and attracted the right investors; too late and you are grappling with completing the application and hope that it is processed in no more than 30 days. Too often, we have business owners that consider the EIS AA process as a separate concern from their growth strategy and funding planning. As we explained above, particularly in the current circumstances, being able to provide investors with EIS relief will be a source of advantage. It could be the difference between getting the funding you need to deliver on plans, and not. Therefore, incorporating the application process into your funding preparation plans and allowing some contingency for fluctuations in HMRC’s response time is advisable.

Important Note

Please remember that receiving Advance Assurance from HMRC is only confirmation that the business could qualify for EIS and does not provide certainty that your investors will meet the conditions of the scheme.

Despite the current conditions, equity deals are still taking place and provide a vital source of capital to growing businesses. However, at the same time, investors are aware that some funding is required for working capital; the purpose of investment must remain for value creation and growth, i.e. not survival. Therefore, businesses who plan to seek equity investment and believe they may qualify for EIS are encouraged to continue to apply for Advance Assurance during this time. Albeit, we would expect that, given the other Government schemes ongoing, that response times may vary.

This blog was written by Jay Sanghrajka, Tax Partner at Price Bailey and Chand Chudasama, Strategic Corporate Finance Partner. If you are raising funds or planning to and are not sure what to do about seeking SEIS/EIS Advance Assurance, please contact either our Tax or Strategic Corporate Finance team via the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you