What are the best options for extracting money from your company?

Finding the right way to extract money from your private company can be a complex matter. Some of us have spent years balancing conflicting factors in an attempt to get to the very best answer.

However, the truth of the matter is, there rarely is a single best solution and there certainly is not a ‘one size fits all’ answer that applies to everyone all of the time, nor is there one that applies to one person all of the time.

While this is the case, we have put together this short article to help provide some guidance on the options available to our UK tax resident clients looking to take money out from a company. For the purposes of the article, we have assumed that the individual in question has control of the business, or at least have sufficient influence to make things happen. Additionally, given that the particular taxes and the rates thereof are complex, this is also best thought about in a marginal context. In other words, it is assumed that the ‘easy wins’ have been exhausted, you have a basic salary to meet day-to-day needs and now have some spare cash in the company to come out. It is this spare cash that we are discussing here.

For the fullest evaluation of the right options, consideration needs to be paid to a number of factors including but not limited to:

- Accounting

- Benefits: current and future

- Cash flows

- Other stakeholders

- Self-assessment and other compliance obligations

- All taxes, including both National Insurance (NI) and the new Health and Social Care Levy (HSCL) that comes into place in April 2023.

The right solution will require a careful balance of each of these points, and will be specific to each individual. Therefore, the best thing to do is not to expand on each of these factors here and instead advise that you discuss this with us or your tax and/ or financial advisor who will be able to assess your particular situation.

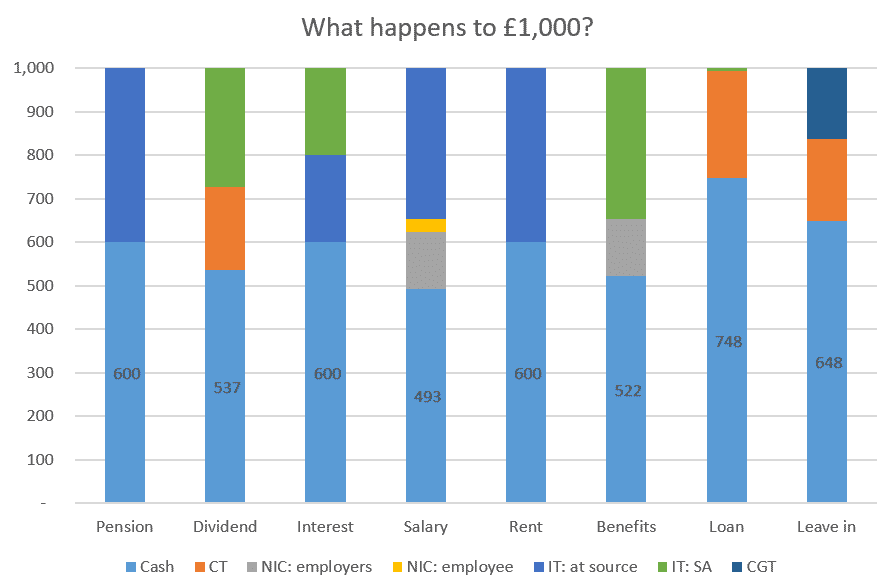

In order to best explain the different ways available to extract money from a private company, we have provided the following chart example that shows what happens to £1,000 in various scenarios. In each case the rates are those that will apply in the next tax year, starting 6 April 2022, to a higher rate taxpayer (40%) who has already reached the NI contributions upper earnings limit.

| Key:

Pension = the payment of a pension (here it is not the payment of pension contributions, which can often end up in a scheme without any tax loss at all). Benefits = although expressed in money terms, benefits cannot be paid out in cash or easily converted into money. CT = corporation tax, IT = income tax, whether payable at source (e.g., PAYE) or by self-assessment (SA), CGT = capital gains tax. NIC = includes the new HSCL for both employers and employees. |

Firstly, if “best” means the smallest immediate tax burden to the individual, then taking a loan from the company would be the optimal choice. However, this option comes with other issues, including the possible adverse longer-term tax consequences that can make loans of this nature unwise. The Gov.uk website provides an extensive guide on the tax responsibilities on company loans, depending on the nature of the loan, amount, and how the loan will be settled. Ultimately though, as with any commercial loan, they have to be repaid and are only really suitable as a short-term fix.

However, taking each of the examples in the chart:

- Pension, Interest & Rent – Each of these options can provide the individual with £600 in cash from the £1,000 available. Nevertheless, each of these require the owner to have something for the company to use: respectively history, money and/or property. If your facts do not fit then these options will not help. However, if you do allow your company to use your money or premises, you should certainly think about charging it for the privilege.

In our experience, there are few companies that want to pay pensions as it can come with unwanted accounting implications. However, if you can persuade your employer to carry on paying you after you stop working in the business, that can be more financially beneficial than staying on the payroll with a well-paid part time job.

- Dividends, salary and benefits – For many, the only available options are between dividends, salary and benefits. The best of the three from a tax perspective is dividends with just over half your money (£537) remaining with this option. However, it is important to note that when the new rate of corporation tax comes in from 1 April 2023 (and assuming all else remains the same) that will fall to £497. The second best option of the three is benefits which should give you £522 of value (not cash). Finally, is the option of a cash bonus to your salary. This falls in last place as it only delivers £493 after all taxes.

Therefore, as of 1 April 2023 the total tax take from dividends and salary is so close as to make little difference. If they did not already do so, the other factors listed at the start of this article will determine what’s best.

- Leave in – Finally, if you don’t need the money then it may be best to leave it in the company and then sell it when you sell the shares. In this instance, you should be left with £648, or possibly more if you have CGT reliefs or exemptions available.

In summary, the mechanism is of paramount importance when looking to take money out of your company and taking the time to assess which is right for your particular circumstance can mean a significant difference in the value you receive. Some mechanisms are generally more popular or widely accepted than others, for example, few owners charge interest or pay pensions, many pay themselves dividends. However, in the new world (1 April 2023 onward) the difference between mechanisms will be significant: £600 compared to £497 is a 20% better return from the same source.

This article was written by Charles Olley, Tax Partner at Price Bailey. If you are considering taking money out of your company and would like to understand how you can improve your returns, please contact the tax team using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

Have a question about this post? Ask our team...

We can help

Contact us today to find out more about how we can help you