Should business owners take any pre-election action?

The 2024 General Election at a glance: Key Tax Considerations

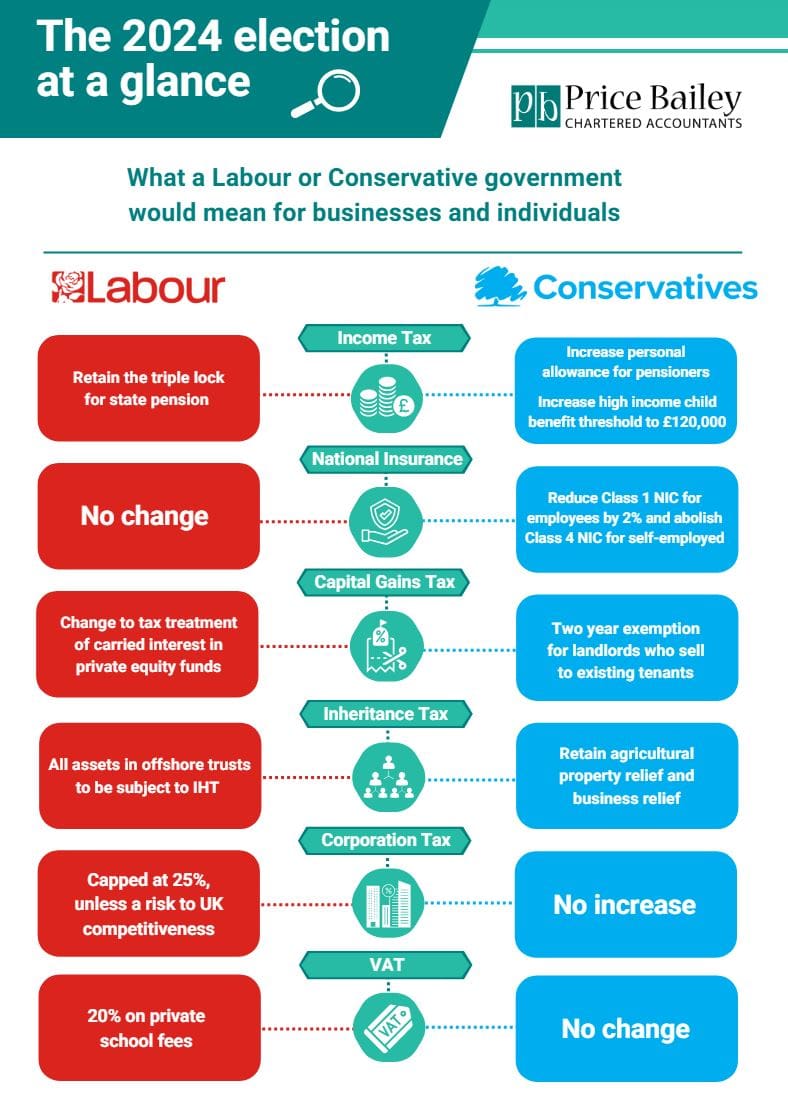

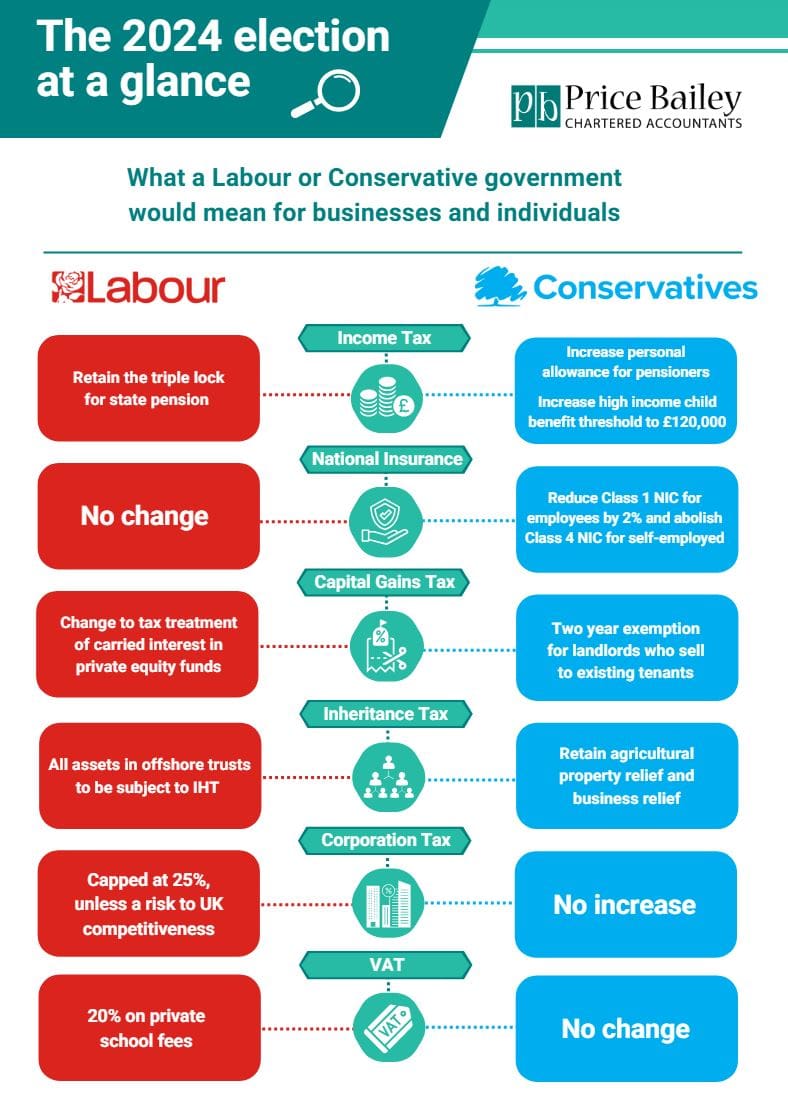

We are days away from one of the most momentous elections in the UK’s history. Campaigning is coming to a close, manifestos have been published and dissected, and many new policies will be decided as a result. Whilst each party has its own key pledges, the pressing concern for many business owners and high net worth individuals will be increasing taxes under a Labour government.

A win for Labour could make a significant difference to such personal and business plans. Should Labour form a government, it will radically redistribute wealth through higher taxes and provide a more significant role for the state, possibly driving some entrepreneurs away from the UK.

The impacts could be felt quickly if a Labour government proceed to hold a post-election budget in September 2024, as suggested by Shadow Chancellor of the Exchequer, Rachel Reeves.

Some will therefore be looking to take immediate action prior to any anticipated changes in tax policy, with pension, capital gains tax and inheritance tax planning as potential key areas of concern, whereas others will favour a wait and see approach for the finer detail to the manifesto promises once the full election result is known.

Common pledges are no increases to the rates of income tax, national insurance and VAT, however beyond those, changes to tax thresholds, allowances, availability of reliefs and more are all areas for voters to weigh up ahead of polls opening on 4 July.

Labour manifesto

The Labour Party’s 2024 manifesto outlines several tax policies aimed at addressing economic stability, public services, and social equity without increasing the tax burden on working people. Key areas include:

- Windfall tax on oil and gas companies: Labour plans to implement a “time-limited windfall tax” on the large profits of energy companies.

- Ending tax breaks for private schools: The manifesto proposes removing VAT and business rates exemptions for private schools.

- Closing non-dom tax loopholes: Labour intends to abolish non-dom status to close tax “loopholes” for individuals with non-domiciled status. The Party will also end the use of offshore trusts to avoid IHT.

- Cracking down on tax avoidance: Labour propose to modernise HMRC and change the law to tackle tax avoidance, in particular focusing on large businesses and the wealthy.

Their manifesto also guarantees that there will be no increases in the rates of income tax, national insurance or VAT for working people. Instead, Labour is focused on making the tax system fairer by targeting high earners and large corporations.

Conservative manifesto

The Conservative Party’s 2024 manifesto outlines its key tax policies aimed at reducing tax burdens and stimulating economic growth. The main points include:

- National Insurance (NI) cuts: The Conservatives plan to cut employee National Insurance by 2%, with a long-term goal of abolishing it entirely when economically feasible. For self-employed individuals, Class 4 NI will be abolished by 2029.

- Income tax and pension policies: The Party has pledged to introduce a “Triple Lock Plus” for pensions. This ensures that the state pension and tax-free personal allowance for pensioners rise by the higher of inflation, earnings, or 2.5%. Working parents will also benefit from an increase in the high-income child benefit threshold to £120,000.

- Capital Gains Tax (CGT): Conservatives will maintain Private Residence Relief so that an individual’s main home is exempt from CGT. Property investors will also benefit from a temporary CGT relief when landlords sell their properties to tenants. Business Asset Disposal Relief will also be retained.

- Stamp Duty Land Tax (SDLT): The threshold at which first-time buyers start paying SDLT will be increased to £425,000.

- Inheritance Tax (IHT): Key reliefs such as Agricultural Property Relief (APR) and Business Property Relief (BPR) will be retained.

- Non-domiciled tax status: The manifesto remains notably silent on the future of the non-dom regime, which was proposed for abolition in the Spring Budget.

Their manifesto also guarantees that there will be no increases in the rates of income tax, national insurance, corporation tax or VAT. These policies reflect the Conservative Party’s focus on tax cuts and maintaining certain tax reliefs to support economic growth and investment.

Other parties

Liberal Democrats

The Liberal Democrats’ 2024 manifesto outlines a series of tax policies aimed at increasing fairness and funding public services.

Key proposals include raising funds through tax reforms such as increasing the digital services tax from 2% to 6%, imposing a 4% tax on share buybacks by large companies, and reversing recent tax cuts for banks. They also propose a one-off windfall tax on oil and gas companies and closing capital gains tax loopholes. The manifesto plans to cut income tax by raising the tax-free personal allowance and aims to implement a minimum global corporation tax rate of 21%.

Green Party

The Green Party’s 2024 manifesto focuses on creating a fairer and more sustainable tax system to fund public services and climate initiatives.

Key proposals include introducing an annual wealth tax of 1% on assets over £10 million and 2% on assets above £1 billion. They also plan to align the tax rates on income and capital gains, remove the Upper Earnings Limit on National Insurance, and simplify the overall tax system.

Reform UK

Reform UK’s 2024 manifesto emphasises significant tax reforms aimed at reducing the overall tax burden via extensive tax cuts funded by reduced government spending.

Key proposals include raising the personal income tax thresholds, cutting corporation tax, and abolishing inheritance tax for estates below £2 million. The party also plans to drastically simplify the tax code and eliminate VAT on energy bills.

Should I take any action pre-election?

If you or your business are close to wrapping up any imminent and time-critical transactions, the answer is maybe. This may be in line with your commercial objectives and provides certainty on the prevailing tax treatment.

More realistically is the importance of reviewing your tax position and taking advice once the full election result is known and ahead of the next fiscal event, which is not commonly expected until September 2024.

During this time, it will be especially relevant for individuals making use of their tax allowances to review their pension contributions, investment decisions, capital gains transactions and estate planning strategies which could be open to change at the next Budget.

Business owners should similarly review any large or exceptional spending which may qualify for specific tax relief, such as capital or R&D expenditure. Fundraising under EIS/SEIS is another example of where reliefs and limits could change.

Finally, completing any ongoing transactions ahead of a post-election budget should result in existing treatment being applied, assuming no retrospective measures are announced. Similarly, there could be scope to defer some transactions if a more favourable outcome is expected.

Whilst personal opinion is likely to be a factor in your decisions, Price Bailey can help answer any questions and advise on the best course of action pre or post-election on these or related matters. Together, we can help you make the best plan for your business and personal wealth.

This post was written by Gemma Thake, Tax Partner at Price Bailey. If you would like to know more then please contact Gemma using the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question about this post? Use the form below to contact one of our experts...

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.

We can help

Contact us today to find out more about how we can help you