How much are companies worth?

Here is our advice based on valuing around 55 companies a year.

What is the difference between Price and Value?

In simple terms “Price is what the seller receives; value is what the buyer receives”

It is very easy to ‘price’ a business. Some advisors will say 7x EBITDA, or 3x revenue. Some business owners will say ‘I’d only sell my business for £10m’ – these are all examples of pricing. They are the pre-tax amounts paid in different securities (normally cash) to the seller.

Value is the combination of two things: PRICE + EXCESS RETURNS = VALUE

‘Excess returns’ are typically formed from the operating cash flows generated through trading and the growth in value of the company’s shares in the eyes of a market.

Value therefore has operating risk. This is why buyers are willing to pay different amounts, in different structures for the same business. They each see the value to them in different ways and ultimately that drives deal structure and price realism.

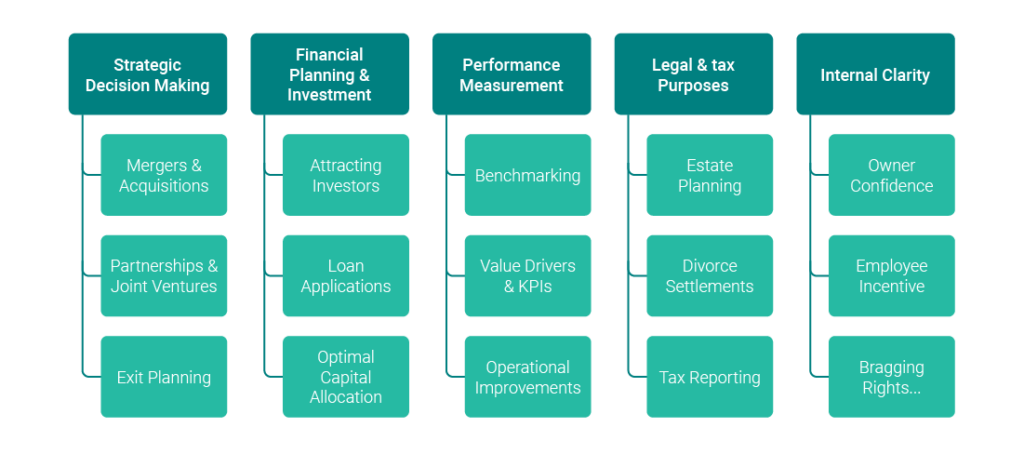

Why does valuation matter?

Understanding the value of a business is crucial for several reasons.

To note a few, it helps in making informed investment decisions. Investors and acquirers need to know whether they are paying a fair price for a company to understand the potential returns they can expect.

As an owner or manager, knowing the value of your business can help with strategic planning, such as identifying growth opportunities, areas for improvement, and setting long-term goals.

Accurate valuations are also vital for succession planning and strategizing an exit, ensuring that business owners maximise returns when the time comes.

Reasons for valuations:

What matters when determining the value of a business?

Two companies were recently targeted for inorganic growth: Curve Games, a publisher of PC and console games with EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) of approximately £11 million, and Blakemans, a sausage manufacturer established in 1953 that reported EBITDA of around £5 million. Both companies were acquired by larger trade buyers from their respective industries, but despite its higher earnings, Curve Games was purchased at a lower price compared to Blakemans.

Why?

This outcome is explained by the valuation approach, where the value of a business is generally calculated as ‘profit’ – in this case, EBITDA – multiplied by a ‘profit multiple’. In these transactions, the profit multiple applied by Curve Games’ acquirer was lower than the multiple paid by Blakemans’ buyer.

How to value a business: The Formula for most businesses

Most businesses are valued based on a multiple of EBITDA which serves as an effective indicator of a company’s core profitability, as it excludes non-cash expenses as well as exceptional and non-recurring items.

PROFITS * PROFIT MULTIPLE = ENTEPRISE VALUE

The appropriate EBITDA multiple is based on comparable companies that have exited, usually matched by sector, size, and transaction timing.

Why do these factors matter?

Sector

Take sector – different industries tend to attract different multiples of profits due to perceived or real differences in the quality of those profits. Quality can be assessed both in terms of the financial reporting available and the sustainability of the earnings.

For example:

- Do long-term contracts and recurring customers underpin the revenue?

- Is there a scarcity value to the product or service being sold?

- Is the market in which the business operates growing quickly?

- Is there a comparative advantage: i.e., quality premium or cost leadership?

- Is the brand well known, with corresponding customer loyalty?

Positive responses to these questions tend to drive high multiples in, for example, the software industry but may result in lower multiples in other sectors depending on the market structure. In 2024, the median TMT (Technology, Media, and Telecoms) multiple was 9.5x, whereas in industrial support services, this multiple was 5.9x.

Profit multiple by sector

Source: MarktoMarket

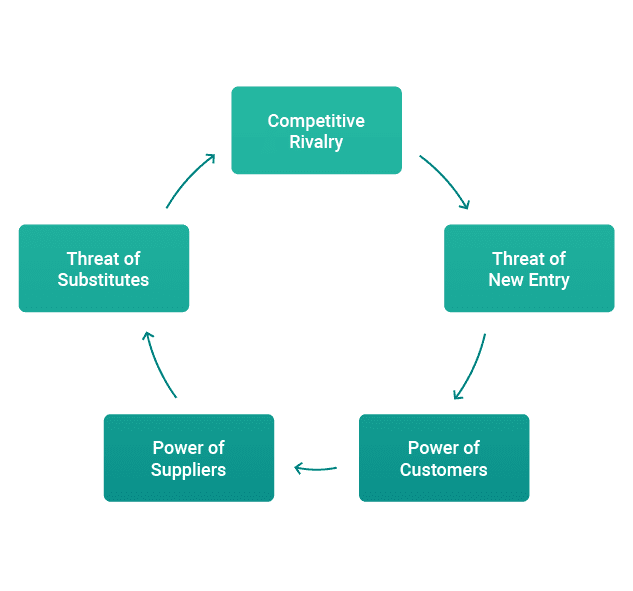

In assessing a target’s competitive position in its market, we will typically lean on Porter’s Five Forces..

Linking back to our examples, a company which commands a higher profit multiple may have:

- Limited substitute products or services available to customers.

- Comparative advantage (unique products, skilled staff, proprietary tech, network effects, etc.) resulting in barriers to entry.

- Economies of scale and high switching costs for consumers.

- A significant number of competing suppliers.

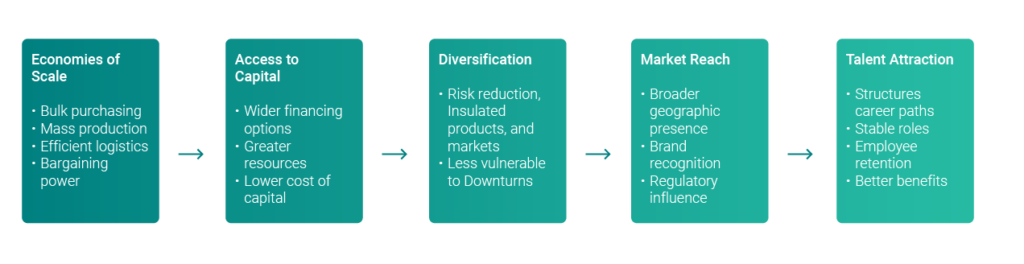

Size

Size is a material determinant in valuing businesses. Larger businesses are perceived to have greater value for a variety of reasons:

As a simple example, diversification allows robust profits thanks to increased immunity to market shocks, whereby low points in one business line or geography are supported by highs from another. If we look at an extreme example, when Amazon’s retail sales dip – being a reduction in discretionary spending – AWS, Amazon’s cloud computing platform can provide a buffer for the downturn.

There is something of a paradox here in that smaller businesses tend to exhibit higher growth rates, which may attract a higher multiple, but this is for another day.

To look at how size impacts multiples, the following graph (with data courtesy of MarktoMarket) shows the premiums or discounts compared to an index of all transactions in 2024. As described, the larger companies typically attract a greater premium on the valuation multiple.

Discount/premium on profit multiples by size

Source: MarktoMarket

In 2024, small-cap businesses have sold for roughly a 40%+ premium compared to micro-cap businesses.

Cycle

Finally, why does timing matter?

We should consider the point in the market cycle when an acquisition takes place.

When a transaction is completed during a period of economic expansion or growth within a specific sector, the multiples include some hope value. On the other hand, where a transaction completes at a time of economic contraction and depressed prices, the multiple paid will be lower, due to a reduced expectation of future performance.

In identifying an appropriate multiple, those closest to the present should have the highest relevance as those transactions will offer the best indication of current market health and sentiment.

Multiples over time

Ultimately, various factors come into play when determining an appropriate multiple and consequently, valuation – such as growth characteristics, quality of the management team, the strength of the brand, and reputation, amongst others – but a valuation approach backed by financial data that can be evidenced, and previous transaction multiples from companies of comparable sector, size, and cycle timing, should provide a great starting point to identifying value.

If you’d like to know more, speak to us by filling out the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Sign up to receive exclusive business insights

Join our community of industry leaders and receive exclusive reports, early event access, and expert advice to stay ahead – all delivered straight to your inbox.