Capital Allowances provide tax relief boost on property expenditure

Capital Allowances is a form of tax relief which can provide a valuable tax saving if claimed on certain property expenditure. Capital Allowances are available to owner occupiers, companies, small enterprises, partnerships, individuals and overseas investors.

Who can claim

Anyone who owns an interest in a property, whether it be a freehold, leasehold or as a tenant and incurs capital expenditure either by acquiring that property, developing it from new, carrying out a refurbishment or fitting it out, will all give rise to an opportunity to claim Capital Allowances. All building types can attract Capital Allowances from offices, industrial, retail to leisure. The only specific exclusion is a dwelling home such as a house or flat, but even for the latter the common areas including plant rooms can be claimed on, as can residential care homes and student accommodation.

The benefit

To benefit from making a claim for Capital Allowances, the property must be held as your business premises or an investment property which you derive an income from. Property developed by a developer and held as trading stock does not qualify. As Capital Allowances is a form of tax relief you must be tax paying, so non-tax payers such as pension funds or charities cannot claim.

Case study 1 – industrial unit acquisition

This freehold industrial unit was acquired for £1,500,000 and the contract stated that there were no Capital Allowances. As the purchaser was the first after 1 April 2008, there was a further claim based on the introduction of integral features. This led to a claim for £225,000 which due to annual investment allowance meant a full deduction in the year of acquisition, which for a 20% corporate tax payer gave rise to a £45,000 tax saving.

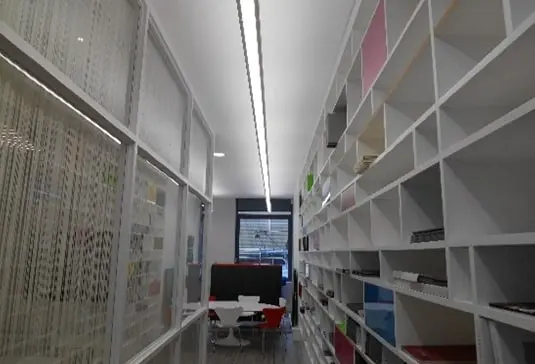

Case study 2 – office fit out

This office was acquired and then later fitted out to include new air conditioning, demountable partitions, kitchen tea point and new flooring. In total, the client spent £250,000 on the fit out, of which a claim of £222,000 was made which based on the partnership being high rate tax payers provided a total cash saving of £100,000 for the partners.

Timing of claim

If you say have a 5 April 2017 tax year end, any qualifying Capital Allowances expenditure incurred in the proceeding 12 months would go into your 5 April 2017 tax return, which for companies must be submitted by 5 April 2018 and for individuals it is 31 January 2018. This would also provide the added benefit of claiming up to £200,000 of qualifying expenditure as the Annual Investment Allowance, rather than claiming those allowances at the standard rates over several years.

Free download: “Inside the Minds of Business Leaders 2019”

Discover what 200 business leaders from London, Hertfordshire, Cambridge and Norwich had to say about growth strategies, Brexit, exporting, their daily concerns and life as a business owner.

Discover what 200 business leaders from London, Hertfordshire, Cambridge and Norwich had to say about growth strategies, Brexit, exporting, their daily concerns and life as a business owner.

Note however, the ability to submit a claim for Capital Allowances is never lost and so for historic qualifying expenditure, if those claimable items are still a fixture in the property, a claim can still be made, you can claim on expenditure which goes back as far as you like. For such historic expenditure, there is the added benefit of being able to amend the first open tax return, which is typically in the last two years.

When it comes to claiming Capital Allowances on individual purchases such as new IT equipment or office furniture, these are easily identifiable at the time the accountant is preparing the annual tax return.

The complexity arises where the potentially qualifying expenditure is either a property acquisition or part of a wider building project where it is not as easily identifiable. Even where cost information is in short supply, claims can still be unearthed and a significant tax cash saving achieved.

This article was written by Nolan Masters of Veritas Advisory. For more information or to ask Nolan a question fill in the form below.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

Have a question? Ask our team...

We can help

Contact us today to find out more about how we can help you