Cosmetic procedure or medical care?

Understand the critical VAT distinctions between cosmetic treatments and medical care, and how misclassification can lead to significant financial consequences with HMRC.

How do you become that famous place to work?

One of the biggest challenges many businesses face is recruiting and retaining enough skilled staff. In some sectors, the problem even threatens growth.

The solution is not simply to pay more in salaries. That’s a short-term solution that can cause cash-flow problems. Although pay is important, you need to offer more than cash; intangible benefits are just as important as the tangible ones of bonuses, staff welfare schemes and social activities. For example, staff can gain very powerful benefits from your management style. If you create a consultative environment where everyone feels they have a say, or is at least aware of business decisions and strategies, your workforce will feel more valued.

To attract and retain the best people, you need to become the ‘employer of choice’, getting yourself noticed among skilled staff who can be selective about where they work. And this reputation must be matched by a strong HR team. So potential employees hear about the company and, when they join, they find the promised benefits really do exist.

Also remember, with social media there are no secrets about what it’s like to work for a company. Disgruntled staff will let their feelings be known – so always ensure your brand image is true to the reality.

We can help you build staff engagement to foster wellbeing within your workforce – and support you in developing a culture that appeals to, and nurtures, the right talent.

Contact us today to find out more about how we can help you

Understand the critical VAT distinctions between cosmetic treatments and medical care, and how misclassification can lead to significant financial consequences with HMRC.

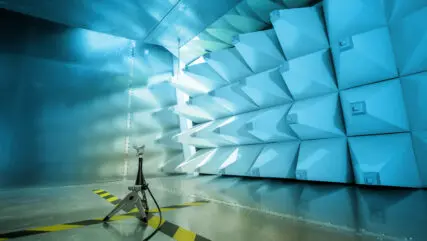

Price Bailey client Electromagnetic Testing Services Ltd (ETS) has been acquired by NMI Group, allowing the Buyer to Strategically Expand into EMC Capabilities and the UK Market. Find out more here...

Our Price Bailey experts assist Falcon Freight Ltd, a logistics and transportation company that continues to grow year on year despite market fluctuations. We support them with audits, accounts, and tax compliance. Find out more here...

Tax Investigations Partner, Andrew Park, provides a round up of the most recent and significant contentious tax news. Read more here...