Current trends and technologies in the UK Agricultural Technology industry

The global population is expected to rise to 9 billion by 2050, amounting to 150% of current production capacity. This increase presents both a growing opportunity and responsibility for the agricultural industry through increased future demand for food, land, energy, and water as well as other complementary resources, such as phosphate for fertilisers.

This expectant demand for agricultural goods and services will need to be met by innovation and development across the industry. Such development will not only allow growing demand to be met, but will likely bring about supplementary benefits including increased crop yield, greater profitability, and increased farming efficiency and resilience to volatile weather conditions.

The current and increasingly disruptive range of agricultural technologies is expansive, spanning from innovative software, biotechnology, and hardware, including automated equipment, to sensors and streamlined machinery. The overarching themes across all areas of innovation demonstrate that the UK agriculture industry is under the same developmental pressures as most sectors within the UK economy. Those being 1) environmental impact, 2) efficient processes, 3) data driven productivity and 4) greater predictability for the industry.

Advances in agricultural technology provide an exciting opportunity for farmers to reduce labour needs and streamline productivity in a sustainable manner. To help you understand the range of industry developments and what this could mean for your business, this report offers a comprehensive review of prominent trends and technological developments across the UK Agri-Tech space. We will start with a brief overview of industry trends and related investment activity, followed by a review of the current technologies that Agri-Tech has to offer.

Increasing Government assistance for UK Agri-Tech

To help facilitate the advancement of agricultural technology the UK Government is taking a proactive stance in offering a wide scope of financial assistance to the industry. In January 2022, as a new instalment of Defra’s productivity focused farming investment fund, a new £25m grant scheme for Agri-Tech businesses was introduced, offering grants ranging from £35,000 – £500,000. The grant scheme allows farmers and growers to receive investment for use in robotics and technology, including autonomous tractors, robots that harvest, spray crops and weed, as well as automated milking systems. Current uptake figures for the scheme are not yet available.

Further exciting news for Agri-Tech start-ups this year includes an announced additional £16.5m of funding from Defra towards R&D as part of its £270m Farming Innovation Programme. In placing a greater focus towards sustainability, the wider farming innovation programme aims to apply agricultural research and science to increase productivity and resilience whilst minimising the environmental impact of agriculture and horticulture.

This investment provides an additional boost to Agri-Tech businesses, who are already able to benefit from R&D tax reliefs that sees them able to claim up to 33% of their development costs, even if the development does not result in a new product or service. To find out more about R&D tax credit relief and eligibility you can read our article here.

Private equity investment in UK Agri-Tech (Q1 2021 – Q2 2022)

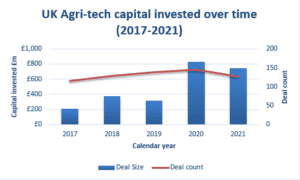

Despite the challenging economic outlook experienced in 2020/2021, increased investment interest towards UK Agri-Tech is reflected through an increase in capital invested over time from 2017-2021.

As shown below, aggregate annual private equity investment in UK Agri-Tech has grown sharply since 2017, growing from £208m across 116 deals to £745m through 127 deals in 2021. Whilst there was a decrease in deal activity experienced between 2020-2021, there is still significant deal activity occurring in the space, and with the marginally lower decrease in deal size compared to deal count in 2021 it appears that the capital invested per deal was slightly larger.

It will be interesting to see how full 2022-year figures compare, given the significant economic difficulties experienced in the last 12 months and the risks to the global agricultural market created by Russia’s war on Ukraine.

Exciting new trends & technologies in Agri-Tech

The move towards renewable technology

With the UK Government’s ambitious goal of reaching net zero emissions by 2050 approaching, and an influx in the use of renewable agricultural technology, UK Agri-Tech has the capacity to respond. This is furthered by the National Farmers Union’s (NFU’s) ambition to reach net zero by 2040 through encouraging and supporting landowners to improve efficiency, land management and altering land use to capture a higher quantity of carbon.

The adoption of renewable Agri-Tech is on the rise as the extensive benefits of renewable Agri-Tech such as reducing the consumption of water, nutrients, and fertiliser, in addition to reducing the impact on the ecosystem become more widely known. Further advantages include greater efficiency, lower prices, and a higher level of sustainability for businesses.

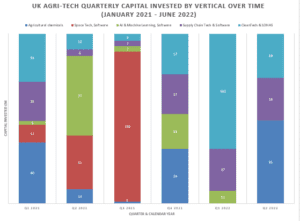

In a recent survey of farmers across the UK, Finance company Propel found that 76% of those surveyed are pursuing the use of high-tech farming equipment with particular emphasis on tractors, trailers, and renewable technology respectively. The focus on sustainability across the sector is translating into UK deal figures across Q1 2021 – Q3 2022 in which we can see a persistent trend in investment interest directed towards sustainability. This is shown through sharp growth in deal activity within Cleantech & LOHAS (Lifestyles of health and sustainability).

Across 2021, deal figures totalled £73m; however, this figure has already been outsized in 2022 with Q1 reaching £102m in deal activity, followed by a further £26m across Q2 – Q3 2022. This 500% increase in capital invested for CleanTech from Q4 2021 – Q1 2022 is bolstered by a £100m late-stage Venture Capital transaction for the Sustainable food production firm GrowUp.

Agricultural robotics

The implementation of robotics technology in the agricultural sector is ground-breaking given the critical issue of labour shortages for the industry. The NFU has found that up to £60m of UK crops has been left to rot due to labour shortages, with £22m of fruit and vegetables being wasted in 2022 so far, with growers expecting a further fall in production of 4.4% in 2023.

With labour shortages expected to continue, the benefits in productivity offered through its adoption are numerous. These range from autonomous tractors and livestock management systems to agricultural robots with the capability to assist farmers in harvesting, picking, spraying, seeding, and weeding. Excitingly, the first non-chemical robot weeding system for cereal crops was released commercially in Autumn 2021 by UK Agri-Tech start-up The Small Robot’s Company; their innovation employs high voltage electricity to efficiently eliminate weeds. In utilising Artificial Intelligence (AI), robots and imaging, this system offers an alternative to the current polluting herbicide dependant methods currently used in farming.

Unfortunately, current figures relating to the general rate of adoption of robotics for UK farms are limited. Of the data available, currently only 6% of UK farms have implemented robotic milking systems, amounting to 30% of new milking systems being purchased. While this figure is growing, it suggests the rate of adoption for robotics technology across UK farms still has some way to go. However, the productivity benefits robotics has to offer are beginning to influence farmers purchasing decisions.

Artificial Intelligence (AI), Machine Learning (ML) & Drones

AI presents vast transformative potential for the UK agricultural sector. The application of AI technology offers significant scope to increase efficiency through its powerful predictive capabilities for weather data, prices, and crop yield, to support well informed critical decisions for farmers.

The solutions offered through AI can be grouped into the following disruptive categories, Detection, Diagnosis, Determination and Delivery.

- Detection involves the employment of various techniques including image processing, soil nutrient monitoring as well as crop and animal health scanning to detect issues undetectable to the human eye. UK start-up Droneag provides cutting edge drone technology offering automation of data collection and analysis as well as real time remote data transfer for farmers. In summary, through geo-mapping and livestock scanning, detection orientated AI provides the potential benefits of cost minimisation as well as productivity optimisation for farms through spotting critical issues early.

- Diagnosis entails the application of advanced data analytics using a variety of data inputs to provide real time solutions to complex issues. This includes the use of telemetric tools to allow for issue diagnosis of equipment & stock. In doing so, this potentially reduces the length of output-hindering issues, whilst allowing for timely identification of equipment and stock problems. Diagnosis AI may help maximise farm output as well as streamlining productive efficiency.

- Determination offers powerful problem-solving capabilities to complex issues allowing for the potential future outsourcing of decisions for farmers. UK start-up Glass Dat provides machine learning driven neural networks capable of understanding the interrelationships between various inputs including soil, climatic, and biological to provide recommendations for farmers to deliver yield optimization. This advance in problem solving potential could be a leap forward in optimising critical decision making for farmers, and in turn providing productivity advantages whilst reducing the time invested to solve critical issues.

- Closely linked to the area of robotics visited above, delivery provides the potential to mitigate labour shortages through the provision of automated solutions to complex and precise tasks previously requiring manual involvement. Unfortunately, a current fundamentally limiting hurdle for scaled agricultural adoption of AI is the high set up costs particularly for smaller farms susceptible to annual turnover volatility. Successfully climbing this cost hurdle may help farms reduce labour needs and in turn wage costs whilst creating greater time availability to be allocated to remaining manual needs.

UK AI and ML in Agri-Tech deal figures from Q1 2021 to Q3 2022 are optimistic with £98m invested during 2021 followed by a further £13m so far in 2022. This shows some aggregate growth relative to an annual investment figure of £21.26m in 2020. Due to restricted figure availability in the featured sample, we anticipate that actual annual deal value in this space is likely higher than stated here.

Vertical farming

A significant supply chain disruptor for Agri-Tech is the adoption of vertical farming. This involves the process of growing crops vertically on shelves to take advantage of all space available in a three-dimensional area whilst providing consistent and optimised conditions. Vertical farming enables plant growth in layers; increasing productivity whilst reducing wastage, not to mention the added protection from volatile weather conditions.

The environmental benefits are compelling as the nutrient rich water soaking the plant’s roots is re-used up to 30x, reducing water usage by 95% and eliminating the runoff of herbicides and pesticides. A restrictive underlying factor in terms of commercial viability for vertical farming, however, is the energy intensive requirements of indoor farming. Although, when paired with renewable energy (as many vertical farms are starting to introduce), the potential for advance in sustainability is significant.

According to IBIS world, the next challenge for vertical farming’s product offering is to extend into fruits and more difficult crops, after the production of leafy green vegetables has successfully proven the vertical concept. The commercialisation of vertical farming in the UK is well under way, with One farm planning to build 25 sites in the UK and the Jones Food company’s Lydney farm earning the title as one of the world’s largest vertical farms spanning 13,500 square metres.

Investment interest is also on the rise with UK alternative investment specialist Gresham House intending to increase its vertical farming investment commitment by 10x to £300m – £500m over the next 3-5 years. Additional recent investment focus on productivity for the sector can be seen in consistent growth in capital invested towards the supply chain technology, animal husbandry, and food production vertical in which deal activity amounts to £46.77m in Q2-Q3 2022. The scale of recent growth for this vertical is notable given that the sum of invested capital from Q2 2021 – Q1 2022 amounts to £29.08 Million.

Precision agriculture

The purpose of precision farming is to apply site specific crop and livestock management processes to maximise the quality and productivity of overall yield. As the agricultural landscape differs widely in terms of soil properties, sunlight exposure and slopes, uniform farm treatment is now outdated. The allocation of precise inputs in terms of fertilisers, pesticides and water is critical to maximise productivity for farmers. The technological applications of precision agriculture are extensive, ranging from satellite systems for soil and geo-mapping, to accurately identifying geographical differences, through to variable rate technology to calculate the optimal allocation of farming inputs with gathered geographical data.

The future growth prospects for precision agriculture are immense with an expected future valuation for the vertical in the UK of £163m by 2027-28 (currently £92m) opening the opportunity field wide open for start-ups and new entrants in this space.

This growth has been driven through agricultural income, business capital expenditure and the deprecation of the pound. However, unfortunately precision agriculture has faced a range of demand pressures.

- Volatile fertiliser prices have hindered demand for industry services, particularly for soil mapping and variable-rate application technology.

- Technological competition with vertical farming, which may present greater cost efficiency in maximising yields relative to precision farming methods that perform the same task.

- High cost and complexity of associated technology and infrastructure serves as a barrier hindering the adoption of agricultural technology. Some relief for satellite costs has been provided by the commercialisation of the space sector led by SpaceX and Blue Origin, this is expected to facilitate new and advanced Global Navigation Satellite System (GNSS) products for Agri-Tech, including improvements to the guidance and use of automated steering systems for machinery including tractors and harvesters. However, deal activity in space tech seems to be relatively stagnant for 2022, perhaps demonstrating a current imbalance between the cost and the opportunity of this sector, in the face of other competitive forces, such as vertical farming.

Given the promising boost in efficiency offered through the wide range of precision agriculture technologies available, precision agriculture may be a useful development for UK Agri-Tech, provided the present hurdles of cost and complexity are overcome.

We hope this report has offered valuable insight into current trends and emerging technological developments within the industry. Whilst the outlook for the UK Agri-Tech industry is optimistic, as can be seen with an increase in adoption and a wide range of support to reduce the cost hurdles for Agri-Tech start-ups, for many smaller farms, there still remains the challenge of high-set up costs. Despite this, Agri-Tech advancements present a range of opportunities for farmers to boost productivity in a sustainable manner. It is hoped that these technological developments will shape a bright future for the Agricultural industry as a whole.

Key takeaways

- Technological advances across UK Agri-Tech offer a wide scope of transformative potential for the agricultural sector with a focus towards greater efficiency and output in an environmentally sustainable manner.

- Persistent hurdles restricting wide scale adoption of Agri-Tech across UK farms include high costs and technological complexity. The UK Government is taking a proactive stance to reduce this barrier to entry in offering generous R&D grants for Agri-Tech start-ups alongside R&D tax credit availability of up to 33%. Unfortunately, in some cases this cost hurdle is likely strengthened by the period of ‘agflation’ currently occurring in the UK in which Agricultural input costs have appreciated by 34% from September 2021/22.

- UK deal activity Q1 2021 – Q3 2022 reflects a growing interest towards sustainability and productivity focused innovation within UK Agri-Tech. Figures show a concentration of investment funding directed towards CleanTech & Lohas, Supply Chain technology, Software, Spacetech, Animal Husbandry & Food.

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.