Covid-19 Archive

Our Covid-19 archive chronologically documents all our articles from the period 13 March 2020 to 3 August 2022 concerning the global pandemic.

The events over the affected years following the announcement of the first national lockdown on the 23 March 2020 presented numerous challenges for all businesses, employees and employers alike.

We documented the schemes, restrictions and legislations in order to support our clients during the pandemic, with articles covering topics such as (but not limited to) furlough, grant payments, deferral of VAT payments, job retention schemes, returning to the workplace, support for businesses, preparation for post Covid-19.

Navigating the schemes being introduced whilst supporting our clients was paramount during this period of uncertainty. Our archives contain the expert advice and updates that we communicated, as well as retaining useful information and resources that you may wish to refer back to.

Business support

Support for businesses that missed out on Government funding

The Government’s support for small businesses has been unwavering and local councils, in the main, have administered the monetary assistance quickly. However, we know that no two companies are the same, nor are their needs during the pandemic.

You must act now. Application deadlines range from the middle to end of June 2020.

We have seen those receiving small business rate relief, rural rate relief, and those in the retail, hospitality and leisure industry, issued with a one-off grant of £10,000. The Government realises though that there are small businesses that have not yet been supported but have high fixed property costs which are seriously feeling the effects of the pandemic.

Local authorities in England have a sizeable discretionary fund worth £617m to support businesses that have not been eligible for the small business or leisure grants. They will aim these funds predominantly at helping:

- Small and micro-businesses (under 50 employees)

- Businesses with relatively high ongoing fixed property-related costs

- Businesses that can demonstrate that they have suffered a significant fall in income due to the COVID-19 crisis

- Businesses that occupy a property, or part of a property, with a rateable value or annual rent or annual mortgage payments below £51,000.

The largest grant available is £25,000, this then drops to £10,000 and the local authority have discretion for any amount under £10,000.

The fund has been set up in the main to support property costs, but the local authorities have the discretion to use their local knowledge to help those in need. The local authorities have a fixed amount of funds and will, therefore, be prioritising:

- Small businesses in shared offices or other flexible workspaces, e.g. units in industrial parks, science parks and incubators which do not have their own business rates assessment

- Regular market traders with fixed building costs, such as rent, who do not have their own business rates assessment

- Bed & breakfasts which pay council tax instead of business rates: and

- Charity properties in receipt of charitable business rates relief which would otherwise have been eligible for small business rates relief.

Due to having a limited amount per local authority, many have given application closing dates. These, in the main, are ranging from the middle to the end of June.

Businesses should submit applications through their relevant local authority website. You can find details on your local authority here including applications and closing dates.

Your local council will ask you to complete a declaration confirming that you will not exceed the relevant state aid threshold, and you were not an ‘undertaking in difficulty’ on 31 December 2019 (only applies to the COVID-19 Temporary Framework).

Eligibility

You will not be eligible for the local authorities discretionary fund if your business is already eligible for:

- The Small Business Grant Fund

- The Retail, Hospitality and Leisure Grant Fund

- The Fisheries Response Fund

- Domestic Seafood Supply Scheme

- The Zoos Support Fund

- The Dairy Hardship Fund

If your business is in administration or insolvent, it will also not be eligible for the scheme.

However, if you have applied for the Coronavirus Job Retention Scheme, you are still eligible. You must have been trading from the business you are claiming for, from at least the 11 March 2020.

If you already get state aid then the discretionary grants fund counts towards this threshold:

- £10,000 payments or less count towards the total de minimis state aid you’re allowed to get over three years (€200,000). If you have reached that threshold, you may still be eligible for funding under the COVID-19 Temporary Framework.

- £25,000 payments count as state aid under the COVID-19 Temporary Framework (€800,000).

This blog was written by Matthew Hector, a Manager at Price Bailey. For further information relating to this article, or any other COVID-19 related support you can contact Matt on the form below.

Navigating the post-COVID ‘perfect storm’

It may not surprise you that there is a general expectation amongst insolvency practitioners (and beyond) that a significant rise in corporate financial distress and, therefore, formal insolvencies are on the horizon.

Many commentators, though, have used the phrase ‘perfect storm’ to describe the potential severity of the situation we may all be facing. Current historically low failure rates may mask the growing number of factors that could converge to make 2021 the toughest trading year in living memory. Why might there be such choppy waters ahead?

The (more obvious) factors include:

The end of government support

The raft of measures, including CBILS & BBLS, the furlough scheme and VAT deferrals, clearly cannot go on forever and will need to be repaid. Sectors such as hospitality and leisure have suffered significantly and, without wishing to state the obvious, the damage will take a toll on many. Within the insolvency profession, there has been much talk about ‘kicking the can down the road’ each time support is extended. While the availability of support is to be commended, there is a growing sense of saving up problems for another day.

Catch-up

Official figures show that UK insolvencies in 2020 were at their lowest since 1989 and 40% down on 2019. Clearly, this isn’t because more businesses are thriving than in the previous 30 or so years. Rather, it suggests some of the measures introduced to help otherwise good and profitable business have also served to artificially prop up those businesses that were already doomed and would have failed. Measures such as the prohibition on winding up petitions, unless the reason for non-payment was non-COVID related (good luck proving that!), have held the number of business failures artificially low for the last 12 months. It cannot be the case that the injection of ‘COVID cash’ and creditor forbearance have turned these otherwise failing businesses into profitable entities. Aside from the unlucky casualties of the pandemic, a spike in insolvencies just to return us to where we would have otherwise been should be expected.

Other important factors:

The return of Crown Preference

For those old enough to have been in business before 2002, you might remember that HMRC used to be able to claim ‘preferential status’ (i.e. would be repaid before other unsecured creditors) in formal insolvencies.

From December 2020, HMRC became a (second-ranking, behind former employees) preferential creditor again regarding some taxes, most notably VAT, PAYE and National Insurance. This places the Crown back ahead of banks and funders with floating charges, making those lenders more vulnerable when a company enters an insolvency process.

The Enterprise Act introduced the concept of the ‘prescribed part’ – where some of the cash otherwise due to a floating charge holder was instead paid to unsecured creditors. The ‘quid pro quo’ for this change was that HMRC’s preferential status would stop, and they would be repaid the same proportion as other unsecured creditors, such as trade suppliers. The new Crown Preference provisions come with no such counterbalance to ensure the banks are no worse off in an insolvency situation.

The proposed reintroduction of HMRC preferential status attracted much criticism when announced (even in the good old pre-pandemic days). I was one of many that suggested that the likely damage to the UK’s rescue culture would far outweigh any potential benefits to the Treasury. With all the government assistance afforded to businesses in the last few months, it seems incredible that HMRC’s proposed bump up the pecking order was not postponed at least.

For example, preferential creditors cannot be bound by a Company Voluntary Arrangement (CVA) without their consent. As such, unless the company hoping to enter a CVA to trade its way out of difficulties is confident of repaying crown debts in full, HMRC now effectively hold a veto on the entire process. Moreover, even if HMRC can be repaid, it is very common in the current climate for businesses to have large tax arrears from taking advantage of the option to defer VAT and PAYE payments. The need to find these amounts in full, ahead of all unsecured creditors, is likely to make many proposals simply unworkable, meaning that ‘terminal’ rather than ‘rescue’ proceedings may be the only possible option.

The banks

Barclays recently reported a 30% fall in pre-tax profits for 2020 and has set aside £4.8 billion for loan defaults due to the economic fallout of the pandemic.

A change in accountancy regulations brought about by IFRS 9 (stay with me!) means that the way the banks recognise these losses will change. Previously they would have only been recognised once the loss incurred. The movement to an ‘expected’ loss model, meaning that these lenders must fully recognise anticipated credit losses in the financial year relating to any loan default. Simply put, the banks’ balance sheets will take a bigger hit all the sooner.

The implication of this and the reintroduction of HMRC’s preferential status is that would-be lenders are likely to become less willing to advance new cash. Unless a company has significant assets, access to finance – especially in a rescue context – is expected to become more difficult.

Lenders might also seek tighter covenants around HMRC payments and greater control of book debts to maintain a fixed charge claim over such debts. In some instances, this might limit directors’ ability to manage immediate cash flow difficulties, removing an often important lever to defer HMRC payments in the short-term.

Pre-pack bashing

They don’t have the best of reputations, driven in no small part by media misreporting, but pre-packaged administration sales (where a buyer is found before a company entering administration and the business and assets are sold with little or no notice to creditors) are an important part of the UK rescue culture.

Numerous government attempts to ‘clean up’ the use of this procedure and improve ‘stakeholder confidence’ have been introduced, the latest of which seeks to make it mandatory for management looking to buy-back a business to employ an independent (but unlicensed) Evaluator. Whilst it can never be a bad thing to increase scrutiny and transparency of such a process, I have little doubt that the criticism of pre-packs has been somewhat overstated. Any IP entering into a pre-pack already has a staggering amount of hoops to jump through to agree and justify the outcome to creditors. The introduction of another barrier seems unlikely to provide any party with any real comfort but will further increase the costs of the process.

Crisis or opportunity?

I don’t wish to paint an unnecessarily pessimistic picture here. It is a common misconception that all insolvencies are bad (and far be it from me to suggest to anyone losing their business or their job to ‘cheer up & look on the bright side’). On an individual level, it is a tough and emotionally draining process for business owners to wind up a company’s affairs after many years and one I never take lightly.

On a more macro-economic level, however, insolvencies serve a vital function for the economy. At best, rescuing viable businesses and preserving jobs is often misunderstood and undervalued (I would say that, I suppose). Even at the lower end of the scale, terminal liquidation procedures, where a business often cannot be saved, serve to recycle assets into the economy and provide opportunities and new growth.

New legislation under the Corporate Insolvency and Governance Act 2020 or ‘CIGA’ (more on that another day perhaps!) has sought to improve the rescue landscape within the UK. My concern, however, is that many factors are potentially conspiring to make the use of tried and tested rescue procedures such as Administrations and CVAs less viable.

Focussing on the positive, the seemingly inevitable rise in insolvency rates affords those well-run, agile businesses with cash reserves and/or quick access to finance many new opportunities for acquisition and growth in the coming months and years. If you look hard enough and plan your journey carefully, perhaps there are some calmer waters to be found and some sunlight poking through the storm clouds ahead.

This article was written by Stuart Morton, Insolvency and Recovery Director at Price Bailey. If there is anything in this article that you would like to discuss or find out more about, please contact Stuart on the form below.

What is the new guidance for living with COVID-19?

On 21 February the Government published its plan for living with COVID-19. Below we have summarised the changes and their potential impact.

What are the changes and when do they come into effect?

21 February 2022

- Guidance for those in education and childcare settings to test twice a week was revoked.

24 February 2022

- Employees are no longer required to self-isolate if they test positive for Covid-19, or if they have been in close contact, regardless of vaccination status. However, the Government guidance is that those testing positive should stay at home and self-isolate for at least five full days, and until there have been 2 negative test results on consecutive days. This guidance will be in place until 1 April 2022.

- Workers, therefore, are no longer legally obliged to tell their employers when they are required to self-isolate.

- Contact tracing has stopped and those who have been in close contact are no longer advised to isolate or take daily tests. Instead, guidance will set out precautions advised for those who live in, or, have stayed overnight in the same household as a positive case to reduce risk to other people; other contacts will be advised to take extra care in following general guidance for the public on safer behaviours.

17 March 2022

- The Statutory Sick Pay (SSP) rebate scheme will close. Employers will no longer be able to claim back SSP for their employees’ COVID-19 related absences or self-isolation that occur after 17 March.

24 March 2022

- The special provisions for SSP for those absent from work because of Covid-19 will be removed, meaning someone will have to be unfit to work in order to be entitled to SSP, and the usual three-day waiting period will apply.

1 April 2022

- Guidance issued advising those testing positive for COVID-19 to stay at home will end, and those with COVID-19 symptoms will be encouraged to exercise personal responsibility (as those who may have flu are encouraged to be considerate to others).

- The ‘working safely’ guidance will be removed and general public health guidance will be issued which will set out the ongoing steps that people with COVID-19 should take to minimise contact with other people.

- Employers should continue to consider the needs of employees at greater risk of serious illness from COVID-19. The Government will consult with employers and businesses to ensure guidance continues to support them to manage the risk in the workplace.

- The Government will no longer provide free universal symptomatic testing for the general public in England. However, free symptomatic tests for the oldest age groups and the most vulnerable to COVID-19 will be provided. The Government is working with retailers to ensure that tests will be available to buy.

- The Government will remove health and safety requirements for every employer to explicitly consider COVID-19 in their risk assessments. The intention is to empower businesses to take responsibility for implementing mitigations that are appropriate for their circumstances.

- The Government will no longer recommend the use of voluntary COVID-19 status certification, although the NHS app will continue to allow people to indicate their vaccination status for international travel.

What are the practical implications?

An increase in those attending the workplace with COVID-19 represents a risk to businesses – as an outbreak amongst a team could jeopardise the ability to continue functioning effectively.

Employees refusing to attend the workplace because of concerns also represents a practical risk in terms of getting work done and management’s time spent dealing with it.

What are the legal implications?

Employers still owe a duty of care, and therefore it is still important to take measures to assess and reduce risks to your workers.

Taking an approach that is at odds with the guidance will make it difficult to discipline employees who wish to self-isolate following a positive lateral flow test result. It is therefore advisable to continue to keep positive cases out of the workplace until the guidance changes on 1 April.

Can employers require people to stay at home, even if they are physically fit?

You could implement workplace rules/policy regarding COVID-19 which would require someone who becomes aware they are positive to stay at home – either working from home or not working at all if they cannot work from home. It is unlikely that a requirement to work from home or stay at home isolating if positive could be argued as being unreasonable unless there is a significant detriment (see ‘what about pay’ below).

What about pay?

If someone is off work with COVID-19 symptoms as they are not fit for work, they are entitled to SSP (or company sick pay depending on your policy) from day one. However, from 24 March you will no longer have to pay SSP from day one, and the usual three day waiting period will apply.

If someone has tested positive but has no symptoms, they can be asked to work from home and should be paid as normal.

If someone has tested positive but has no symptoms, and you require them to stay at home but they cannot work from home, they will be entitled to SSP from day one until 24 March. However, please be aware that if you do have a policy of only paying SSP for employees self-isolating in accordance with government guidance, this does run the risk of potentially infected employees failing to inform you of their self-isolation requirements, so they can continue to attend work and receive pay. Employers should therefore think carefully about their position on pay during self-isolation in these circumstances.

If an employee is a close contact of someone who has tested positive, or, if you require them to stay at home and they cannot work, then subject to any contractual provision to the contrary, they will need to be paid in full.

From 24 March, if someone is physically fit to work, and is ready and willing to do so, but you require them to stay at home (because they are asymptomatic, or have been in contact with someone who has tested positive) and they cannot do their job from home, you will need to pay them in full.

What steps should I take?

- It is sensible to continue with any COVID-19 health and safety measures in place currently. These will help mitigate the impact of an increase of COVID-19 in the workplace.

- Consider purchasing testing kits, to reduce the problem of lack of testing.

- Decide what your policy will be if someone tests positive, in terms of working from home or requiring them not to attend.

- Set out your policy on pay for those with COVID-19 or those that are isolating, and communicate this to employees.

- Consider what your position will be for those who are reluctant to attend the workplace. It is still advisable to take steps to address concerns and take into account any personal circumstances, but given that the guidance to work from home has come to an end, it will normally be reasonable to expect healthy employees to return to the workplace if required to do so.

When more guidance is available, we will update you on its content and the potential impact on employment decisions.

Job Support Scheme calculator

You can use this Job Support Scheme calculator to help you quickly and easily work out your employees’ pay and the various contributions that need to be made under the Government’s new Job Support Scheme (JSS). Use it to find out how to scale back your employee working hours, if needed to retain staff.

Please note: The Job Support Scheme is being delayed due to the extension of the Coronavirus Job Retention Scheme or more commonly referred to as the furlough scheme.

Preparing for your first audit in a post-COVID world

The role of the auditor has been under increasing scrutiny over the past few years after some high-profile collapses. If anything, the impact of the COVID-19 pandemic has served to bring that into an even sharper focus.

At the same time, new auditing standards, ISA 540 on Accounting Estimates and ISA 570 on Going Concern, have been issued to provide further clarity on the responsibilities of auditors and the expectations of both auditors and company directors. These new standards focus further on the requirements of the auditor to sufficiently challenge management assertions and representations and demonstrate sufficient scepticism.

Given these changes, company directors may be left wondering how these changes will affect their company, particularly their first post-COVID audit. Our conversation with Corporate Partner, Darren Amott, may help to address any pressing questions they may have in this respect.

In this video, Darren talks about the changes occurring in the audit world and the potential impact of COVID-19 on company financial statements and the audit report. He also provides advice on how best to prepare for your upcoming audit and the additional questions you can expect from your auditor.

How do we value a business in the post-COVID era?

This time last year, we wrote an article on valuing a business in the COVID-era. A year on, and in circumstances that more closely resemble a normal that we all recognise, we revisit the topic to see what has changed and is changing for business valuations in today’s world.

An issue that came about this time last year and is still debated is, is the last two years at all relevant to valuations? Instead, is the focus on now, with more emphasis on budgets and forecasts from here forwards? It is our, and the opinion of many valuation experts, that the very definition of a valuation ought to be about the future cash flows of the business, and COVID-19 has highlighted how recent past results can be very irrelevant to future opportunities. Increasingly we’re talking about what is happening today, what is the budget for the next 12 months and what is the direction of travel?

Additionally, conversations are rapidly moving to post-COVID issues, such as the impact of the war on Ukraine, the value of the pound, and whether oil or commodity prices or interest rates are going to rise further. In many ways, business concerns are now moving beyond COVID.

That is not to say that consideration should not be paid still to the performance impacts of COVID; in many instances, the events of the last two years have created significant changes in how certain businesses operated. Therefore, while the performance of 2020 and 2021 may not be repeatable, it may very well have influences over what today has in store.

With that, we take to looking at areas of performance that are central to this debate.

Revenue expectations

This might be still something that is fairly difficult to forecast. However, in our role as valuation experts, we would ask our client to focus on comparisons of pipeline today with a pipeline that would have been expected in the 6 months from 01 March 2020, in spite of COVID. For instance, if a business would normally have the next 6 months of sales in its pipeline, what has it got today? And what does it look like?

The follow up to that is then whether the next 6 months sales are owed to catch up, a bubble from missed sales or the emergence new markets. If it is, can the underlying business meet current demand in a short space of time? Some businesses can because they have the capacity to catch up, whereas other businesses can only do a certain amount of revenue in a month, so the only thing they can do is change the price, not the volume. Some businesses are also severely resource constrained at the moment – whether it be microchips or steel – so this also needs to be considered.

Looking at the individual business and understanding the drivers of that business is vital, but we also need to understand the variables that the business can control compared to those that the market controls. The more variables the business can control, then the higher quality of valuation they are going to end up with.

Cash flows

Cash will remain a very important tool to have, as it allows a business to buy quickly, avoid needing to use credit and that does give you some price advantage on the buy-side. All of that said, there is still a lot of care needed to ensure there is some proper credit control going on.

- Government support repayments – CBILS or Bounce Back loans were hugely successful in supporting businesses. We are now over a year on from when they were first available, and repayments on the majority of facilities will have started. Many of these businesses, however, will not have used some or all of them, meaning that this cash is sitting in the bank ready to be repaid, or already paid off. Consequently, in these circumstances, adjustments for repayments to cash flow and performance are now largely irrelevant.

- Credit control – In the first lockdown, businesses focussed on cash and cash collection. Since then, as business has slowly returned to normality, some of those working capital gains from year one have been lost and old ways of debt collection are returning. Understanding the extent to which tighter cash collection can be maintained or not, again, highlights the need to not rely on the past and look to the future – has the business changed or can it change its credit terms? Has it employed or outsourced more credit control resource to support with debtor collection? An efficient cash cycle remains a source of premium attraction in valuations.

Working capital

The normalised working capital calculation in valuations will continue to require careful consideration. The impact of COVID and those periods where businesses were closed, grants were coming in to cover costs, tax deferrals and rent free periods created real skews to the actual working capital both then and now.

An approach we have taken with clients is to separate out the normal adjustments from the COVID ‘special’ adjustments. Taking VAT as an example, we continue to treat the latest quarter’s VAT as a working capital item, but the deferred VAT from 2020/21 that is being repaid will be treated as debt, rather than working capital. We would therefore extract deferred VAT from the working capital calculations and add in to the debt calculations in both the average and the actual comparison.

Justifying a premium

It is incredibly important to look at the underlying business and the story around future performance expectations and assumptions, rather than just looking at a set of black-and-white accounts and assume you can tell what the important factors of the business are.

Methodologies

We aren’t seeing alternative valuation approaches being used, but there are some more interesting metrics appearing. For example, we’ve seen EBITDAC (Earnings before interest, tax, depreciation, amortisation and COVID) being introduced – but there is still a need to properly assess whether any adjustment for COVID is a proper and normal adjustment, and ensure you’re able to reasonably justify it.

We are challenging far more on the adjustments being presented, but also putting ourselves under scrutiny on the adjustments that we propose to make.

- Multiples – If the transactions within a dataset that is being relied upon for a multiple occurred during the pandemic then it is vital to understand the true underlying earnings within the businesses involved in each transaction. If that’s not obvious from the data available, then it may require looking into the transactions on a case by case basis to identify those that are relevant. Often databases will provide the high level figure that may or may not have scrutinised to ensure all the transaction data input into it is relevant. Relying on these too heavily, or without additional research, can be misleading.

- Scenario and sensitivity analysis – In theory, we want to be able to put some scenarios and probability analysis through to get an idea of the likely valuation parameters, but if there isn’t a base forecast in place already, then it is difficult. Unfortunately, this is often the case in SME businesses. We are already spending more time with clients this year to encourage them to work on their base case forecasts first. Having such forecasts and sensitivities available is not just helpful for valuations, but ideal management information to plan with. Whilst none of us predicted a pandemic, as we sit today we can look at the impact of varying levels of increased interest rates, temporary excess energy and fuel costs and the inflationary impact on pricing, sales, materials costs and wages.

Predictions for 2022

Both valuation experts and their clients will need to be prepared to explain any COVID adjustments, provide suitable evidence in support, and set out what future pipeline is expected to look like. Businesses should prepare for future performance to be the subject of as much, if not more, scrutiny as any historical data.

With this, we’d expect a higher proportion of M&A deals to have earn outs, and for those earn outs to be higher proportion of overall consideration on the deal.

This article was written by Simon Blake, For any questions regarding this article, you can contact Simon on the form below.

Cash flow management – Why and how in today’s climate

Cash flow is often monitored far more closely in times of uncertainty or change.

Many will now be closer to their cash flow than ever before, but how is best to manage it? What tools are available to continue monitoring after the pandemic? And how do you recover funds you are entitled to but have not been paid?

We hosted a webinar with our panel of in-house experts Matt Howard and Lee Sharman, who discussed:

- The importance of understanding where you are now to help better forecast for the future

- Tools for effective cash flow management, and how to identify and resolve common issues

- How dispute resolution and debt recovery can support you being paid as a priority over others; whilst mitigating risk, cost and being time efficient.

Thank you to everyone that attended. Here are the slides and recording from the webinar in case you would like to review them.

Webinar slides

If you would prefer you can download a copy of the slides below.

Download webinar slides

Webinar recordings

If you would like to watch the webinar again you can access the full recording below:

We aimed for the session to be interactive and hope we answered a number of questions. Some we have followed up with directly after the event. If you have any other questions following the webinar series and would like to discuss these with one of our experts, please complete the form below.

The commercial property market during COVID-19: a reflection

Economic pressures since the start of the Coronavirus pandemic has resulted in increased difficulties and complications for both landlords and tenants.

Many commercial property owners will have been impacted by tenants being less able to keep up payments – particularly those in the retail and hospitality sectors – with many left considering the provision of concessions relating to rent (including deferrals, rent holidays and rent reductions).

Covenant waivers and improved terms regarding loan repayments were introduced in an attempt to provide support to commercial property landlords, however these require careful planning with banks and tenants, and lenders’ outlook towards these developments have recently begun to change. The reasons above, amongst others, have resulted in the fluctuation of commercial property valuations throughout the pandemic.

This article goes some way into exploring the impact of the pandemic on the commercial property market and offers an auditor’s perspective on managing developments.

The immediate impact of the Coronavirus pandemic on the commercial property sector

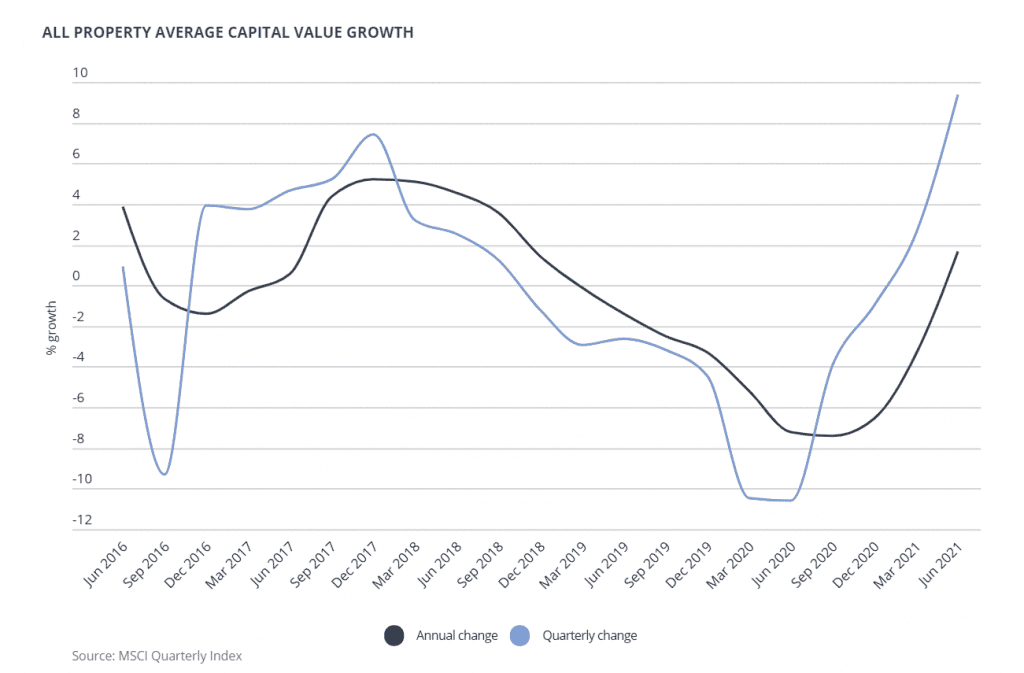

When lockdown restrictions were announced by the government, the majority of commercial property owners were immediately affected, with restrictions particularly impacting the hospitality and retail sectors. Although, with the government’s ‘stay at home’ order, many office spaces and manufacturing businesses were also left abandoned. In the year to June 2021, Morgan Stanley Capital International (MSCI) data stated that rental value growth for office and retail remained between -0.2% and -6.2%, compared to 2018 where rental value growth for retail was between +0.5% and -3%, and rental value growth for offices remained above +1.5% and below +2%.

The low levels of retail rental growth experienced prior to the pandemic is in part due to changing consumer habits and low consumer confidence levels. However, a decline in growth for office rentals represents the immediate impact of the pandemic on office landlords and tenants alike.

The circumstances of COVID-19, alongside the low growth in commercial rental values left commercial property landlords in a difficult position. They faced uncertainty around the future viability of their tenants, further uncertainty around their ability to find new tenants should their current tenants close/ fail, and thirdly, the overall value of their main assets i.e. the properties, was stagnating and potentially threatening to shrink given the 2021 rates referenced above. Consequently, numerous landlords had to be creative about how they dealt with this sudden shift in their market, through both reviewing their position, and working in collaboration with their tenants and banks to mitigate any negative impacts.

What was the effect of the restrictions?

Property valuations became increasingly challenging

The uncertainty in the market created by the COVID-19 pandemic and the resultant shrink in rental values made it increasingly difficult to value property both during the lockdowns and subsequently as restrictions have eased.

For surveyors, this meant including large caveats in many valuations, particularly with regard to the economic impact on the market and the future viability of the properties. All major valuers subsequently introduced a material uncertainty qualification for valuations dated 31 March 2020 and onward.

Auditor’s perspective

As valuing a property is more difficult than ever, this means that auditing these valuations is equally difficult. Auditors have therefore either had to rely on other means to assist in substantiating values, such as reviewing the strength of tenants, the yields, and other factors in more detail. In many cases, particularly at the outset of the pandemic, auditors were unable to adequately quantify the valuations, resulting in a ‘Limitation of Scope’ or an ‘Emphasis of Matter’ paragraph being included in the audit report in respect of the property values.

As valuations stabilise in the future, auditors face three major issues

1. Being sure surveyor’s valuations of commercial properties are accurate

2. The ongoing concern in light of liquidity restrictions, covenant breaches and tighter lending

3. The recoverability of rent arrears as a result of new restrictions that will be imposed

Defaulting tenants

As a result of the Coronavirus pandemic many businesses were forced to close their premises, which for the majority of these businesses meant temporary closure of operations too – particularly if their business model could not easily be adapted to be online or virtual. This resulted in a number of businesses defaulting on their rent payments or making use of rent deferrals and repayment holidays, due to cash shortages.

Defaulting tenants, unfortunately, also have a negative impact on the value of commercial property. When a surveyor is valuing the property, amongst other factors, they analyse the quality of the tenant and the length of the lease, as this provides an indication for future uses of the property. If you have a strong and established client in the premises with a longer lease, this will likely increase the valuation of a property compared to less established tenants on shorter leases.

Auditor’s perspective

Currently, there are a significant number of rent arrears in the market with landlords often unable to enforce debt collection. From an audit perspective, they have to audit recoverability of those debts – this will be a difficult judgement on the part of directors – and auditors will need to ensure they are as comfortable as possible that these judgements are sound and based on robust assumptions.

At the start of the pandemic, the government recognised the initial risks of cash shortages and defaulting payments, and responded efficiently by introducing varying legislation and schemes to support tenants, including; rate rebate, Furlough, Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS). In addition, the Corporate Insolvency and Governance Act (CIGA) which covered areas such as a moratorium protecting tenants facing problems with rent repayments as a result of COVID-19, included other specific legislation regarding the rights of tenants and landlords during this period.

Corporate Insolvency and Governance Act (CIGA)

On a larger scale, the CIGA hindered the ability of landlords to recover any unpaid rent from tenants. So whilst tenants received vital support from the government, some landlords were left feeling ignored and under financial pressure if they faced cash flow issues themselves.

Whilst the Government saw CIGA as vital for preventing wholesale eviction of tenants, it has created apparent problems for landlords – with commercial landlords leveraged to varying degrees and still having to make their loan repayments; many relied on their banks to be understanding and agree repayment holidays. The Government have recently extended the restriction on rent related forfeiture of business tenancies until 25 March 2022, which means commercial landlords will continue to have limited powers until then.

The Government have also announced that a new Act of Parliament may be enacted to address the rent arrears that have built up since the start of the coronavirus pandemic. The details of this Act of Parliament remain relatively unclear for now, however it is likely that landlords will have to take a rent cut where tenants were forced to close during the pandemic. It appears that this is an attempt by the Government to further reduce the chances of a surge in insolvencies as soon as the CIGA restrictions are removed. This fear of insolvencies once the CIGA restrictions are removed, is particularly prevalent in the retail and hospitality industries.

Impacts for landlords

The limitations of CIGA regarding actions landlords could take against tenants for non-repayment of rent left many feeling disappointed, with many commercial property landlords also highly leveraged with tight banking covenants that pre-dated the Coronavirus pandemic. In the event that tenants defaulted on rent to the extent that loan repayments on the part of the property owners could not be met, there was (and still remains, given the extension of CIGA) the risk of covenant breaches. In many cases, a breach of this nature often triggers a clause that means the loans technically become repayable immediately. Whether or not this is enforced by the bank – the effect is that the loans often move from ‘creditors due in more than one year’ to ‘creditors due within one year’. On paper this significantly weakens the landlord’s balance sheet, potentially putting the business at risk. If however, the landlords is proactive and is able to obtain a waiver from their bank in advance of the year end, then the loan can continue to be reflected as due in more than one year.

For commercial property owners that were at risk of the knock-on effects of their tenants not being able to pay their rent, they were advised to sustain open communication with their banks in relation to the landlords defaulting on any loan repayments. Banks, under pressure from the Government and realising the extent of the situation, were initially sympathetic to covenant breaches and provided waivers and improved loan arrangements to commercial property businesses. However, banks are now generally becoming more risk averse to the property sector and as well as having a lower inclination for lending in the sector, are also beginning to restrict covenant ratios i.e. decreasing loan to value ratios.

Auditor’s perspective

Many businesses had tight banking covenants prior to the Coronavirus pandemic, and the pandemic meant that they were in breach immediately. This technically means that loans were due within one year of the breach. For auditors, they needed to assess what steps businesses and bankers took when, or ideally prior, to these breaches occurring, and whether any waivers were received, before assessing the impact in going concern.

What should commercial property owners be doing/thinking about with regards to their properties now?

Alongside an increase in covenant waivers and improved terms for loan repayments for commercial landlords, there has been a surge in progressive lateral thinking regarding alternative uses for property, including the conversion of premises to residential property and the conversion to serviced offices – which provides certain flexibilities to tenants. Whilst many commercial property holders have a diversifying portfolio anyway, some may take this as an opportunity to develop their existing holdings into residential property, given that this market is expanding. The ONS have reported that 41% of people are still working from home exclusively or part-time (time of writing: Sept 2021), which raises the question if offices will ever reach the levels of demand they were in before lockdown. However, because serviced offices offer short-term leases, they are great for tenants that want to be flexible and expand/contract as needed in line with their business plan. However, the exact outlook and what it will mean for valuations in the market remains unclear at this time.

Alternatively, there has been an increase in demand for different leases – including turnover based leases. This is where a part of the tenants rent is based on the level of turnover they achieve and are a great mechanism for engaging both the landlords and the tenants in a symbiotic relationship – when the tenant succeeds so does the landlord, and when the turnover the tenants generate is lower, this often incentivises the landlord to support the tenants. These types of leases have become popular recently in the UK in the retail and hospitality industries – and we suspect, will continue to gain traction – as a result of the pandemic, and tenants’ progressively growing bargaining power.

What is likely to happen next?

The economic downturn over the past 18 months has certainly affected some sectors more than others, including the hospitality and retail industries. The future for some commercial property tenants will be challenging as they will still need to repay their rent deferrals and bank loans, furlough will be withdrawn and full rates will need to be paid again. However, legislation such as the Act of Parliament will provide some protection to tenants that were forced to close during the pandemic. Commercial property landlords may also face a challenging time ahead; lower valuations and a change in outlook from the banks is likely to put more pressure on covenants and make it harder for landlords to obtain finance.

It is likely that both tenants and landlords will face a continuation of difficulty ahead with regards to ongoing uncertainty in the property industry, legislation developments and restriction of covenant ratios, amongst other factors. It is important that as a commercial property owner, you are proactive in communicating with your stakeholders. If you have defaulting tenants or are concerned about their continued ability to meet rental payments, it is advised that you speak to your bank and advisors as soon as possible. This should be in advance of a potential breach with the view to obtaining a waiver before the year end, to avoid unnecessary negative impacts on the company balance sheet.

If you are a tenant or a commercial property landlord, and require any further support regarding anything discussed above, then please contact Darren Amott using the form below.

Delaying import duty payments due to COVID-19

For businesses globally, the COVID-19 pandemic is creating an unprecedented amount of uncertainty. The Governments relief measures and certain HMRC payment deferrals are working to offset some of the cash-flow strains felt by businesses.

This now also extends to those businesses in the UK that trade internationally. Below we’ve set out the latest guidance from HMRC on the details of duty/import VAT payment deferrals. The latest announcement from HMRC for existing duty deferment account holders and non-account holders is set out below.

Duty deferment account holders

A duty deferment account lets you make one payment a month through Direct Debit instead of paying for individual consignments.

Duty deferment account holders who are experiencing severe financial difficulty as a result of COVID-19 and who are unable to make payment of deferred customs duties and import VAT can contact HMRC for approval to enter into an extended period to make full or partial payment, without having their guarantee called upon or their deferment account suspended. Account holders will be asked to provide an explanation of how Covid-19 has impacted their business finances and cash flow.

If you had deferred customs duties and import VAT due on 15 April 2020 and did not have sufficient funds to be able to make payment, Price Bailey advise that you contact HMRC immediately. Details of who to contact are listed on the HMRC website here.

“Duty Deferment account holders will be able to use their accounts during the extended payment period agreed unless they default on a subsequent payment in that period, in which case HMRC may consider suspending their account. The outstanding payment will not affect their duty deferment limit so they will not need to increase their guarantee to cover the outstanding payment. Where HMRC agree to an extended payment period, interest will not be charged on the outstanding payments provided they are paid in full by the agreed date.”

Duty/import VAT payments not covered by a duty deferment account

“Registered Importers who pay cash or an equivalent and are facing severe financial difficulties as a direct result of COVID-19 can contact HMRC to request an extension to the payment deadline at the time the payment is due. They will be asked to provide an explanation of how COVID-19 has impacted on their business finances. HMRC will consider this request and decide whether or not to agree an additional time to pay. The decision will be taken on a case-by-case basis and could be refused.

If the request is approved the conditions, including the length of time offered, will depend upon the importer’s individual circumstances and may require the holding of a guarantee for the period of the time extension. We cannot offer this facility to non-registered importers.”

Further information on customs duty deferrals can be found here.

If you are worried about duty/import VAT payments due for your business and are unsure on what you need to do, please contact us using the form below.

Legal sector round table: What lessons were learnt from the change in our ways of working?

Price Bailey hosted a round table in collaboration with Modern Law. By drawing on 12 voices from 12 legal firms across the country, we hoped to find out more about the important questions that have come out of the past 18 months. What lessons were learnt from the change in our ways of working, i.e. flexible working, virtual meetings, remote management?

Have these things led to an increase in bottom-line figures? What impact has this had on maintaining a firms’ culture and attracting new talent into the firm? How can firms look to maximise the opportunities out there, and will they look to add additional service lines in order to mitigate revenue stream risks?

Chair: What’s been the key lessons that you’ve learnt in the last 18 months, and what positives have come out of having to go into lockdown for your law firm? Has productivity increased?

Kicking off the discussion was Roger Bull, Burges Salmon LLP. “From the client perspective, our firm received an overwhelmingly positive response, and it also helped develop relationships because we were all fighting the same fire. I think there was some initial concern that the client relationships would suffer and, in turn, business development, but in fact, we found a lot more of our clients were willing to use technology to have a 20-minute meeting or catch up.” Roger goes on to speak about how it had also driven collaboration within their team. “People have pulled together with an absolute common goal. We’ve taken some real positives around transparency and communication – being a lot more open with what’s happening to the business, what the leadership thinking is and why we’re doing what we’re doing at this current time.”

Jessica Szczelkun, O’Neill Patient Solicitors, agreed with this view before adding her own insight to this question posed by the Chair. “We’ve found that a real positive has been how it’s built greater trust in our firm. We didn’t see productivity suffer; we saw it shift. Though our workforce was working slightly different hours and people would be logging in after the children had gone to bed, we supported that and were able to offer a more flexible style of working. I feel it has really helped strengthen the relationship across the board and has pulled us much closer as an organisation. There’s more accountability, and there’s more communication because we knew we had to make the effort to get in touch with people, rather than just being busy or doing all-day jobs.”

“Yeah, I completely agree with that,” says Nadia Biles Davies, Sharpe Pritchard LLP. “For us, there was a concern around a dilution of culture because everyone’s working further apart. However, actually, we’ve been working more closely than ever because you can have an all firm meeting, but you don’t have to get everyone in the room – everyone can join in. Nadia outlines some of the initiatives they have set up in order to keep the team connected and strengthen the culture of the firm. “We recently did a ‘Desert Island Discs’ where everyone had to share their island discs with a bit of a story behind it. It was actually the brainchild of our wonderful trainees, and by getting everyone from across the firm involved, within a few short months, we really got to know each other in a way that I think we wouldn’t have done before lockdown. In many ways, that culture of us all being in it together – like Roger mentioned earlier – meant that our culture continued to be enhanced as opposed to diluted.”

The hardest thing is to work out what makes an attractive client and then working out how to develop a relationship with them and how you can add value to that relationship.

Chair: That’s great to hear that you feel there have been huge positives for your firm. So, with that in mind, what’s your message about returning to the office for you as a firm?

“For us, it’s about trying to take your team along on your journey and providing that flexibility,” says Richard Baker, Stephens Scown LLP. “We’ve gone for, in principle, two days a week in the office but are leaving it very flexible. We wanted to allow our team leaders to make a lot of those decisions and have given them the training around that in order to try and balance what we call the ‘scowner’ experience (people who work here) with the client experience.” Richard believes it’s really important to provide people with flexibility because there are very genuine concerns coming out in the sector around well-being. “We’ve tried to pick up on them, but we haven’t necessarily seen the full extent of it yet. It’s not just about work, is it, it’s about what people have been through in their personal lives, whether that’s their parents, friends or other relatives who might have suffered – it’s been a very hard time for people.”

“With us, I don’t want to be controversial, but our experience has been a mixed bag”, claims Abu Kibla, Stuart Miller Solicitors.

“I found that many of our staff didn’t know how to manage themselves working at home. They actively called me and said, look, can I come back to the office? Surprisingly it was mainly the younger members of staff that did this.” For Kibla – whose firm litigates criminal cases – having your own caseload can be very isolating and what he’s seen is that most of his team are happy to be back in the office. “I see the connections that people have made since coming back, and though I share the sentiments of others around this table, in terms of the massive improvements in cost savings and being more efficient, I think on a human level when you take into account the type of work we do – it has been very difficult.”

Jeff Lewis, Brabners, picks up on the point that Kibla makes about junior members of staff. “That’s the one thing that we probably do need to keep a real eye on going forward – supervision, mentoring and training our junior people. As I always say to junior people or those that are newly qualified – you can read as many books as you like and go to as many training courses as you like, but actually sitting in the office and watching the people who have been doing the job for a long time is priceless.” Lewis explains that you need to make sure that there is still the ability for people to learn from those who have been doing it for a long time and has learnt over the past 18 months that this is not always the same when working from home. “We also need to make sure that our senior people have got people on hand who they can delegate the work to. Otherwise, it’s very easy for senior people to cling onto the work and say, well, I can do it faster myself, but that’s not doing the firm or the junior people any benefit in the long term.”

With everyone talking about the generational differences in wants and needs, Chris Godsave, Price Bailey, suggested people need to feel connected to other people and to place.

“Place plays a big part in creating that ethos and culture. If people are going to be working remotely, you might suggest that maybe the older generation – with their nice family homes and gardens – are happier to work from home than the younger generations who are in much smaller spaces. Consequently, there’s then a danger that your office is unevenly split between juniors and those with more experience.”

Chair: That’s an interesting point, Chris… how important do you think office space is in keeping your culture?

“I think it’s really important for the younger generation”, claims Ayesha Nayyar, Nayyars Solicitors. “A lot of the reasons they get these jobs in the city is to be a part of the whole graduate training vibe and comradeship. You want to enjoy those friendships where you go out for lunch/ dinner or drinks after work, and you want that network culture. I think we have to have an office so that even those members of staff who don’t come in regularly have still got somewhere to go.” In fact, Ayesha introduced an outside garden area at their office, which is something that she says would never have happened two years ago. “When the weather is lovely, it’s absolutely fabulous. Even on the colder days, they want to be outside because some of the staff have made it beautiful. Recently we’ve enjoyed a Euros party out there and have many more social gatherings planned now things are opening up – it’s great for the team spirit.”

After a short break, the Chair decided to move the conversation on to pastures new…

Taking the opportunity to pose a question was Chand Chudasama, Price Bailey, who asked if anyone had found the need to diversify how work is won? “I think for many lawyers, work is won through referral and cross-selling other services to the existing client base. This might be harder if we stay in a remote environment, but not necessarily. Have people found that digital marketing and other ways of attracting new clients has been high on the agenda?”

I definitely feel from a recruitment perspective it’s been massive. Most people we speak to that work in and around the legal sector are finding tremendous problems with recruitment.

“Definitely so. We’re quite systematic about it, and we do a lot of big data analytics to work out who we want to work with in order to segment the market”, states Stephen Crow, Clarion Solicitors. “The traditional approach for professionals is that you meet somebody for dinner or at some sort of event, you exchange business cards, and you might then convert them into being a client. However, the risk is that you then realise they’re not the client you wanted, or they might not want to pay for your service at all. The hardest thing is to work out what makes an attractive client and then working out how to develop a relationship with them and how you can add value to that relationship. That’s what we spend a lot of our time doing.’

Ian Jones, Backhouse Jones, followed this by explaining what they had done to diversify how their work was won. “We did two things, and we diversified into two areas: the training side we took online, and we set ourselves a modest revenue aspiration, shall we say. Thankfully, we completely smashed through that five-fold and we’re now charging for the training that we provide to the transport industry.” Ian goes onto explain how the other way that they expanded was equally interesting. “The one thing that I’ve always wanted to do for 20 years was take our brand and diversify it into an insurance brokerage. We had all this time last year where we could rethink our business model, and so we started BACKsure. Though it’s a different regulatory framework (which we had to get our heads around), it’s now up and running. So certainly, from a diversification point of view. we’ve done two things – BACKsure and BACKacademy.”

Coming in from a banking angle was Graham Martin, Barclays Bank. “Another model that I’ve seen being adopted is the consultancy model. A firm that I work with is very much a consumer, high-volume model, but about two years ago, they started to also introduce the consultancy model. What I’m now seeing is an escalation in this due to the flexibility of working from home and geographical restrictions being lifted. I’m not saying it’s right for every firm, but it’s certainly worked for that firm and has diversified their income stream so that when the conveyancing market does subside – they’ve got that model there as half their income. I definitely see that model having a place for firms going forward.”

Chair: Are you finding that the changes you’ve made to your firm are, in turn, changing the geography of your client base? Are you now picking up clients where geography isn’t important to them anymore? And same with staff as well?

Though most of the attendees around the table nodded in agreement to this question posed by the Chair, it was Joanna Kingston-Davies, Jackson Lees Group, who began the discussion. “I definitely feel from a recruitment perspective it’s been massive. Most people we speak to that work in and around the legal sector are finding tremendous problems with recruitment.” Joanna explains that they are now seeing city firms able to pay city rates to people who are not necessarily working in the city but instead are able to work in the countryside or less urban areas remotely. People are attracted by London or Manchester salaries without the need to commute anymore, so it’s huge. “I think client wise we’re seeing that a little bit less, although, obviously the fact that people can communicate with you via Zoom exclusively means that the opportunities are there – whether anybody has, I’m not sure just yet – but the opportunity I think is there for the taking.”

“One of our pushes has been on social media”, states Verity Slater, Stephens Scown LLP. “We’ve invested heavily in digital marketing over the years and punch well above our weight. In January of this year, DSMN8 ranked us the UK and Ireland’s 7th most active law and legal professionals on social media. That’s definitely brought in quite a lot of national clients for us that otherwise, you might not have attracted to the Southwest.” Funnily enough, Verity tells the group that they’re not having too much of a problem with recruitment because there’s an awful lot of people that want to get out of the cities and come and live with their families in the southwest (where they’re based).”For those that do want to leave the traditional city firm but also want a firm that has great work and a strong culture – we’re a strong choice. However, we are losing the odd person up the other way who are being attracted by corporate jobs. They’ve been enticed into going in-house for big nationals because they’re getting larger salaries and they’ve only got to go up to those places once or twice a week, whereas previously they wouldn’t have even considered that they could get a job with one of those firms if they lived down in the Southwest.”

Bringing the roundtable to a close, and from an interesting angle of a law firm working in the international arena, was Sunil Sheth, Fladgate LLI? “Personally, I think we’re seeing a talent war out there. Recruitment is a challenging process anyway, but over the past 18 months, it’s become more challenging because people have left the profession, and the development of associates has stalled because of not having the experience that they would have had working in the office. This has resulted in the salaries moving on an upward trajectory, and that’s been quite hard for us.” Despite the challenges, Sunil is quick to point out that there are plenty of opportunities too. “We found that people started thinking more about things like estate planning, wills, trusts and power of attorney because they were worried about what was going on.” He goes on to explain that about 30% of their revenue is also generated from foreign clients. “We’ve seen a lot of clients based abroad who think that Britain is a great place to be because our vaccine program is so far advanced, and we’re a safe haven for their funds. Consequently, we’ve recently set up a family office catering for high-net-worth individuals who have assets that need looking after from here – so there are obviously opportunities out there to diversify. But again, it’s a question of being fleet of foot and getting in there as early as possible.”

Conclusion

Earlier this year, Price Bailey hosted a roundtable with the aim of gaining a better understanding of how law firms were coping with the third national lockdown and the impact this was having on their law firms. Fast forward a few months, and after careful navigation of the government roadmap, Modern Law sat down with them again to discover what lessons have now been learnt, what positives there have been and how the attendees’ law firms had changed both from the inside and the out.

The discussion was hugely positive, and from the write-up, our hope has been to show you a slight glimpse into their experiences over the past 18 months. Not only did we hear that people had ironically come closer together during a time when we were told to stay apart, but the culture within the firms had grown too.

What‘s more, we heard how many of our attendees had adapted their businesses in order to win more work — whilst others told us of their excitement and need to be back in the office environment.

Yes, there were common concerns about the recruitment of talent after such a challenging year, but there was also huge optimism due to the perquisites of technology that have made geographical restrictions a thing of the past.

The pandemic isn’t going away any time soon, and we may never return to the normality we all knew before in the legal sector… but what this roundtable has shown is — is this necessarily a bad thing?

The impact of COVID-19 on corporate residence

With the global lockdown to quell the COVID-19 pandemic set to continue, what does this mean for corporate residence?

Under UK law, a company incorporated overseas will be subject to UK taxation if it centrally managed and controlled from the UK. Many other territories have a similar “central management and control” provision in their domestic legislation. With so many displaced people at the current time, this throws up two potential issues:

- Decision-makers stranded overseas risk creating a dual residency for any UK entities they manage

- For structures which rely on certain group entities being outside of the UK tax net, e.g. Guernsey or Jersey companies, the inability to travel to these locations to hold board meetings jeopardises the offshore status of these companies. It could result in significant profits being subject to UK taxation.

Certain tax authorities (the UK, Ireland, Australia) have already stated their position, saying they will be lenient and acknowledging that these are exceptional times. The Organisation for Economic Co-operation and Development (OECD), in its recently released guidance also highlights that it would be difficult for a state to assert taxing rights purely as a result of the short term impact of COVID-19 on the location of key individuals. For territories whose double tax treaty is based on the model OECD treaty, guidance around the “tie-breaker” clause discusses where senior executives “usually” or “ordinarily” carry out their duties, which provides businesses with comfort that a short term change in such arrangements is unlikely to have consequences.

However, as the crisis continues, we may see revenue-hungry territories start to challenge residency more aggressively. While the tax treaty network does provide a mechanism for attributing taxing rights and also dispute resolution, this is not a quick process. Equally, the outcome may be that while there is not ultimately double taxation, profits may be taxable in a higher tax jurisdiction. It is also worth noting that not all taxes are covered by tax treaties, and this is where local guidance is required.

For the time being, to provide the best possible support for a company’s residence, businesses must ensure robust record-keeping – where decisions have been made and why, citing, for example, local government travel restrictions.

In the longer term, COVID-19 related travel restrictions are likely to persist for some time, and it is expected that there will future episodes of lockdown around the globe as countries continue to grapple with the pandemic. With this in mind, businesses should give thought to the parts of their group structure that are particularly sensitive as far as residency is concerned. For example, those entities in territories where there are no permanent employees or UK companies whose directors are not physically in the UK all of the time because their family and permanent home is overseas. This will enable businesses to consider what mitigating strategies might be put in place, for example, the appointment of a local director, to provide more certainty in a landscape where free international movement of people can no longer be taken for granted.

This post was written by Sarah Howarth, a tax specialist at Price Bailey. If you require any questions relating to corporate residence, please contact Sarah on the form below.

Growth beyond the lockdown: webinar slides and recordings

How we do business is changing beyond recognition, through innovation and necessity. We believe that those businesses that are quick to adapt can not only survive but thrive in a post-lockdown world.

Over the course of three weeks, we hosted a series of webinars along with a panel of experts, to look at the opportunities that we expect to arise from the crisis. As well as discussing what growth strategies successful businesses should focus their efforts on in both the medium and long-term.

Thank you to everyone that attended. Here are the slides and recordings from the webinar series in case you would like to review them.

Webinar slides

If you would prefer you can download a copy of the slides below.

Webinar recordings

If you would like watch any part of the webinars again you can access the full recordings for all three webinars below:

Webinar 1: Future opportunities for organic growth – the five key growth decisions

Webinar 2: Growing by acquisition and selling your business.

Webinar 3: Evolving business models – what choices will growing businesses have to make now?

We had a really interactive session and answered a lot of questions. Some we have followed up with directly with those that asked, after the series. We understand, however, you may have any other questions following the webinar series and if you would like to discuss these with one of our experts, please complete the form below.

Charity support

The Charity Governance Code 2020 refresh: key changes

Background

The global Pandemic has significantly affected the charity sector, whereby many trustees are prioritising safeguarding cash flows and maintaining charitable activities during a lockdown, in times of increasing demand and constraints on resources. Despite economic uncertainty, effective governance and skilled trustees making informed decisions are crucial ingredients to ensure charities maximise the fulfilment of their aims and objects. The Charity Governance Code (the Code) is an important resource assisting charities to develop high standards of governance and many charities are turning to the Code to help them consider best practice and improved governance in their organisations.

The Code outlines the principles and recommendations for good governance and was created by a sector steering group. The Code is made-up of the following seven principles:

- Organisation purpose

- Leadership

- Integrity

- Decision-making, risk and control

- Board effectiveness

- Equality, diversity and inclusion

- Openness and accountability

Refresh

In an ever-changing world, the Code’s steering group recognise the importance of evolving the Code where required to ensure it continues to be fit for purpose.

Following feedback from an extensive consultation process, the refreshment of the Code in December 2020 focuses on enhancing Principles 3 (Integrity) and 6 (Equality, Diversity and Inclusion), which occurred as these principles received the most consistent feedback concluding amendments were required.

The Integrity principle

This principle has been updated to emphasise the importance of applying ethical principles to decision making, and ensuring a welcoming and supportive culture is embedded into the charity’s values.

The rationale significantly refocuses from the primary concerns of protecting charitable assets and reputation and now additionally highlights culture, values and the right of everyone to be safe. Key outcomes now include:

- Ensuring Trustees understand their safeguarding responsibilities

- Ensuring everyone in contact with the charity is aware of how to raise concerns

- To address power imbalances/conflicts of interest where they exist or arise

- To establish appropriate procedures, which are integrated with risk management and training

Thus embedding the values, ethics and culture of the charity into everything it does and its decision making – the personal behaviour of Charity Trustees for instance is paramount which has been clarified in the Code.

The equality, diversity and inclusion (EDI) principle

The ‘Diversity’ principle name was renamed ‘Equality, Diversity and Inclusion (EDI)’ principle following consultation conclusions that the principle should be reworded to work towards inclusive cultures as well as Board diversity.

Effective EDI is considered a journey and sits at the heart of good governance. The rationale of principle 6 is to aid boards to maximise public benefit, redesign their charitable purpose where necessary and make robust and informed decisions. The EDI principle now recommends Boards to consider the following four stages of practice:

- Assessing an understanding of EDI and considering why it is important for the charity to consider.

- Formulate context-specific plans and targets and assess the charity’s starting point.

- Taking action and monitoring EDI performance.

- To be transparent and learn from progress to date.

Final considerations

The Code’s principles, rationale and outcomes are considered to apply to all charities regardless of size or activities. Governance practices can differ significantly depending upon a charity’s activities, complexity, income or size; different versions of the recommended practice have therefore been published to address some of these differences, split between ‘larger’ and ‘smaller’ charities.

It is worth noting that some of the principles and recommended good practices set out by the Code are deliberately aspirational, and a stretch for many charities to achieve. This is intentional, as the steering group want the Code to be a tool for continuous improvement towards the highest standards.

The full Charity Governance Code, along with additional information, can be found here.

This post was written by Simon Rowley, Manager and charity sector specialist at Price Bailey LLP.

COVID-19 and its effect on VAT recovery for charities

In many cases, COVID-19 has changed not only the overall value but also the relative composition of a charity’s income. Therefore, this may have implications on the charity’s VAT recovery due to the partial exemption method calculations and the annual adjustment.

For VAT registered charities that need to restrict their VAT recovery based on a partial exemption method, this change could impact the amount of overhead VAT they can recover as most recovery calculations are based on income. For example, retail sales declining relative to grant income could mean more non-business and less recovery. In contrast, sponsorship, increasing relative to exempt admission income could mean a higher recovery. There will be winners and losers.

VAT recovery calculations are normally finalised at the end of your VAT year that ends in January, February or March. We recommend that you estimate the impact that COVID-19 has had upon your VAT recovery now, before undertaking this annual calculation. This is because if your recovery has been detrimentally affected, it might be possible to seek a special recovery method from HMRC. This usually will need to be applied for before the end of the current VAT year. If you predict your VAT recovery percentage will fall as a result of COVID-19, get in touch, especially if you have an open capital goods scheme item.

This article was written by Helena Wilkinson, a charity specialist and Partner at Price Bailey. If you have any questions on how your VAT recovery might be impacted, you can contact Helena using the form below.

Employment law support

Why redundancies might not be your only option

As the Government’s job retention scheme is scheduled to come to an end in March 2021, many employers are now considering what their workforce will look like going forward and if redundancies are going to be needed.

In these circumstances, making employees redundant is an obvious option for reducing costs. However, making redundancies is a real loss for businesses. Not only is it expensive, but it often means letting go of good people who employers have invested in and may not easily be replaced.

However, if there is a possibility of an upturn in the short to medium term, retaining employees may be the best approach.

How can you retain employees?