News Archive

Price Bailey’s news archives present a timeline of our Press Releases over recent years.

Demonstrating our growth and success as a company, our collection of articles exemplify why Price

Bailey is recognised as an award-winning accountancy and business advisory firm and how we have

shared our success with our clients.

Our archives also document our data led PR; produced in collaboration with our research and

insights colleagues to communicate proprietary industry and economic insights on topics relevant to

our audiences and national interest.

We have collated our internal promotions, career opportunities, company accolades, data led

insights, acquisitions and advisory success, as well as keeping our clients updated on our

partnerships within the local communities and the charities we have supported through our

fundraising efforts. Price Bailey pride ourselves on the service that we provide our clients and the

local communities through our people and advice.

Should you wish to find out more about PR at Price Bailey, discuss any topics within the news

archives or for PR enquiries, please contact our Media and PR representative Eleanor Lodge.

2023

13th March: Commonwealth Day 2023: The Commonwealth Advantage

Commonwealth Day is an annual celebration observed throughout the commonwealth, with this year especially noteworthy as it marks the tenth anniversary of the signing of the Commonwealth Charter.

As Price Bailey approaches its first year as a member of the Commonwealth Enterprise and Investment Council, Simon Blake, Partner at Price Bailey, reflects:

“Having joined the Commonwealth Enterprise and Investment Council a year ago, I’ve had the opportunity to witness first-hand the benefit and opportunities available for businesses within the organisation.

“As Britain continues to adjust to post Brexit trade and business, the Commonwealth provides an abundance of economic opportunities. From access to a population of 2.4 billion of which 60 per cent are under 30 years old, the Commonwealth represents a billion middle-class consumers. Through to the Commonwealth Advantage, which offer an average 21 percent lower bilateral costs for trading partners throughout the 56 strong association of countries.

“The Commonwealth is also an advocate for climate change and sustainability, offering greater international opportunity for conversations around this growing issue.

“Thirty-one of the Commonwealth’s members are small states, and 23 are Small Island Developing States (SIDS), which are among the most vulnerable to the impact of climate change or developmental challenges

“With upcoming conferences in Singapore, Rwanda and the Commonwealth Forum, which will see 16,000 people from across the Commonwealth come together, Price Bailey’s involvement with the Commonwealth Enterprise and Investment Council has opened channels to greater international relationships and prospects.

“The Commonwealth offers a direct line to businesses built on shared values and access to fast growing economic markets such as those seen in Africa.

“Price Bailey was recently appointed by a new client in Africa looking to list in the UK and this was a direct result of our involvement with the Commonwealth association.”

2022

1st October: Price Bailey has announced six senior-level promotions

Price Bailey has announced six senior-level promotions this month as the firm continues to invest in its future.

Price Bailey, a top 30 chartered accounting and advisory practice, has appointed two new directors, Steve Butcher and and Michael Morter, both in the Tax team and four senior managers, Stella Anthanasiadou in the Corporate team, Seb Humberston in the Strategic Corporate Finance team, James Elvin in the Business team and Charlotte Page in the Tax team. These senior-level appointments follow two new partner promotions and five other senior-level promotions earlier in the year.

Commenting on this round of promotions, Martin Clapson, Managing Director, said:

“We are delighted to celebrate all the promotions across the firm effective 1 October, in particular the achievement of the following people in reaching a key milestone in their careers. We are particularly proud of the five individuals who joined as Price Bailey trainees.

These promotions demonstrate that career progression can be achieved either by joining Price Bailey part way through your career or as part of our Stepstone trainee programme. Together with the ability to smart work at every level of the firm, exampled by our previous senior promotions, we are pleased that people continue to choose Price Bailey as being their great place to work.”

Steve joined our Corporate team as a trainee in 2003, qualifying ACCA in 2006. He then became CTA qualified and transferred to our Tax Team in 2014, becoming an Authorised Tax Expert in 2018. He is consulted regularly in his areas of expertise, particularly with share incentives. He leads technical tax advisory projects and assists our corporate and business teams with compliance. In addition, he is actively supporting the growth of the Norwich corporate tax team by developing additional tax advisory opportunities. Steve enjoys cooking, heavy metal, keeping fit, time with friends, and outdoor activities with his family outside of work.

Michael is a personal tax specialist within the Tax Team and joined the firm in July 2017 as a Manager, moving from Larking Gowen. He provides tax return services to an extensive portfolio of clients, including individuals and trusts, and tax advisory services to clients across the firm. Whilst predominately based in Norwich, he works with clients across all our locations. Michael is a keen traveller, having visited 30 countries, and he and his wife live near Norwich.

Stella Anthanasiadou – Senior Manager

Stella joined as a trainee in 2015. Since qualifying in 2017, she quickly progressed to becoming a manager in 2021. She has experience working with a broad range of commercial companies, charities, membership organisations and entities within the not-for-profit sector. Her portfolio also includes several PLC clients, one being the UK’s largest angling retailer. Outside of work, Stella enjoys football and travelling.

Seb Humberston – Senior Manager

Seb joined as a trainee in 2012, moving into the Corporate Finance team in 2014. He heads up the firm’s Financial Due Diligence offering and is involved in all the department’s service offerings. He has significant experience advising on Management BuyOuts, Buy and Sell-side leads advisory support, valuation work, financial projections, and debt and equity fundraising.

He has recently helped to support the team in delivering a significant volume of FDD work and continues to help grow and develop this service offering. Outside work, Seb is a keen runner and an occasional golfer and balances all this with a young family.

Jimmy joined the firm in 1998 as a trainee. He now leads the Norwich Business Team and actively collaborates with our other offices. He is focused on encouraging staff to develop smoother working practices, including sharing resources with Cambridge. He also provides the Business Team guidance on SEIS treatment in accounts and tax returns and has rolled out team-wide advice on Wiki Staff Skills. Outside of work, Jimmy is a very keen Norwich City football fan.

Charlotte Page – Senior Manager

Charlotte joined as a tax trainee in April 2016. She specialises in providing direct and indirect tax advice and regularly assists the corporate and business teams with their VAT and tax questions. Additionally, she works on various complex advisory projects, including corporate reconstructions, sale and purchase transactions, property and construction matters, employee share schemes, research and development and patent box claims.

Having previously completed a PhD in mathematics, Charlotte still enjoys maths and logic puzzles and reading a good book in the garden.

– Ends –

8th September: A tribute to Her Majesty Queen Elizabeth from Price Bailey

Since Price Bailey was founded, we have operated within a changing world with many different economic, political and social issues. Throughout this, Her Majesty Queen Elizabeth has been a constant beacon for the United Kingdom and the Commonwealth, and her public service has been an inspiration to many generations.

While many of us will mourn the death of Her Majesty Queen Elizabeth, we should also be grateful to have witnessed the UK’s longest-reigning monarch, and we should celebrate her achievements over the last 70 years since her accession to the throne.

In her life, Her Majesty has visited hundreds of countries, conducted many public engagements and met thousands of people from around the world. During this, she has had to meet and overcome some huge challenges along the way, none more so than the death of her beloved husband, HRH Prince Philip.

However, despite all this, she always set an exemplary display of resilience, humility and dignity, as well as having an extraordinary ability to unite so many friends, families and communities together even during the most challenging of times.

Of course, this is also a time for us to reflect on our own lives and remember our loved ones who are no longer with us.

Our people, who choose to, can take some time to reflect on this sad news and so responses to enquiries may be slower than usual.

Please hold those you love dearly close by and remember what is important in life.

Martin Clapson – On behalf of Price Bailey

24th June: Price Bailey showcases career opportunities at Cambridgeshire County Day.

The county’s first Cambridgeshire County Day was held to celebrate her Majesty the Queen’s Platinum Jubilee and showed off the best parts our county has to offer.

Price Bailey sponsored the event and used it as an opportunity to connect with school leavers and showcase the wide variety of career opportunities available at the firm.

The firm expects to hire over 100 people in several disciplines over the next 12 months to help it realise its growth plans.

Price Bailey was recently officially recognised by the Best Companies survey 2022 as one of the best companies to work for in the UK, being described as ‘Outstanding’. Best Companies independently surveyed staff at Price Bailey across a wide range of workplace factors.

Commenting on the firm’s upcoming recruitment plans, Nadia Khan, a partner at Price Bailey who sits on the Board and oversees the firm’s HR function, said, “Our aim is to position ourselves as the employer of choice for those seeking a well-established and forward-thinking mid-tier firm.

In 2022, our people rated us as ‘outstanding to work for’. We were one of the first professional services firms to offer truly flexible working through our ‘smart working’ approach and can provide the opportunity to work with varied and entrepreneurial clients.

Together with giving people accountability and ownership, we regularly benchmark our salary and reward packages to ensure our propositions are competitive, if not market-leading. In addition, we’ve recently launched a new Wellbeing Agenda to ensure that our people’s mental and physical health is prioritised. Our approach is to continuously improve our strong people focus and ensure that our people are happy and well looked after.”

The event was held at the July Course at Newmarket Racecourse, and Price Bailey also sponsored the 15:10 Price Bailey Fillies’ Novice Stakes at Newmarket which was won by Midnight Moll, ridden by Kieran Shoemark and trained by Ed Walker. Price Bailey is a big supporter of Newmarket Racecourse and regularly attends meets.

The royal icing on the cake was the special appearance from the Duke and Duchess of Cambridge, who were greeted by cheers and met and chatted with many people attending the event.

The event was organised by the Lord-Lieutenant of Cambridgeshire, Mrs Julie Spence OBE QPM. Commenting on the day, the Lord-Lieutenant said, “Cambridgeshire County Day is unique; it has never happened before and will never happen again in the same format. The day is filled with exciting showcases of the best of our county, and we want it to be accessible, relevant and engaging for everyone in the community. Young people will be given a platform to learn about, be inspired by and connect with the people and organisations that make this county so special.”

Price Bailey has several career opportunities and roles, from trainees to experienced people. For more information, you can visit our careers page or speak to the firm’s Talent Acquisition Manager, Duncan Crooks.

– Ends –

3rd May: Price Bailey appoints new audit partner to support growth

Price Bailey has announced the appointment of Adam Norman as an Audit Partner in their Corporate team with effect from 3 May 2022. This brings the total number of partners in the firm to 29 across 11 offices.

Adam joins Price Bailey, having previously worked for a top 4 accountancy firm since 1998. Over those 24 years, Adam has specialised working with privately owned, venture capital-backed and private equity-owned businesses across a range of sectors including fast-growing tech companies, high-end fashion brands, and other privately-owned retail businesses; whilst also fulfilling internal secondments in training and strategy.

Pictured from left to right is Paul Cullen, Head of Corporate, Adam Norman, Audit Partner, Martin Clapson, Managing Director.

Adam will be based in their Cambridge office and has a strong, well-established professional network in the area. Adam leads and is a key member of “Pro Network”, of which Price Bailey is an active member.

Adam will work alongside Paul Cullen and the other corporate partners, strengthening the firm’s audit offering to its clients.

This appointment further enhances the partnership team at Price Bailey after the promotion of both Michael Cooper-Davis and Lewis Ratcliffe to Partner last month.

Martin Clapson, Managing Director at Price Bailey, commented on the appointment, saying, “I am delighted Adam is joining Price Bailey. We are very proud of our audit team offering and see Adam as a key person who will support our exponential growth. We have a clear strategy at Price Bailey and I am sure Adam will contribute fully to achieving our strategic objectives.”

Following his appointment, Adam Norman shared his thoughts on joining the firm adding “I am really pleased to be joining Price Bailey, which is a growing and exciting business that I have admired for a while. I look forward to helping them continue to have a positive impact on many businesses in the marketplace.”

– Ends –

21st February: Price Bailey named 'Best Accountancy Firm to Work For'

Price Bailey has been named the ‘Best Accountancy Firm to Work For’ in the UK for Q1 2022 at the BestCompaniesLive event on 18 February. Price Bailey had already been officially recognised by the Best Companies survey 2022 as one of the best companies to work for in the UK, being described as ‘Outstanding’. Best Companies independently surveyed staff at Price Bailey across a wide range of workplace factors.

The firm was recognised at the BestCompaniesLive event, which was held virtually from MediaCityUK in Manchester and hosted by BBC’s Dan Walker.

During the day-long event, Price Bailey was also listed as one of the Top 25 Companies to Work For in the East of England and London, ranking 17th and 18th respectively, as well as ranking 41st best company to work for overall in the UK in the national listing.

Commenting on the accolades, Human Resources Partner Nadia Khan, who was pleased to see Price Bailey recognised this way, described the announcement as “exciting news” and paid tribute to the staff, thanking them for their efforts and saying the award was “a testament to all our people making Price Bailey such a great place to work.”

The company was notably recognised for its family-friendly credentials and work-life balance. As well as the firm’s ‘Smart Working’ policy, which has been in place for several years, even before the pandemic, and enables staff to work flexibly, the company offers school hours contracts to all staff and enhanced maternity pay. A good work-life balance is vital at Price Bailey. Price Bailey added circuit-breaker days during the pandemic, giving its team extra time off to recognise their hard work and commitment. The firm’s IT systems were completely shut down to ensure everyone had a proper break from work.

The firm also excelled in staff retention, with over 40% of the workforce working there for more than five years. Staff retention is taken very seriously, and the firm has several schemes to ensure they retain the best talent.

Everyone at Price Bailey is invited to join the employee share scheme once they have completed 12 months of service; this gives them a stake in the business’s success and recognises the value of their contribution.

“We aim to be the best in the world at building trust and providing support that creates value to all.”

Price Bailey was founded in 1938 with one office in Bishop’s Stortford and a single partner. Today it has 30 partners, with locations in London and East Anglia, and a strategic international presence.

In recent years, Price Bailey has demonstrated an ongoing commitment to Access Accountancy, aiming to broaden access to the accounting profession. The company’s PB Inspires initiative works with local schools to develop the next generation of employees from disadvantaged backgrounds; it also develops staff leadership skills.

Commenting on the firm’s culture, Martin Clapson, Managing Director, who, through choice, retained a client portfolio to ensure he maintains an understanding of how the firm’s systems and procedures said:

“We work within a culture that is open and inquisitive to new ideas, one that embraces change. We empower our people to challenge the norm and to look for opportunities. We want everyone to feel fulfilled in their role and to understand their contribution to the service we deliver to our clients.”

While Price Bailey takes its culture very seriously, that’s not to say Price Bailey’s senior leaders take life too seriously. Some can be found with their heads and hands in stocks on charity day, facing a barrage of wet sponges. Giving back to the community, the firm donated laptops to schools in 2021 and provided two paid leave days for employees to participate in voluntary work.

Recently the firm also celebrated National Apprenticeship Week. Price Bailey has many trainee accountants, taken on as apprentices and graduates. Staff are encouraged to return to their old schools or universities to promote the firm.

Commenting on their commitment to their apprenticeship scheme, Human Resources Partner Nadia Khan said:

“Price Bailey is proud to be an employer that utilises the apprenticeship scheme and gives young people a head start with their careers. It is fantastic to see them grow and develop as they work towards a professional qualification, whilst also benefitting from on the job training under the guidance of our experienced senior members of staff. We also really value the concept of upskilling our existing workforce and have seen tremendous benefit when our people have continued studying later in their careers.”

– Ends –

21st February: Price Bailey is officially an 'Outstanding' company to work for

Price Bailey has been officially recognised by the Best Companies survey 2022 as one of the best companies to work for in the UK, having been awarded 2-star accreditation and described as ‘Outstanding’. Best Companies independently surveyed staff at Price Bailey across a wide range of workplace factors.

In the same week that the firm celebrates National Apprenticeship Week, Price Bailey received the award due to incredibly high levels of employee engagement.

2021

10th December: Price Bailey helps negotiate the sale of Root Solutions joining PDSVISION

The sale was negotiated with the support of Price Bailey’s SCF department

SCF Partner Phil Sharpe explains more

Tailored technology service provider Root Solutions Ltd. announced that it has joined PDSVISION Group in a move that sees the Swedish entity expand its UK operations.

The Cambridge-based technology company, Root Solutions, provides engineering-based software to companies across the UK. This includes Computer Aided Design, Augmented Reality (AR) and Product Lifecycle Management (PLM). These solutions help clients improve their engineering processes and product quality and is backed up by comprehensive technical support and training.

PDSVISION are a global provider of solutions and services focused on enabling their digital transformation journey from product development to aftermarket services. PDSVISION’s solutions are centred on the portfolio of products provided by NASDAQ listed PTC and ANSYS. PDSVISION also develop their own range of software applications. The group is headquartered in Sweden and has operations in Finland, Denmark, Norway, Germany, United Kingdom, South Africa and the USA.

Roger French Co-Founder and Managing Director of Root Solutions commented, “Root Solutions and PDSVISION complement each other perfectly. We have the same business goals and same team culture. We will now be part of a global organisation in which our collective know-how and experience will give customers an even broader solution portfolio and fuel future growth. It is the foundation of a strong partnership which will benefit both customers and employees.”

Johan Klingvall, CEO of PDSVISION said, “This acquisition strengthens our position in UK and allows PDSVISION to continue the growth of the services we provide as part of the continued expansion of our global footprint. There are clear synergies in combining our services and winning cultures, not only to continue supporting our customers, but to also develop a deeper understanding of how we can enhance the services and support we provide. I am excited to continue the journey together with our new UK colleagues.”

Price Bailey’s SCF Partner Phil Sharpe helped negotiate the sale commented: “We are thrilled to have had the opportunity to advise on the sale of Root Solutions. We started this journey with the shareholders, Roger and Mark, four years ago, having advised them on the sale of sister company Innova. When they decided to sell Root Solutions we were delighted that they asked for our help again. The deal has delivered a positive outcome for all parties involved and again demonstrates how successful local businesses are achieving international recognition.”

Roger French commented further, “Anyone considering the sale of their business should get advice from an experienced professional. Even if you have already received an approach or offer there is a lot of work and complexity in getting the deal completed. Phil Sharpe and his team at Price Bailey were a perfect partner to walk that journey with us. Your guidance and experience was vital but more than that it was a pleasure working with the Price Bailey team.”

Mark Bradford, co-founder added, “We are extremely grateful for your ability to make a complex process understandable for us and helping to get the transaction done. It has been an enjoyable process with your team by our side. This is the second transaction you’ve completed for Roger and I over the past few years and we’ve been very happy with both outcomes. We really appreciate the support you have given us throughout the process.

23rd November: Price Bailey assists with BrightGen joining Omnicom's Credera

- The acquisition was negotiated with the support of Price Baileyrsquo;s SCF department

- SCF Partner Phil Sharpe explains more

Tailored technology service provider BrightGen announced that it has joined Omnicomrsquo;s Credera after the US listed entity acquired the company.

The London and Essex-based technology company, BrightGen, primarily partners with CRM aggregate software Salesforce which aims to help marketing, sales, commerce, service, and IT teams synergise more effectively. Award-winning BrightGen focuses on enabling clients to provide optimal experiences to their customers. It has grown significantly in recent years and now one of the largest implementers of Salesforce’s software with many global clients. Their management team will continue to lead the company and provide utmost autonomy at the benefit of clients and customers.

Credera made the investment as a move to expand its digital transformation reach, as well as expanded depth in marketing technology and customer experience capabilities. The firm is part of Omnicom’s Precision Marketing Group (OPMG) which specialises in digital and customer relationship management.

Rob Stevens and Martin Tyte, Co-CEOs and Co-Founders of BrightGen commented, “Having established BrightGen in 2006, the past 15 years of building the team and client relationships has been fantastic. BrightGen is now ready to take the next step in our growth through a partnership with Credera and Omnicom.

“Together, we have the strategic vision and cultural fit that will expand our capabilities and accelerate our growth,” they continued. “This is an exciting time for the business and our team.”

Justin Bell, President and CEO of Credera said, “We remain committed to prioritising investment in organisations that create remarkable customer experiences with meaningful outcomes for our diverse client base and we have tremendous confidence that BrightGen’s depths of expertise will better enable us to do just that.”

Price Bailey’s SCF Partner Phil Sharpe helped negotiate the sale commented: “We are thrilled to have had the opportunity to advise on the sale of BrightGen. The deal has delivered a great outcome for all parties involved. BrightGen’s acquisition by Credera again demonstrates how successful local businesses are achieving international recognition.”

Rob and Martin commented, “We were delighted to have engaged the Price Bailey team who supported us through this exciting and fast paced sale process.”

Anna Bowes, Finance Director added, “Good advice and lots of preparation before you embark on your sale is key to a smooth journey through the process and achieving a successful outcome. Having a team around that you trust and who you know are on your side proved invaluable to us. It is important to not under-estimate the amount of time, effort and emotion it will take to get through due diligence! The PB team were on hand whenever we needed them, with a calm voice and their collective experience helped guide us through this complex and challenging process. I cannot thank them enough for their support.”

4th October: Price Bailey announce nine new senior-level promotions

Price Bailey has announced nine new senior-level promotions across the firm this month.

These include two directors, Mark Roach in the Corporate team and Gemma Thake in the Tax team and seven senior managers, Stacey Ellwood in the Finance team, Sarah Howarth and Andrew Parsons, both in the Tax team, Simon Lovick, Simon Rowley and Stephan Schmitt in the Corporate team and Mark Rowntree in the Strategic Corporate Finance team. These promotions are a critical part of the ongoing success of Price Bailey.

Commenting on the promotions, Martin Clapson, Managing Director at Price Bailey, said, “These promotions recognise how diverse our teams are and how wide-ranging our skill base is. Some have joined after qualification, others have had their whole career at Price Bailey. But what was clear is that everyone recognises the importance of a successful work-life balance, and the ability to work either full-time or part-time does not impact ongoing development and promotion. Congratulations to all these individuals and to the other 23 promotions awarded across the firm.”

Corporate

Mark is part of our corporate team and joined the firm in 2012 as a graduate trainee. Since qualifying in 2015 he has continued to progress quickly, becoming a manager in 2017 and senior manager in 2020. Managing a range of clients across a variety of industries, Mark looks after some of our largest clients within the City office. He is a key player leading the ongoing growth of the City corporate team and continues to drive this growth. Outside of work Mark enjoys most sports, particularly a round of golf and often less enjoyably attending Arsenal.

Tax

Gemma joined Price Bailey in 2017 as a manager in the tax team and was promoted to senior manager in 2019. Prior to this she started her career at Deloitte and then spent 10 years at PEM in Cambridge. She is ACA and CTA qualified and specialises in corporate tax, working on some of our most complex advisory work and regularly assisting the corporate and business teams with compliance. Gemma also specialises in R&D tax relief and Patent Box claims, which is an area she will continue to focus on as well as growing and developing the tax team. Outside of work, Gemma has a young son and is a trustee of a local charity.

Corporate

Simon joined Price Bailey in 2014, having previously qualified as a chartered accountant at Chantrey Vellacott. He works within the corporate team and manages a diverse spectrum of both corporate and not-for-profit clients. This exposure has enabled him to develop a strong knowledge of UK GAAP as well as current auditing challenges facing both OMBs and charitable organisations. Simon is also critical in driving the growth of our City office. When not at work Simon can be found keeping fit and socialising with family and friends.

Stephan Schmitt – Senior Manager

Stephan joined Price Bailey in 2017 from BDO, having also previously worked as an actuary. He is an audit specialist and works with some of East Anglia’s most respected organisations as well as some companies outside the region. In addition to the usual corporate work, Stephan has started to roll out analytical audit techniques across the firm. This will continue as digital audit techniques become increasingly prominent across the profession. Outside of work Stephan has a young family, and enjoys a variety of water based activities, one of the many reasons he lives close to the Norfolk Broads.

Simon Lovick – Senior Manager

Simon has worked in our corporate department since joining the firm in 2008. He has been based in our Bishop’s Stortford after growing up in the local area and living there with his wife and 2 children. Simon was promoted to manager in 2017 with a portfolio comprising standard corporate audit clients, academy schools and other sector specialisms, notably occupational pension schemes. Simon has continued to grow these ‘niche’ specialisms and is now working with FE&HE Colleges.

Finance

Stacey Ellwood – Senior Manager

Stacey joined Price Bailey in 2005 straight from A Levels as a trainee purchase ledger clerk, qualifying in 2010, becoming a manager in 2015. Stacey is now Price Bailey’s financial controller, managing both the finance team and, more recently, the facilities function. Her role is varied and ever changing, she has been instrumental in the changes to our offices front of house areas, and what the office environment will be going forward in the new normal. Outside of work Stacey is a mum to a two year old girl, and attempts to play netball now and then.

Strategic Corporate Finance

Mark Rowntree – Senior Manager

Mark joined Price Bailey in 2015 originally as Business Development Manager in London after working in corporate finance for over eight years. Following a period working within the wider SCF department he transitioned back to corporate finance full-time and has since worked on a range of growth capital projects, management buyouts and company disposals. Mark maintains a strong network of Private Equity relationships in London which will help deliver work and originate new opportunities for the firm in the future. Outside of work, Mark is a father of two very young children but used to have plenty of hobbies before this, including playing and watching a wide range of sports, traveling, reading and bedroom deejaying.

Tax

Sarah Howarth – Senior Manager

Sarah has been part of the tax team for two and half years having joined Price Bailey after 10 years with Ernst and Young. She works across a wide range of tax advisory projects, but specialises in large and complex corporate groups, and international tax matters. She will continue to support the tax partners and wider firm in these areas in particular going forward. Outside of work, Sarah enjoys the great outdoors and spending time with her young family.

Andrew Parsons – Senior Manager

Andrew joined Price Bailey’s tax team in 2015 after beginning his career with Dixon Wilson. He is responsible for portfolio of personal and trust tax clients and property tax work, and have developed an in depth knowledge in these areas. In addition, he has developed knowledge and skill in SDLT/ATED matters, and will continue to support the wider team advising clients with complex affairs.

Across the firm, there were 23 other promotions awarded this month.

– Ends –

5th August: Cambridge United and Price Bailey partnership continues

Price Bailey is delighted to announce that the long-standing partnership with Cambridge United Football Club will continue for the 2021/22 season.

The renewed deal will see the Price Bailey logo prominently displayed on the tracksuit used by all first-team players at the club.

Cambridge United’s opener is at the Abbey Stadium against Oxford United on Saturday, 7 August, as they look to kick start their League One campaign off the back of their recent promotion from League Two last season.

Martin Clapson, Managing Director of Price Bailey, commented, “Price Bailey has a long-standing relationship with Cambridge United, and we’re very proud to continue our association with the club this season. We are committed to supporting our local community and understand how important sport is in bringing people and communities together.”

Head of Commercial at Cambridge United, Neil Rowe, added, “It is great to announce the extension to the partnership between Price Bailey and Cambridge United for the upcoming season. As a club, we are proud to work with a local business that offers a professional service and engages with the community. Price Bailey is certainly one of those businesses, and we are delighted to continue the relationship”.

– Ends –

21st July: Smith Cooper System Partners announces acquisition of Price Bailey Business Systems

Smith Cooper System Partners are delighted to announce the acquisition of the Price Bailey LLP Business Systems Division.

Based in Cambridge and with more than 20 years’ experience as a Sage Business Partner, Price Bailey Business Systems has earned a fantastic reputation for customer service and quality Sage 200 support. The business provides all the standard Sage 200 products and services and, in line with their parent company Price Bailey LLP, is rightly proud of the fantastic relationships it enjoys with its loyal customers.

Chris Smith, MD of Smith Cooper said “The growth and progress of our company over the last six years has been immense and this is another important but sensible step on our journey. The acquisition of Price Bailey’s Sage division is a fantastic addition to our operation in the Southern region and our business at large. From the early stages of discussions with the Price Bailey team we recognised a synergy in the way we all believe a Sage Business Partner should work and how Sage 200 customers should be treated. However, we also recognised an opportunity for Smith Cooper to provide some assistance to the team and add even more value for the clients. I am naturally thrilled that Price Bailey has chosen Smith Cooper as the company best placed to work with them to move their business systems division forwards into a new era, whilst safeguarding the quality of service their clients currently enjoy.”

Alan Becker, divisional manager of Price Bailey Business Systems who will be remaining at Price Bailey, said “We are immensely proud of our history as a quality Sage 200 support partner and have worked tirelessly over the last 20 years to achieve the reputation we enjoy today. Both myself and the team value the service we provide to our clients above all else and are very confident that Smith Cooper will not only retain our levels of service but actually improve it with a wider team and an expanded service offering. I believe this is a fantastic development for our clients, staff and suppliers.”

Smith Cooper System Partners would like to thank Howard Sears and the senior team at Price Bailey LLP, Flint Bishop LLP and Tees Law for their professional assistance in moving this transaction to completion.

Should you require any further information with regard to this news, please email [email protected].

11th June: Price Bailey and Action Medical Research highly commended for Corporate Partnership of the Year at the Chartered Institute of Fundraising East Anglia Awards

Recognised for two-year funding raising partnership between Price Bailey and Action Medical Research which raised over £100,000

Price Bailey, one of East Anglia’s leading accountancy firms, has been highly commended for Corporate Partnership of the Year at the Chartered Institute of Fundraising East Anglia Awards for their work with charity partners Action Medical Research. The awards were held online on 10 June.

The Chartered Institute of Fundraising is the professional membership body for UK fundraising and organises prestigious annual awards to recognise fundraising excellence. This year’s awards focused on how charities adapted to the pandemic while also acknowledging the remarkable achievements made by fundraisers and funders from across the board.

The East Anglia Awards consisted of the following categories: Campaign of the Year, Charity Partnership(s) of the Year, Corporate Partnership of the Year, Grant Giver of the Year, Professional Fundraiser of the Year and Volunteer Fundraiser (incorporating virtual events) of the Year. Price Bailey was highly commended in the Corporate Partnership of the Year category alongside Action Medical Research.

Price Bailey recently completed a series of charity skydives for Action Medical Research in Cambridgeshire, which marked the conclusion of a two-year fundraising partnership during which Price Bailey volunteers raised over £100,000 in support of their ‘Saving Tiny Lives’ campaign. The campaign is focused on research into reducing premature births. Around 60,000 babies are born prematurely in the UK, and sadly 1,000 tragically die, making it the biggest cause of death in babies; for those that do survive, it is also the leading cause of disability.

Catherine Willshire, Corporate Social Responsibility Partner at Price Bailey, comments: “We are delighted to have been highly commended for this prestigious award. Everyone at Price Bailey is immensely proud of the commitment demonstrated by our teams in fundraising in support of this vital cause. We are a firm with a substantial presence in East Anglia, and while we have grown nationally and internationally in recent years, being shortlisted for this prestigious accolade demonstrates that it is possible to combine top-level ambition with a personal, family-oriented culture that ensures we remain deeply embedded in the local communities we know so well in East Anglia.”

Lyndsay Wood, Corporate Fundraising Manager at Action Medical Aid, comments: “We would like to thank Price Bailey for their enthusiasm and dedication over the two years of our fundraising partnership. They exceeded what was an incredibly challenging fundraising target, which will help us to continue our crucial work of helping sick and disabled children lead better lives.”

– Ends –

3rd June: Price Bailey advises on the sale of leading Irish-based automation business

Price Bailey, the chartered accountants and business advisers, have advised the shareholders of Ireland-based Control and Information Management Limited (CIM) on the sale of the business to German-based Process Automation Systems (PA Solutions), a subsidiary of Canadian parent ATS Automation Tooling Systems (ATS), a manufacturer of automated systems, listed on the Toronto Stock Exchange with a market cap of £1.6bn.

CIM was founded in 2003 by Darrin McCrudden and Eamonn Nally through a management buyout of the Siemens Ireland Industrial Projects division and is now one of the leading system integrators in industrial automation in Ireland. Its core business is the delivery of fully validated automated process control systems in the highly regulated life sciences industry and it maintains significant long-term relationships with the major blue-chip companies operating in this arena in Ireland.

CIM has experienced double digit growth over the past number of years as a result of the growing demand for quality process automation systems and engineering solutions from the life sciences and high-tech manufacturing industries. The Company has continued to expand in this competitive market because of its exceptional team of project managers, lead technical engineers and automation engineers that deliver consistent solutions to specification, schedule, quality and cost.

Price Bailey’ Strategic Corporate Finance (SCF) team acted as lead advisor on the Company’s sale to PA Solutions and Mark Rowntree, who led the transaction for Price Bailey commented “We are pleased to help Darrin and Eamonn on the transition of their business to PA Solutions. PA is a very good home for the CIM team, and the two companies will be able to offer a broader portfolio of consulting and engineering services to the market, whilst also competing for larger CAPEX projects.”

Darrin and Eamonn, who will remain with CIM, will aim to leverage the product innovation of ATS and the engineering excellence of PA Systems and add significant value to its current Irish client base. They will also drive the growth strategy for the combined business to strengthen their presence in regulated and non-regulated manufacturing. Eamonn comments “We have developed a strong relationship with PA Systems since our initial engagement with their leadership team and we share the same ethos for providing high-quality, technical engineering solutions and services in the automation space. We are excited to grow with the backing of an international partner.”

On working with Price Bailey, Darrin comments “It was a pleasure working with the Price Bailey team on our sale to PA Systems. They were with us every step of the way and added significant value to us as well as to the wider sales process”.

This latest transaction is another example of a successful virtual cross border deal for the Price Bailey SCF team, having also completed the sale of Diamond Pharma Services and Noahs Ark Chemicals in March 2021 with more cross border deals in progress. Simon Blake, head of Strategic Corporate Finance at Price Bailey comments. “We continue to see significant interest in UK and Irish businesses from a range of hungry international corporate acquirers. Virtual deal-making has levelled the playing field somewhat for international buyers as they can commit similar levels of effort, resource and cost as any local acquirer when it comes to origination and transacting. It will be interesting to see what happens as the world opens up.”

In addition to Price Bailey, CIM was supported by Flynn O’Driscoll (legal) and RBK (accounting and tax). PA Systems was supported by LK Shields (legal) and Mazars (financial due diligence).

Link to the official deal announcement here.

– Ends –

19th March: Price Bailey advises on the sale of Diamond Pharma Services to US-based ProPharma Group

Diamond Pharma Services, a British pharmaceuticals consultancy specialising in compliance and regulation, has been acquired by ProPharma Group, the world’s leading provider of compliance and regulatory expertise to pharmaceutical, biotechnology, and medical device companies. Price Bailey, the top 30 accountants, advised Diamond Pharma Services on the sale.

Diamond Pharma Services provides regulatory affairs, pharmacovigilance, and compliance & quality services to support pharmaceutical and biotechnology companies in obtaining and maintaining medicinal product licenses throughout all stages of a product’s life cycle.

Founded in 2005 Diamond Pharma Services is headquartered in Harlow, Essex, employs over 70 staff and serves clients from the very small and virtual, through to large multinational pharmaceutical companies. The company has satellite offices in London and Cambridge, Amsterdam, Dublin, and Cambridge-Boston (US).

Phil Sharpe, Partner at Price Bailey, comments: “We have seen a surge of interest by foreign buyers in acquiring UK companies over the past year. This deal is a good illustration of that trend and shows that the fundamentals of the UK economy remain sound post-Brexit. The UK continues to be regarded as a stepping-stone to Europe, and the conclusion of a Brexit trade deal, together with favourable exchange rates, has released a lot of pent-up demand from foreign buyers.”

Dawn Sherman, ProPharma Group’s CEO, comments: “We are excited to welcome Diamond Pharma Services into the ProPharma Group family. This acquisition further solidifies ProPharma Group’s position as the leading global provider of regulatory, compliance, pharmacovigilance, and medical information services. With our mission and higher purpose of improving the health and safety of patients, we are focused on delivering the highest quality of services throughout the full product lifecycle.”

Maureen Graham, Founder, Diamond Pharma Services, comments: “Joining forces with ProPharma Group offers a fantastic opportunity to enhance the ways in which our teams can bring value to our customers, working together to improve the health and safety of patients. Our complementary experience and expertise will allow us to bring even more depth and breadth to the services we provide our clients.”

– Ends –

12th March: Price Bailey advises on acquisition of leading London-based chemicals distribution business

Noahs Ark Chemicals, one of the UK’s leading chemical distribution businesses, has been acquired by Count Energy Trading, based in the Netherlands. Price Bailey, the top 30 accountants, advised Noahs Ark Chemicals on the sale.

The business has been acquired from Bharat Bhardwaj, the company’s founder, who established Noahs Ark Chemicals in Cambridge in 2001. Since then, the business has successfully established satellite operations in Belgium and Switzerland and trades across global markets, including China, Europe, India, South Korea, the Middle East, South America, and the United States.

This transaction will allow Count, a trading house specialising in chemicals, fuel components, and advanced recycling, to further deepen its presence in the chemical distribution market.

Jeroen Baaima, CEO of Count Energy Trading, comments: “We have known Bharat and Rashmi – the founders of Noahs Ark Chemicals – for many years and are proud they have put their faith in us to take their company to the next level.”

Bharat Bhardwaj, CEO of Noahs Ark further elaborated: “This acquisition will allow us to strengthen our capability to continue business growth. Mr. Jeroen Baaima will take over as CEO of the Noahs Ark Chemical Companies and I shall be working closely with him, with our teams, in ensuring success in this year ahead. With the support of the new owners, I will also be continuing my work on leading the development of the digital platforms of the chemical distribution industry via the GoBuyChem and Impratech ventures.”

Chand Chudasama, Partner at Price Bailey, comments: “We have seen an increase in business owners looking to cash out and retire since the start of the Covid-19 pandemic. Fortunately, the acquirer was in a position to finance the transaction with cash. This was important to getting the deal completed smoothly as High Street banks have shown themselves reluctant to finance deals on terms acceptable to management over the past year. This transaction puts the business on a firm footing for navigating the current economic headwinds and continued expansion.”

– Ends –

8th March: Price Bailey provide advice and guidance to ensure a "smooth and stress-free" transaction

Price Bailey has advised management on the shareholder buyout of Carvels Lettings Limited, a lettings and property management company based in Norwich. The Company specialises in residential lettings and student properties.

Sheridan Derbyshire and exiting shareholder Anna Daniels co-founded the Company in 2013 and have managed the business since. Anna decided to leave the business to pursue a new business venture, presenting the opportunity for Sheridan to undertake a shareholder buy out and acquire full control of the Company.

Price Bailey provided lead advisory support throughout the process, including; initial feasibility and transaction structuring, review of financial projections to support the transaction and funding discussions, exploring suitable funding options, obtaining tax clearance for the transaction and liaising with the legal advisors, offering advice and support through to successful completion.

Sheridan Derbyshire, Carvells Lettings said, “Price Bailey’s advice, support and project management helped guide us to the outcome we desired. Their input at the early feasibility stages was pivotal and helped ensure this was a smooth and stress-free transaction. I would like to thank Seb and Sam at Price Bailey for their help and support.”

Seb Humberston, Price Bailey said, “It was pleasing to be able to help Sheridan and Anna structure a simple deal that worked for both their needs and, working with the respective lawyers at Rogers & Norton and Ashtons Legal, meant that it was possible to conclude matters quickly and efficiently. I am sure Sheridan will continue Carvels successfully, and of course, we also wish Anna well in her new venture.”

We always recommend that you seek advice from a suitably qualified adviser before taking any action. The information in this article only serves as a guide and no responsibility for loss occasioned by any person acting or refraining from action as a result of this material can be accepted by the authors or the firm.

2020

15th December: Interview: Matt Howard discusses looking at the foundations of your business

Matt Howard, Insolvency and Recovery Partner at Price Bailey is interviewed on Future Radio and explains the insolvency process as well as considering practical steps business owners can take in order to turnaround a struggling business, including taking an honest look at the foundations of your business. For more information, you can contact Matt below.

Matt Howard – Partner Price Bailey

This interview was with Future Radio 107.8FM – A community radio station for Norwich

15th October: Record numbers of businesses voluntarily closing due to economic uncertainty and fears over Capital Gains Tax rises

• 3,126 businesses voluntarily liquidated in Q3 2020

• 52% increase in voluntary liquidations compared to Q3 2019

A record number of businesses are voluntarily closing down due to the economic uncertainty around coronavirus and fears over a possible increase in Capital Gains Tax, according to data obtained by Price Bailey, the Top 30 accountants.

According to data obtained by Price Bailey, 3,126 businesses voluntarily appointed liquidators in Q3 2020, a 52% increase on Q3 2019, when 2,058 businesses voluntarily appointed liquidators. The number of voluntary liquidations in Q3 2020 represents the highest Q3 total on record.

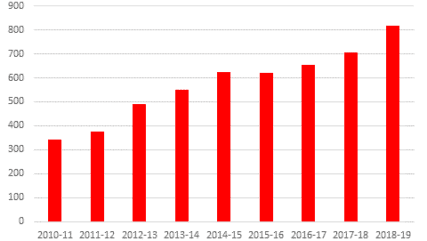

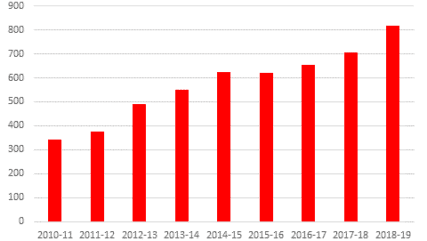

Members’ voluntary liquidations, Q3 2014 to Q3 2020

Price Bailey says that it has seen a surge in enquiries from business owners in the past quarter looking to close down their businesses in an orderly way and take cash out. In many cases, however, business owners are acting in haste and could take more cash via a trade sale or management buy-out.

Price Bailey points out that it has been widely speculated that Capital Gains Tax will be increased to a maximum rate of 40 percent as the Chancellor looks to shore up the public finances in the wake of the coronavirus pandemic. Many businesses owners are currently eligible for Business Asset Disposal Relief (Entrepreneurs’ Relief). This reduces the amount of Capital Gains Tax they are legally be required to pay when taking cash out of their businesses to 10 percent.

Matt Howard, Partner at Price Bailey, comments: “We are seeing a flood of enquiries from business owners seeking to voluntarily cease trading and cash out. Many business owners adopted a wait-and-see approach during the early stages of the pandemic but as the crisis has worn on and the economic outlook has worsened increasing numbers are taking matters into their own hands. They believe they are facing a stark choice between either shutting down now and taking some money or hanging on and potentially running up losses.”

“Many of these business owners are a decade or more before retirement age and their businesses are perfectly viable. Closing them down in many cases will result in job losses, which will have a knock-on effect on the wider economy. There is a large ecosystem of potential buyers with cash to spend, and many of these businesses will have built up intangible value, such as goodwill, which will be lost if they simply cease to trade.”

He adds: “Insolvencies in which the creditors pull the plug on businesses are at their lowest level in over a decade due to government support measures. It is therefore all the more ironic that so many business owners are voluntarily switching off the lights.”

According to Price Bailey, the mooted rise in Capital Gains Tax has spurred many business owners to accelerate plans to exit their businesses. For viable businesses, however, a members’ voluntary liquidation is often the worst option. Historically low interest rates mean that debt is cheap for potential buyers, so a trade sale or management buy-out, are alternatives worth exploring.

Matt Howard says: “There are plenty of available buyers that are able to access cheap debt to finance acquisitions. While High Street banks are showing some reluctance to lend, alternative lenders have an appetite to finance acquisitions. With the Autumn budget cancelled, we are unlikely to see an increase in Capital Gains Tax in the current tax year, which means that business owners have sufficient time to explore all the options alongside voluntary liquidation.”

– Ends –

28th August: HMRC yield from enquiries into taxpayers with offshore assets surges

HMRC yield from enquiries into taxpayers with offshore assets surges to £684,298 per enquiry.

The amount per enquiry nearly doubles since 2016/17. Higher fines and more sophisticated data analytics leading to behavioural change among taxpayers

The amount of tax collected per enquiry into wealthy taxpayers with income and/or assets offshore has almost doubled in the last three years to £684,298 per enquiry, according to Price Bailey, the Top 30 accountants.

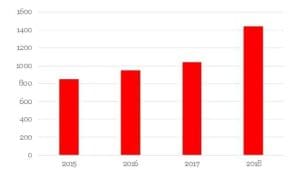

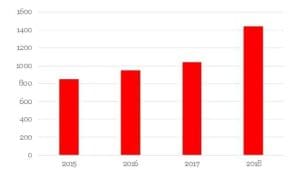

Price Bailey obtained data from HM Revenue & Customs (HMRC) under the Freedom of Information Act, which revealed that £414 million was identified from 605 investigations in 2019/20 (£684,298 per enquiry) compared to £325 million from 842 investigations (£385,786 per enquiry) in 2016/17. The data represents the work of the Offshore, Corporate & Wealthy unit, which sits within the Fraud Investigation Service at HMRC.

Price Bailey points out that the absolute number of enquiries and tax identified fell from a high of 827 and £560 million respectively in 2017/18. The reason for the falling number of enquiries and the amount of tax collected is likely a result of taxpayers modifying their behaviour due to much more punitive fines (up to 300% of the tax due for those with undeclared assets/income offshore), combined with HMRC’s use of big data, which is likely leading to behavioural change.

Jay Sanghrajka, Tax Partner at Price Bailey, comments: “While the number of enquiries has fallen to the lowest level in four years, the yield per enquiry has jumped by more than three quarters. HMRC is becoming much better at identifying and challenging the worst offenders by using Connect, a data matching and risking tool, that allows it to cross match one billion HMRC and third-party data items. This enables it to target the most non-compliant taxpayers with greater accuracy, which has pushed the yield per enquiry ever higher.”

“A new source of information for HMRC has been the Common Reporting Standard (CRS) launched in 2017 by the OECD which has increased transparency with over 100 countries participating in automatic exchange of information on taxpayers.”

“HMRC’s offshore unit is staffed by highly experienced lawyers and accountants and is sifting through huge amounts of data, including information on bank accounts from offshore financial centres such as the Channel Islands, Bermuda and the British Virgin Islands. HMRC is able to use its algorithms to analyse vast amounts of personal and commercial information and establish links between individual taxpayers and businesses, income, assets and transactions.”

“Those caught out by HMRC will pay considerably more in penalties on top of the tax due. This is because HMRC can charge an increased penalty where the income or asset that gives rise to the penalty is held outside of the UK. Penalties of up to 300% of the amount of the outstanding tax can be imposed where the taxpayer has moved assets to avoid having details reported to HMRC under international agreements.”

“The ramping up of penalties for offshore non-compliance and the introduction of a strict liability offence making it a criminal offence to fail to declare offshore income over £25,000, together with HMRC’s greater use of big data analytics, is likely to have encouraged behavioural change. Taxpayers who may have hidden assets and income arising offshore only a few years ago are now more likely to think twice.”

– Ends –

23rd July:Price Bailey support Comtec sale to French-based Euro Techno Com Group (ETC Group)

Cambridgeshire-based Comtec has been sold to French-based Euro Techno Com Group (ETC Group) in a deal supported by business and financial advisory specialist Price Bailey and law firm Keystone.

Founded in 1978, Comtec Group is one of the UK’s largest value-added distributors of telecom and IP equipment to both the carrier and enterprise markets, and a specialist in supply chain management for telecoms operators and systems vendors.

It serves most major telecom operators and installers in the UK and the Middle East, including BT, Virgin Media, Sky and Ooredoo. The company has experienced continuous growth since its inception and has scaled through targeted acquisitions and sustained international growth. Comtec has seven offices across the UK, Oman, Qatar, the UAE and Hong Kong.

Since completing a management buy-out, the business has continued to develop. Revenues have more than doubled over the past five years to over £70m.

ETC Group has operations across six countries in Europe and North America. It is regarded as a global leader in product design, procurement, supply chain management and the distribution of passive and active telecom equipment and materials with best-in-class technical and logistics solutions for communications service providers’ network deployment and maintenance. Its 2,000+ customers include major American and European cable operators and telecoms service providers, as well as large and small independent installers and sub-contractors.

The transaction provides ETC Group, which was acquired by Carlyle last year, a strong foothold in the fast-growing UK market, where all major telecom operators and alternative networks have started a long-term deployment phase of fibre across the country to support the ever-increasing demand for high-speed connectivity.

The acquisition also allows ETC Group to serve the growing IP infrastructure market for enterprise customers and further expand its offerings and expertise in data centre supply and maintenance.

John and his fellow Comtec managing directors, John Buck and Dan Conway, remain with the business.

John Archer, CEO of Comtec, said: “We are delighted to join ETC Group and to combine our offering, expertise and scale to further support our customers in accelerating their fibre and IP infrastructure deployments. The acceleration of fibre roll-out will create several business opportunities for which the enlarged group is uniquely positioned.”

The Price Bailey Corporate Finance team led the deal process through negotiations and transaction structuring. Phil Sharpe, Corporate Finance Partner at Price Bailey, who led the deal, said: “We are thrilled to have had the opportunity to advise on the sale of Comtec. The deal has delivered a great outcome for all parties involved, strengthens Comtec’s offering and supports the continued growth of Comtec’s business. This is the first of many deals I hope to complete following my move to the Price Bailey in April”.

Archer went on to say “I am delighted to have been supported on the by the Price Bailey team. I have known Phil for a long time, and he has a good understanding of our business, the key issues and how we like to work. Phil provided some fantastic advice on the deal and helped us achieved a result that the shareholders are very proud of.”

Rich Grimster, Head of Tax at Price Bailey, provided Tax advice on the transaction.

Keystone law provided legal advice to the sellers, with Rob Matthews leading the team at Keystone.

– Ends –

16th July: Deprived rural and inner London areas hardest hit by coronavirus jobs crisis

Some parts of the country have more than twice the proportion of furloughed employees than others

Data points to a very uneven economic recovery

Deprived rural and inner London boroughs have been the hardest hit by the coronavirus jobs crisis, according to an analysis by Price Bailey, the Top 30 firm of chartered accountants.

Price Bailey analysed data obtained from HM Revenue & Customs and National Statistics, which shows that the 10 hardest hit out of 370 local authorities in the UK as measured by the proportion of employees furloughed are either in rural areas heavily dependent on tourism or deprived London boroughs.

The three hardest hit local authorities are South Lakeland (Cumbria), Pendle (Lancashire) and Craven (North Yorkshire), which have 46.9%, 40.3% and 39.9% of their employees being paid via the Government’s Coronavirus Job Retention Scheme respectively. This compares to just over a quarter (26.4%) of all UK employees who are currently furloughed.

The next hardest hit are the London boroughs of Brent, Haringey, Hounslow and Newham, in which 39.5%, 37.7%, 37.3% and 36.5% of employees are furloughed respectively (see table 1 below for details).

According to Price Bailey, the analysis shows that employees in the parts of the economy that were shut down entirely, including non-essential retail, hospitality and tourism, are disproportionately concentrated in certain parts of the country, which suggests that there are likely to be significant regional disparities in the economic recovery.

Commenting on the analysis, Stuart Curtis, Partner at Price Bailey, said: “These data indicate that the recovery could be very geographically uneven. The proportion of employees furloughed is twice as high in some boroughs as in others, revealing a stark divide in how the economic crisis is affecting different parts of the country.”

“Rural areas in the North of England, which are heavily reliant on tourism, along with boroughs in London with a high proportion of service sector jobs, such as Hounslow, which is home to thousands of people working at Heathrow airport, have borne the brunt of the economic impact of the lockdown.”

“Nearly half of all employees in South Lakeland in the Lake Distract are on furlough compared to just one fifth in Cambridge. The divide in London is starker still given the close proximity of the boroughs. The proportion of employees furloughed in Harringay, Hounslow and Newham is nearly twice as high as in Camden, the City, Islington or Westminster.”

“Furloughed employees will be spending less in their neighbourhoods, which will have a knock-on effect on local businesses. We could see pockets of deprivation become more entrenched as the areas which have been hardest hit take considerably longer to recover lost output.”

Curtis went on to say “The proportion of the workforce which has been furloughed is a barometer of the health of local businesses. As the furlough scheme unwinds, businesses will need to consider the turnover levels they are likely to achieve and the impact on cashflow of bringing furloughed staff back onto payroll. While some sectors of the economy likely will rebound quickly, others will need to take a more cautious approach.”

Table 1. Local authorities with the lowest proportion of furloughed employees

| Local authority | Number of employees (16+) | Number of employees furloughed | % of job furloughed |

| Cambridge | 63,900 | 12,300 | 19.2% |

| Cherwell (Oxfordshire) | 71,600 | 13,800 | 19.3% |

| Islington (London) | 117,400 | 22,800 | 19.4% |

| Camden (London) | 106,400 | 20,700 | 19.5% |

| Cities of London and Westminster | 105,900 | 21,800 | 20.6% |

| Sheffield | 257,000 | 53,500 | 20.8% |

| Dartford (Kent) | 55,900 | 11,700 | 20.9% |

| Cardiff | 168,300 | 36,00 | 21.4% |

| Boston (Lincolnshire) | 29,700 | 6,400 | 21.5% |

| Richmond on Thames (London) | 85,800 | 18,500 | 21.6% |

| UK average | 33 million | 8.7 million | 26.4% |

Table 2. Local authorities with the highest proportion of furloughed employees

| Local authority | Number of employees (16+) | Number of employees furloughed | % of job furloughed |

| South Lakeland (Cumbria) | 35,200 | 16,500 | 46.9% |

| Pendle (Lancashire) | 30,000 | 12,100 | 40.3% |

| Craven (North Yorkshire) | 17,300 | 6,900 | 39.9% |

| Brent (London) | 126,400 | 49,900 | 39.5% |

| Haringey (London) | 111,800 | 42,100 | 37.7% |

| Hounslow (London) | 114,000 | 42,500 | 37.3% |

| Newham (London) | 145,600 | 53,200 | 36.5% |

| Scarborough (North Yorkshire) | 39,700 | 14,500 | 36.5% |

| Ealing (London) | 136,000 | 49,600 | 36.5% |

| North Norfolk | 31,300 | 11,200 | 35.8% |

| UK average | 33 million | 8.7 million | 26.4% |

Areas with higher proportions of public sector jobs and high-value private sector jobs least affected by jobs crisis

The research by Price Bailey reveals that cities and localities with a high proportion of public sector jobs, and private sector jobs which allow for remote working, have not been as badly affected by the economic impact of the lockdown as other parts of the country.

Cambridge has the lowest proportion of workers furloughed in the UK, with 12,300 out of 63,900 employees, representing 19.2% of the total.

Other cities such as Sheffield, which has 20.8% of employees (53,500 out of 257,000) furloughed and Cardiff, which has 21.4% of employees (36,000 out of 168,300) furloughed, have also benefited from a high proportion of workers being public sector employees. 27.7% of the workforce in Cardiff are employed in the public sector, compared to just 16.5% nationally.

Curtis offers an explanation this by saying “The world-renowned education sector in Cambridge is clearly a major factor in the significantly lower number of employees being furloughed. A large proportion of workers in the education sector are not eligible for the furlough scheme and have been retained on full pay instead. The Cambridge economy, including the education sector, is highly internationalised, which has shielded it from the direct impact of the lockdown on the UK economy.”

“Other cities with a high proportion of public sector workers, such as Cardiff and Sheffield, have also fared better than the national average.”

Price Bailey points out that the introduction of flexible furloughing will add complexities to the furlough claim process. The firm has processed over 500 claims to date, from basic claims to those with complex salary sacrifice and pension arrangements.

– Ends –

1st April: Price Bailey appoints Strategic Corporate Finance Partner from Grant Thornton in Cambridge

Price Bailey, one of the Top 30 chartered accountants and business advisers, is pleased to announce the appointment of Phil Sharpe as Strategic Corporate Finance Partner with effect from 1 April 2020, bringing the total number of Partners in the practice to 33 across 11 offices.

Phil has 22-years’ experience as a corporate financier and is well known to many in Price Bailey and across Cambridgeshire. He joins Price Bailey with a wealth of experience working previously at Grant Thornton and two big four accountancy firms, PwC and EY, in Cambridge.

Over the past 22 years Phil has advised a variety of clients, ranging from owner-managed businesses to FTSE 100 companies and public sector organisations. He has advised companies on strategy, disposals, acquisitions, debt and equity fund raising, restructuring and cash optimisation.

Phil will be primarily based out of Price Bailey’s Cambridge office. Head of Strategic Corporate Finance and Partner, Simon Blake said: “The appointment of Phil is an exciting and positive opportunity for Price Bailey and the Strategic Corporate Finance team and continues to demonstrate our ability to compete on many levels in the marketplace. He brings with him a wide range of transactional and advisory experience across a range of sectors.”

He joins an ever-expanding team as part of our drive to offer a greater breadth and depth of expertise to our clients.”

Phil Sharpe added: “I am delighted to be joining Price Bailey and welcome the opportunity of adding my experience and expertise to an already comprehensive corporate finance offering from the firm. Having spent most of my career in Cambridge, I have a strong network across the local business and advisory community and I’m looking forward to growing Price Bailey’s Strategic Corporate Finance and wider business. Whilst corporate finance will be my primary focus, I expect my work in other areas of advisory will be of particular relevance given the challenges businesses and shareholders will experience in the coming period.”

– Ends –

31st March: Price Bailey promotes three new Partners, five new Directors and four Senior Managers

Price Bailey, a Top 30 chartered accountants and business advisers, is appointing three new Partners, bringing the total number of Partners in the practice to 33 across ten offices.

Darren Amott, Andrew Booth and Stuart Curtis, pictured below, are long-term Price Bailey employees and collectively have been with the firm for 75 years. Both Darren and Andrew will become Partners in the firm’s audit practice, while Stuart will become a Partner in the Business practice.

Darren Amott – Corporate

Darren joined the firm in May 2000. He started in Bishop’s Stortford and played a key role in the small team which opened the City of London office in 2007. Darren is responsible for a large portfolio of the firm’s larger corporate clients. Last year he qualified as an audit RI. Darren will continue concentrating on delivering excellent service to existing clients as well as developing and winning new work and helping to support and grow the City of London office.

Andrew Booth – Corporate

Andrew joined the firm straight from school in 1984 and is generally based in the Cambridge office. Andrew primarily focuses on audit and has been part of the Corporate team since its inception. Andrew is a highly respected and key member of the Corporate department, working closely with many of the team across all offices. Andrew became Price Bailey’s first non-partner audit RI in 2010 and since then has been RI for many of the firm’s most challenging audits. Andrew will continue in his RI role and will continue to be the main relationship contact for many of the firm’s key clients, together with assisting the Partner team across Price Bailey.

Stuart Curtis – Business

Stuart joined Price Bailey as a manager in 2002 working in the Highams Park office. He has spent time in both the corporate team and, since 2012, the business team, looking after predominately owner-managed businesses and acting as a team leader, based in the City office, then Bishops Stortford and Cambridge. Stuart has a diverse set of skills, including being one of the firm’s qualified coaches and is an active participant in the PBInspires programme. Going forward Stuart will be working closely with William Wilson supporting the managers and team in Cambridge, Sawston and Ely in delivering the business team services to clients and growing the client base. From 1st April, payroll is moving out of the business team so, in addition to Stuart’s promotion, he will also be Head of Department for payroll.

Price Bailey is also appointing five new Directors, all of whom are employees of the firm. Gary Frear and Lewis Ratcliffe are being promoted to Directors in the Business practice, Heidi Berry will be a Director in the Legal Services team, and Tom Meeks and Stuart Morton will become Directors in the Corporate and Insolvency & Recovery teams respectively. Four employees are also being promoted to senior managers – Jacob McCloskey, Lee Sharman, Mark Roach and Padmeenee Hurdowa.

Martin Clapson, Managing Partner at Price Bailey, comments: “The appointment of three new Partners and five new Directors, all of whom are longstanding employees of the firm, is testament to our ethos as a firm which seeks to nurture and promote local talent. These are people who have deep networks within the local communities in which we operate, they understand the needs of local businesses and individuals, and have demonstrated great commitment to developing those relationships over many years. Their promotions are well-deserved, and I wish them continuing success with Price Bailey as we grow.”

– Ends –

19th March: HMRC issuing demands for tax it has no legal right to following software errors

- Follows HMRC computer error which rejected thousands of returns in 2018 and 2019

- Relates to 2016/17 and 2017/18 self-assessment returns

- Taxpayers should seek immediate advice

HM Revenue & Customs (HMRC) is issuing letters to taxpayers demanding payment of tax it has no legal right to, according to Price Bailey, the Top 30 accountants.

According to Price Bailey, tens of thousands of self-assessment returns were rejected for the 2016/17 (31 January 2018) and 2017/18 (31 January 2019) filing deadlines due to a problem with HMRC’s software, which meant that it could not always accurately calculate the amount of tax due if taxpayers had unusually complex tax affairs, or if reported income was significantly different from HMRC’s expectations.

Price Bailey says that HMRC can correct errors in tax returns and demand any unpaid tax but this must be done within nine months of the date on which the particular tax return was delivered to HMRC. In most cases, that nine-month window has now closed, meaning that HMRC has no legal basis for demanding tax that was underpaid through no fault of the taxpayer.

Price Bailey warns that many taxpayers receiving letters relating to their 2016/17 and/or 2017/18 tax returns are unlikely to be aware of HMRC’s legal position and may pay the tax anyway without seeking advice.

Jay Sanghrajka, Partner at Price Bailey, comments: “HMRC had until the end of October 2019 to make corrections to 2017/18 tax returns and demand payment. Most of those returns would have been filed on or before the 31 January deadline, which means that in many cases HMRC has missed its chance to correct those returns. Taxpayers who have already paid as a result of receiving a correction letter might be able to ask for their money back.”

“Many taxpayers who receive a letter from HMRC are likely to assume the revised calculation is correct and pay without first seeking a second opinion. In some cases, the amount of tax being demanded runs into tens of thousands of pounds, which likely will cause some taxpayers emotional distress and financial difficulty.”

He adds: “The statutory position is that these corrections do not appear to be formal enquiries or discovery assessments. The time limit for opening an enquiry into 2017/18 tax returns ran out on 31 January 2020. Enquiries into 2016/17 returns had to be opened by 31 January 2019 at the very latest.”

Price Bailey points out that when HMRC misses enquiry deadlines they often raise discovery assessments instead, where the time limit is four years, or six years in cases of carelessness.

Jay Sanghrajka says: “It is difficult to see how a tax inspector could “discover” an error, which was created by a flaw in HMRC’s software, and attribute that to a taxpayer. If a taxpayer refused to pay and HMRC opened discovery assessment in response, it is doubtful whether a tribunal judge would consider a discovery assessment valid in such circumstances.”

6th March: How our Strategic Corporate Finance team supported Foresight Group LLP in its investment into McIntyre Electrical Limited to facilitate a management buy-out

Price Bailey’s Strategic Corporate Finance (SCF) department, have supported Foresight Group LLP (Foresight) in its investment into McIntyre Electrical Limited (MEL) to facilitate a management buy-out (MBO).

MEL is a provider of safety-critical fire and electrical inspection, maintenance and monitoring services primarily undertaking work with housing associations. Foresight has invested £5 million into MEL through a combination of shareholder loan and equity investment.

This investment is the first from Foresight’s £100m East of England Fund which is focused on private equity investments into SMEs based primarily in the East of England, corner-stoned by the Cambridgeshire Pension Fund.