News Archive

Price Bailey’s news archives present a timeline of our Press Releases over recent years.

Demonstrating our growth and success as a company, our collection of articles exemplify why Price

Bailey is recognised as an award-winning accountancy and business advisory firm and how we have

shared our success with our clients.

Our archives also document our data led PR; produced in collaboration with our research and

insights colleagues to communicate proprietary industry and economic insights on topics relevant to

our audiences and national interest.

We have collated our internal promotions, career opportunities, company accolades, data led

insights, acquisitions and advisory success, as well as keeping our clients updated on our

partnerships within the local communities and the charities we have supported through our

fundraising efforts. Price Bailey pride ourselves on the service that we provide our clients and the

local communities through our people and advice.

Should you wish to find out more about PR at Price Bailey, discuss any topics within the news

archives or for PR enquiries, please contact our Media and PR representative Eleanor Lodge.

2024

14th November: Price Bailey welcomes Corporate Finance specialist

Price Bailey is pleased to announce the appointment of Chartered Accountant and Corporate Finance specialist Pat Walters, who joins the firm’s Cambridge team as Strategic Business Development Director.

With over 25 years of experience, Pat has worked with clients throughout East Anglia and the Home Counties. Pat brings specialist expertise in Corporate Advisory and Debt Finance and has been a trusted advisor to many businesses, as well as leading transactions including refinancings, management buyouts, acquisitions, and disposals in the mid-market category.

With over 25 years of experience, Pat has worked with clients throughout East Anglia and the Home Counties. Pat brings specialist expertise in Corporate Advisory and Debt Finance and has been a trusted advisor to many businesses, as well as leading transactions including refinancings, management buyouts, acquisitions, and disposals in the mid-market category.

Pat’s role will operate across Price Bailey’s service lines and locations, working closely with the Partnership team as the business continues its rapid growth, welcoming 94 new starters in 2024, including over 40 new trainees.

Pat’s arrival comes as Price Bailey receives several accolades through Best Companies and is named one of the Apprenticeships Top 100 Employers for the fourth consecutive year. The firm also recently received three prestigious awards at the Central and East of England Insider Awards, a recognition of the top acquisitions, buyouts, and funding deals of the past year, and the people that made them happen.

Pat Walters, Director at Price Bailey, comments:

“I’m delighted to join Price Bailey, and look forward to supporting our clients across all our service lines. Price Bailey is a strong and well-respected brand, and I am excited about helping the firm connect with more businesses in East Anglia and our new offices in Peterborough and Oxford.”

Paul Cullen, Partner and Finance Director at Price Bailey, comments:

“We are pleased to welcome Pat to Price Bailey. He is very well known in the marketplace and brings extensive experience from many years in business working across Price Bailey’s patch.

“He has advised businesses of all sizes from both an accounting and banking perspective and the knowledge and expertise he has built will be very valuable in Price Bailey. Pat’s enthusiasm and relationship-first approach to helping organisations grow will make him a valuable contributor to the firm. We are excited to see him support Price Bailey’s future growth.”

-Ends-

13th November: More than twice as many businesses in the North plan to increase borrowing to fund growth

- 24% of Northern businesses plan to increase borrowing compared to 11% of Southern counterparts.

- Survey of 750 Finance Directors.

More than twice (24 percent) of businesses in the North compared to the South (11 percent) intend to increase borrowing to fund growth, according to research by Price Bailey, the Top 30 firm of accountants.

Price Bailey surveyed 750 Finance Directors who work for businesses with a turnover of £10m-100m, asking them about projected sales volumes and the prices of the goods and services they provide. The full report can be found here.

According to Price Bailey, the survey suggests that while businesses in the South are in a better position to finance growth through cash reserves or attracting investors, their counterparts in the North are much more reliant on debt, which is still expensive by the standards of the last 15 years.

The results reveal that overall the two most popular methods of funding growth in the year ahead are via equity finance (52%) and cash reserves (49%), although significant regional disparities are evident.

The research also reveals an approximate 2:1 ratio of finance directors who anticipate a reduction in borrowing compared with those who anticipate an increase. In total, 28% of finance directors anticipate that their business will borrow less over the next 12 months, compared with 15% who believe it will borrow more.

What changes to your balance sheet, if any, do you expect to see over the next 12 months?

Chand Chudasama, Partner in the Strategic Corporate Finance Team at Price Bailey, comments:

“While UK businesses are generally bullish about their growth prospects over the next year, there is a marked regional divide in how that growth will be funded. Businesses in the South have, on average, carried forward stronger balance sheets and we know from our prior research also tend to hold better access to investors, which gives them more options for funding growth. For businesses in the North, generally, we can conclude there is a greater reliance on debt which may limit the potential for growth as rates remain relatively high and the costs of doing business are rising.”

“The significant increase in tax and borrowing announced in the Budget are forecast to fuel inflationary pressure next year, which will likely mean that interest rates stay higher for longer. For businesses in the North, which are more reliant on debt to fund growth, this Budget could pull the rug from under growth plans.”

He adds: “There is also a notable trend towards share buybacks – meaning money that could have funded growth is instead being used to return value to shareholders. This could indicate a lack of confidence in the UK’s business environment as shareholders look to extract value rather than reinvest.”

-Ends-

31st October: Thousands of holiday homeowners face difficult decisions amid tax changes

- Data by Price Bailey indicates that more than 130,000 UK residents are set to be affected by tax changes on Furnished Holiday Lets.

- This comes as private owners now won’t get full relief for mortgage interest if they are a Higher Rate or Additional Rate taxpayer.

- Findings highlight the number of people with difficult decisions to make.

According to research by one of the UK’s top 30 accountancy firms Price Bailey, more than 130,000 individuals who have income from furnished holiday lettings (FHLs) accommodation in the UK are set to be affected by the removal of tax benefits.

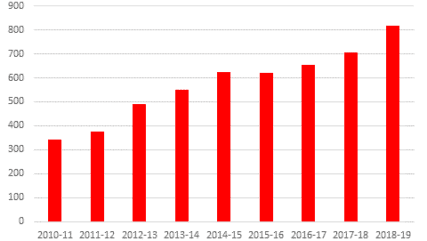

The data, obtained under a Freedom of Information request, highlights a 67% increase in SA105 Furnished Holiday Let (FHL) taxpayer returns between the 2013-14 and 2022-23 financial years, reaching 132,000. While growth rates dipped in 2020-21 in the first year of the pandemic, a spike the following year returned growth rates to a mean average of six per cent per year over the last ten financial years.

The removal of the FHL tax regime will take effect from April 2025 and will harmonise furnished holiday letting with other forms of residential property income. Current tax rules offer beneficial tax treatment for Furnished Holiday Lettings, with exemption from finance cost restriction rules, beneficial capital allowances rules, access to reliefs from taxes on chargeable gains for business assets and inclusion as relevant UK earnings when calculating maximum pension relief.

Andrew Park, a Partner in the Tax team at Price Bailey comments:

“It’s clear that the Government is trying to disincentivise people from using holiday letting to subsidise the ownership of second homes. Repealing the beneficial tax treatment for Furnished Holiday Lets, alongside increasing scrutiny from councils, with some regions charging second homes or holiday homes a premium Council Tax rate of up to 300%, could make running a Furnished Holiday Let and paying the mortgage unviable.

“For those who do continue to operate, their profitability will be squeezed. Everyone will feel the effect of this.”

Park continues: “Although there are other changes too for those with Furnished Holiday Lets – including companies, the most dramatic change is seen for private landlords who now won’t get full relief for mortgage interest if they are Higher Rate or Additional Rate taxpayers – and will end up paying tax on profits they haven’t really made, often with cash that will need to come from other sources.”

Park explains that incorporating their rental properties as a business could be a route for landlords who want to mitigate the effects of the tax changes.

“Companies will continue to get full mortgage interest relief against their profits. Incorporating would typically mean paying Corporation Tax of 19%, since annual profits are normally well below £50k, and then paying personal Income Tax if an owner wants to take cash out of the company.”

Park concludes: “The big thing is, I don’t think that many are going to want to do this through a company and so I do expect that we will see an uptick in owners looking to sell. Fortunately, yesterday’s Autumn Statement has left the special rate of capital gains tax on selling residential properties unchanged at 18% for basic rate taxpayers and 24% for higher rate taxpayers.”

-Ends-

29th October: Businesses more confident about growing sales than raising prices

- Suggests businesses may struggle to pass on Autumn Statement tax and minimum wage rises to customers.

- Survey of 750 Finance Directors.

Businesses are on average more optimistic about increasing their revenues from sales over the next year than putting up prices, according to research by Price Bailey, the Top 30 firm of accountants.

Price Bailey surveyed 750 Finance Directors who work for business with a turnover of £10m-100m, asking them about projected sales volumes and the prices of the goods and services they provide. The full report can be found here.

According to Price Bailey, the survey suggests that mooted tax and minimum wage increases in the forthcoming Autumn Statement are likely to erode profit margins as businesses struggle to pass higher costs on to customers.

The results revealed that in certain industries there are some clear disparities between finance directors’ growth expectations and how they expect their businesses to hit their revenue targets. This suggests that price elasticity continues to be significantly uneven by industry.

For example, in the case of architecture, engineering and building, 34% more finance directors expect to see an increase in revenue via sales growth compared with those forecasting increased prices for goods and services.

Chand Chudasama, Partner in the Strategic Corporate Finance Team at Price Bailey, comments:

“It is encouraging to see that UK businesses are generally optimistic about their prospects of revenue growth over the next year.”

“The research suggests that the plan for achieving growth is ‘work harder’. There is limited evidence that creating value through the product or service mix to capture higher pricing is part of the plan. Certain industries have a clearer strategy than others for hitting their revenue targets. In some industries, businesses do not appear to be sufficiently targeting output, and price rises as strategies for growing their top line.”

“It is likely that the Autumn Statement will increase the cost of doing business and those costs will eat into operating profits for many businesses. Businesses in sectors as hospitality and retail are already walking a balance sheet tightrope and will struggle to realise growth if that comes at the expense of already thin profit margins being further eroded.”

In the year ahead, will your prices or volume sold increase or decrease when thinking about driving your revenue changes? (By industry)

The regional perspective

In some regions of the UK, the research highlights a gap between those businesses that are anticipating a revenue uplift and those that are expecting to increase their volume and prices of goods and services over the next 12 months.

In the West Midlands, for example, 39% more finance directors expect to see an increase in revenue compared with those forecasting increased prices for goods and services. Similarly, 36% more finance directors in the region expect higher revenues compared with those who believe that their business will sell more output.

This gap is also evident in the East Midlands, Greater London, the North West, the West Midlands, and Wales.

In Scotland and the South East, the data highlights that businesses will focus significantly more on selling products and services over the next 12 months to hit their revenue goals, rather than on raising prices. Overall, 80% of Scottish finance directors and 55% of finance directors based in the South East expect their business to produce greater output. In contrast, 57% (Scotland) and 39% (South East) anticipate hiking up prices.

Chand Chudasama says:

“The research also highlighted some individual regions where finance directors are more likely to anticipate revenue growth than to predict that their business will sell more goods or services or increase its prices. These findings mirror other findings in the research – specifically that finance directors in the North are less optimistic than their southern peers about their business’s ability to increase the volumes and prices of its products and services.”

He adds: “While the Government cannot necessarily accommodate the needs of different industries and regions in the Budget, it should be sensitive to the fact that not all businesses are equally well positioned to take advantage of the UK’s economic recovery. Businesses’ ability to sell more products and services and increase their prices can vary significantly according to their industry and location.”

In the year ahead, will your prices or volume sold increase or decrease when thinking about driving your revenue changes? (By region)

-Ends-

24th October: Smaller businesses less optimistic about growth prospects as government looks to hike taxes and red tape in autumn statement

- Nearly twice as many businesses with more than 500 employees think sales volumes will rise than businesses with under 250 staff.

- Smaller businesses more likely to think minimum wage increases will have a negative impact.

Smaller businesses are less likely than their larger counterparts to anticipate growth in the volume of products and services they sell over the next 12 months. They are also less confident about passing on increases in costs to customers, according to research by Price Bailey, the Top 30 firm of accountants.

Price Bailey surveyed 750 Finance Directors who work for business with a turnover of £10m-100m, asking them about projected sales volumes and the prices of the goods and services they provide.

The results revealed that most UK finance directors (67%) expect their business to sell more services and products over the next 12 months, with 63% anticipating an increase in prices. Businesses with over 500 employees are the most optimistic. The overwhelming majority (96%) expect to increase sales volumes while 95% forecast higher prices.

Optimism begins to dip for businesses with 500 employees or fewer, and businesses in the smallest category (between 10 and 249 employees) are the least optimistic of all. Just over half (57%) of finance directors of businesses with between 10 and 249 employees expect an increased volume of services and products sold over the next 12 months, with 52% forecasting an increase in prices.

In the year ahead, do you expect the volume of products or services sold to increase or decrease? (Company size split)

According to Price Bailey, concerns about forthcoming legislation such as the Employment Rights Bill and the prospect of tax and minimum wage hikes in the forthcoming Autumn Statement are likely to be weighing heavily on small businesses.

Chand Chudasama, Partner in the Strategic Corporate Finance Team at Price Bailey, says:

“Small businesses are the backbone of the UK economy yet they are disproportionately affected by increases in the cost of doing business, whether that is tax or red tape. Concerns that tax rises in the Autumn Statement could fall heavily on small businesses are sapping confidence.”

“In light of the challenges they face, the Government should consider how it can provide targeted financial support to smaller businesses. The UK already has several successful schemes that help to channel investment into SMEs, including the VCT, EIS and SEIS schemes. It should consider how it can further promote these schemes to encourage interest from potential investors who may not have used them before. It should also explore whether further incentives are needed to unlock capital investment into smaller businesses.”

He adds: “As well as providing financial support, the Government should reflect on how it can create the right environment for all businesses to thrive. That involves minimising their administrative and regulatory burden and ensuring that they can access robust digital and physical infrastructure.”

Impact of National Minimum Wage changes

Another notable finding of the research is that the UK’s largest businesses are far more likely than their smaller peers to anticipate a positive impact from changes to the National Minimum Wage (NMW). In April 2024, the NMW increased to £11.44 per hour and further increases are expected as part of the Government’s New Deal for Working People.

Overall, 91% of finance directors for businesses with over 500 employees think that changes to the NMW will be beneficial, while just 5% see them as negative.

In contrast, just over half (53%) of finance directors for businesses with between 250 and 500 employees believe that changes to the NMW are a benefit. Nearly a quarter (23%) think they will have a negative impact.

The smallest businesses, with 10 to 249 employees, are most likely to view changes to the NMW as a disadvantage. For businesses of this size, 42% of finance directors maintain that changes to the NMW will have a negative impact while only 38% see them as a benefit. This is likely because they have proportionately more employees earning the NMW than larger businesses so changes will drive up their wages bill.

How much do you expect changes to the National Minimum Wage to affect your company finances, either positively or negatively? (Company size split)

-Ends-

24th October: Price Bailey welcomes Transaction Services Specialist to strengthen Strategic Corporate Finance team

Price Bailey is delighted to announce the appointment of Mohammed Imran, a Chartered Accountant, who joins the firm’s growing Strategic Corporate Finance team as a Director. His appointment follows the recent announcement of 110 promotions, reinforcing Price Bailey’s ongoing commitment to expansion and excellence.

Imran brings a wealth of experience to Price Bailey, having had a distinguished career in Corporate Finance, with extensive expertise in M&A advisory, Financial and Vendor Due Diligence, and capital markets support. His experience spans working with entrepreneurs, Private Equity (PE) especially buy and build platforms and publicly listed companies, making him a versatile and highly valuable addition to the PB team.

While Imran will operate as a generalist, he has a particular passion for advisory work within the Healthcare and Life Sciences sectors. He has played a pivotal role in guiding both corporate and PE buyers through complex strategic transactions in these industries. Imran’s background includes training in audit, before transitioning into Corporate Finance / Transaction services and most recently working in M&A at an investment bank.

In his role at Price Bailey, Imran will focus on further enhancing the firm’s Financial Due Diligence and Transactional Services offerings. With his sector expertise and leadership, the firm is now poised to expand capabilities in these areas.

This appointment marks yet another milestone in Price Bailey’s continued success. Alongside Imran’s arrival, the firm has recently been named one of the Apprenticeships Top 100 Employers for the fourth consecutive year, and has retained an “Outstanding Company to Work For” status by Best Companies for a second year running.

Mohammed Imran, Director at Price Bailey, shares his thoughts on joining the firm:

“I’m thrilled to be joining Price Bailey and look forward to collaborating with my colleagues to grow and elevate our transactional services and due diligence offerings. I’m particularly excited about strengthening our connections within the Healthcare and Life Sciences sectors and working with entrepreneurs, acquirers, funds, and banks as they navigate future transactions.”

To contact Mohammed Imran, click here.

15th October: Businesses in the North facing greater challenges than peers in the South

- Twice as many businesses in the North expect sales volumes to fall over the next 12 months.

- Businesses in the North less confident about putting their prices up.

Businesses in the North of England are more likely to face challenging financial headwinds over the next 12 months compared with their peers in the South. These headwinds include a potential fall in demand for their goods and services and barriers to raising their prices, according to research by Price Bailey, the Top 30 firm of accountants.

Price Bailey surveyed 750 Finance Directors who work for business with a turnover of £10m-100m, asking them about projected sales volumes and the prices of the goods and services they provide. The full report can be found here.

The results revealed that more than twice as many businesses in the North of England (25%) expect their company’s volume of products and services sold to decrease over the year ahead compared to their peers in the South (12%).

Businesses in the North are also significantly less confident about increasing their prices than their counterparts in the South. 20 percent of businesses in the North expect to increase their prices significantly over the next 12 months compared to over a third (37%) of businesses in the South. This is despite UK inflation having fallen to 2.2% in August 2024, down from 6.7% a year earlier.

The new Government recently expanded the remit of the Low Pay Commission, which sets the NMW/NLW, to include taking account of the cost of living, rather than the emphasis being solely on labour market conditions. The NLW is expected to surge from £11.44 to £12.10 per hour by April 2025, a much greater increase than forecast in March.

Chand Chudasama, Partner in the Strategic Corporate Finance Team at Price Bailey, says:

“As UK businesses continue to navigate difficult trading conditions and an evolving policy environment, the evidence suggests that their resilience levels are likely to vary according to where they are based.”

“In the upcoming Budget the Government should be conscious of regional and sector-based differences. These differences create fundamentally different economic outcomes to the lives of many people and the unintended consequences of broad changes to matters such as minimum and living wage and taxes can create systemic and irrevocable issues to both sectors and communities.”

He adds: “It is likely that businesses will seek to pass on wage rises to customers, which could feed through to inflation. Businesses in the pub and restaurant sectors have little room to absorb higher wage costs while borrowing costs stay relatively high. Many will be hoping for a rate cut but that could be delayed if statutory wage rises lead to stickier inflation.”

-Ends-

13th September: The effect of a pension increase on personal income tax and public finances

Andrew Park, Partner and Tax Investigation Specialist from Price Bailey, shares insight on the effect of a pension increase on personal income tax and the impact the move could have on public finances.

In June, the Labour Party announced plans to review the pensions landscape. In Labour’s Manifesto, the party detailed ambitions to improve pension outcomes, a commitment to retain the triple lock for the state pension and the promise of reforms to workplace pensions, to deliver better outcomes for UK savers and pensioners.

In their commitment to the triple lock, figures from the treasury now suggest that the Government is expected to raise the state pension by £460 from April. This comes amid the controversial move to end winter fuel payments for all but the poorest pensioners, with millions of elderly people now set to lose their access.

Andrew Park, Partner and Tax Investigation Specialist from Price comments:

“The triple lock guarantees that the state pension is getting bigger and bigger in real terms every year, but this comes alongside frozen tax thresholds. The suspected raise to the state pension will bring the full pension perilously close to the £12,570 threshold at which people start paying Income Tax on any earnings above that. It will also pull countless more pensioners with a state pension and just a small level of personal pension or savings income into paying Income Tax. Pensioners must prepare for that.”

Park continues: “It could be suggested that a fairer and more transparent approach, would be to revert to linking the state pension just to inflation and unfreezing personal allowances, increasing them in line with inflation too. However, the new government looks determined to keep thresholds frozen until 2028 and with the triple lock increasing fiscal pressure on government finances – I expect the rise will make the Government more rather than less disinclined to raise the tax threshold.”

-Ends-

12th September: Tax Investigation Specialist shares insight on the effect of a state pension increase

In June, the Labour Party announced plans to review the pensions landscape. In Labour’s Manifesto, they detailed ambitions to improve pension outcomes, a commitment to retain the triple lock for the state pension and the promise of reforms to workplace pensions, to deliver better outcomes for UK savers and pensioners.

In their commitment to the triple lock, figures from the treasury now suggest that the Government is expected to raise the state pension by £460 from April. This comes amid the controversial move to end winter fuel payments for all but the poorest pensioners, with millions of elderly people now set to lose their access.

Andrew Park, Partner and Tax Investigation Specialist from Price comments: “The triple lock guarantees that the state pension is getting bigger and bigger in real terms every year, but this comes alongside frozen tax thresholds. The suspected raise to the state pension will bring the full pension perilously close to the £12,570 threshold at which people start paying Income Tax on any earnings above that. It will also pull countless more pensioners with a state pension and just a small level of personal pension or savings income into paying Income Tax. Pensioners must prepare for that.”

Park continues: “It could be suggested that a fairer and more transparent approach, would be to revert to linking the state pension just to inflation and unfreezing personal allowances, increasing them in line with inflation too. However, the new government looks determined to keep thresholds frozen until 2028 and with the triple lock increasing fiscal pressure on government finances – I expect the rise will make the Government more rather than less disinclined to raise the tax threshold.”

-Ends-

4th September: Price Bailey welcomes over 40 new trainees in 2024

The firm’s summer 2024 trainee intake brings 14 graduates, 15 school leavers and three 12-month industry placements.

Price Bailey welcomes its summer intake of trainees, with 29 team members joining on an initial two-week induction period at Price Bailey’s Cambridge office, before they move on to their respective offices and departments. The induction period offers all trainees an opportunity to learn about Price Bailey and integrate with existing staff, through events such as a pizza night!

This comes following the addition 11 graduates, hired through Price Bailey’s inaugural winter trainee intake, back in February 2024, as well as three 12-month placement students earlier this summer.

Price Bailey trainees attending an induction session

The firm is now recruiting for its February 2025 intake and expects to welcome another 15-20 hires from the local area.

Applications for the summer 2025 intake will open late-October.

To be considered for a place, school leavers must hold a minimum of 112 UCAS points, with graduates requiring a minimum of a 2:2 in any undergraduate degree subject.

Duncan Crooks, a Senior Manager who leads the firm’s Resourcing function and specialises in trainee recruitment said:

We continue to invest heavily in our Early Careers programme here at Price Bailey and this year we have welcomed over 40 trainees, joining our various trainee programmes.

This year we took on a winter intake for the first time, along with the traditional summer intake, and the obvious success of this has now made it a permanent fixture in our calendar.

Duncan continues:

We recognise that career development, structured training and a great life/work balance is important to future talent. As such, we’re delighted to offer all of our trainees a comprehensive programme that includes full study support for their accountancy qualifications; flexible working through our Smart Working policy; ongoing soft skills training and a structured progression pathway.

Our trainees are the future of the firm, so we’re committed to unlocking the potential of each and every one of them. One of the highlights of my role is seeing them flourish in our supportive and inclusive environment.

Price Bailey was ranked in the Apprenticeships Top 100 Employers list for 2024. This is the fourth year the firm was placed in the Top 100 Apprenticeship Employers, marking an excellent achievement and a testament to the training and development offered.

9th August: Tax incentive cuts could stifle business investment, warns Price Bailey MD

Martin Clapson urges government action to support entrepreneurial SMEs, warning that the withdrawal of tax incentives could deepen business reluctance to invest.

The reluctance of business owners to invest in significant capital projects has become increasingly entrenched, posing a risk to economic recovery if tax incentives are withdrawn in the forthcoming Autumn statement.

Martin Clapson is the Managing Director at Price Bailey and Chairman of the Association of Practising Accountants.

At Price Bailey, we are committed to helping our clients navigate these uncertain times, providing the right advice to ensure they are well-prepared for any changes that lie ahead. As part of the APA survey, Price Bailey shared the survey with its own clients to allow them to feed into research.

If you have any questions or concerns about the survey or how these developments might affect your business, please do not hesitate to contact us or chat to us using the live chat.

30th July: Price Bailey Listed in the Apprenticeships Top 100 Employers List for Fourth Year Running

Price Bailey Listed in the Apprenticeships Top 100 Employers List for Fourth Year Running

Following the publication of the Best Companies results for 2024 and being recognised as a 2-star Outstanding Firm to Work For, Price Bailey has announced that the firm has ranked 45th in the recent Apprenticeships Top 100 Employers list for 2024. This is the fourth year Price Bailey has placed in the Top 100 Apprenticeship Employers, marking an excellent achievement and a testament to the training and development offered by the firm.

The Apprenticeships Top 100 Employers list celebrates England’s outstanding apprenticeship programmes, recognising an employer’s commitment to creating new apprenticeships, the diversity of their apprentices, and the number of apprentices who successfully achieve their apprenticeships. Price Bailey continues to recruit a large number of apprentices, with trainees from both schools and universities across the country, including 45 new apprentices joining the firm throughout 2024.

This recognition indicates that Price Bailey has outstanding levels of engagement and provides excellent opportunities for trainees and apprentices. We are proud of the achievements that both the Firm and our apprentices continue to make.

The apprenticeship training is complemented by internal training via the Stepahead programme. All new trainees undertake training from day one to help them make the best start, build relationships with their colleagues and clients, and eventually support the development of new trainees joining.

Commenting on the listing, Martin Clapson, Managing Director, said:

“I am very pleased to see Price Bailey recognised in the Top 100 Apprenticeship Employers list once again. This achievement underscores our commitment to fostering talent and providing exceptional opportunities for apprentices. At Price Bailey, we believe in investing in the future of our workforce and maintaining an environment where trainees can thrive and contribute meaningfully to their career progression and our success.”

25th July: Early-stage businesses that seek crowdfunding are experiencing lower growth rates, compared to Private Equity or Venture Capital backed businesses, according to new research

Accounting and advisory firm Price Bailey has released a report revealing that early-stage businesses who received funding from the crowd, experienced lower growth than those who sought Private Equity and Venture Capital investment.

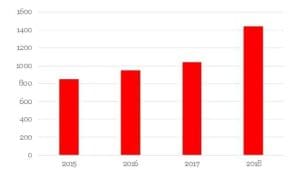

Using the research database Beauhurst, the firm retrieved data on 1,075 Crowdfunded businesses and 3,472 Private Equity and Venture Capital (PE/VC) funded businesses, that had experienced a funding round that raised at least £500k, between FY Q1 2016 and FY Q3 2023.

The data reveals that “seed stage” businesses, who went to the crowd for funding, raised on average, £1.1m with an average turnover of £141k at the point of investment. In contrast, seed-stage businesses who sought investment from PE/VC investors, raised on average, £2.9m with an average turnover of £1.3m for said round.

The data goes on to show that at the “venture stage”, crowdfunded ventures had an average cheque size of £1.4m with an average turnover of £2.8m at the point of investment. Comparatively, those who went to PE/VC investors raised, on average, £4.4m in their first round with an average turnover of £3.2m at the point of investment.

Total amount raised and average cheque size for respective significant rounds

Commenting on the report, Chand Chudasama, Partner and Strategic Corporate Finance expert at Price Bailey says:

“From our research, we can see that regardless of where these businesses are sourcing their investment from, it has been a challenging time. This is no surprise, given the prevailing economic uncertainty over the last few years, but there has been a sharp and distinct decline in investment deals from the heights of 2021.

“It’s also clear that at both stages of evolution (Seed and Venture), those businesses that went to the crowd are seemingly at the smaller end of the stages, while those who went to PE/VC investors are at the larger end.“There also appears to be a split in investment source for consumer and B2B businesses, with the majority of consumer businesses seeking the crowd for investment, while B2B organisations seek PE/VC investment the majority of the time.”

“I hope the findings from our report will be useful for early-stage business owners, looking for information on the best route for fundraising, as they grow their organisation.”

-Ends-

10th June: Planning to sell your healthcare business? Get ahead of the election.

With the general election announced for July, Price Bailey is urging healthcare businesses to sell up now to avoid potential post-election tax hikes.

“When a new or existing party leader gets into government, tax rates on selling businesses tend to increase. Businesses in all sectors should look to get their sale in before this happens.”

says Holly Gibson, partner at Price Bailey,.

Between 2022 and 2023, the value of UK healthcare transactions rose from £8.6 billion to £15.4 billion, growing more than any other industry, according to recent reports. The prevalence of business sales may stem from rising operational costs, workforce shortages and increasing regulatory pressures, but is further fueled by private equity firms actively seeking opportunities to invest in the healthcare market, attracted by its resilience and potential for growth.

Several high-profile acquisitions from private equity firms have been making headlines in recent months as healthcare business owners look at leveraging the appeal of private equity to optimise the value of their business.

Price Bailey advises selling your healthcare company via a management buyout (MBO), rather than selling overseas, to transfer generational wealth and retain knowledge and expertise within the UK. Gibson notes that there are over 17,000 companies in the UK who could sell to their management teams through an MBO, rather than selling to trade buyers. “Then the economic benefits stay in the UK,” she notes, “with no leakage to international investors or tax authorities in other countries.”

She goes on to explain that, “since the beginning of 2023 there have been 330 healthcare sector MBOs. 22% of these were focused on care services and a further 16% focused on clinical and outpatient services. We’ve found that the average deal value of these MBOs was 6.45x Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA).”

Dentists, opticians and pharmacists will need to start preparing for sale as soon as possible, including ensuring an investigative analysis of the financial performance of the company is carried out to determine its prospects for a sale.

Expanding on this, Price Bailey recommends those looking to sell their healthcare business consider the following steps with the support of their accountants:

- 1. Plan ahead: Establish an exit plan at the earliest opportunity, considering any regulatory requirements and patient care continuity.

- 2. Get ‘sale ready’: Maximise value by conducting an in-depth analysis and action plan to optimise performance, reduce debt, secure revenue, enhance your brand and attract potential investors.

- 3. Identify buyers: Research using industry-specific corporate intelligence databases and professional networks to find suitable buyers familiar with healthcare operations.

- 4. Market effectively: Send targeted teasers to healthcare investors and manage any NDAs required to protect practice information.

- 5. Negotiate: Review offers, select bidders, and negotiate terms while ensuring potential buyers have adequate funding in place, the correct medical licensing needed and access to carry out due diligence.

- 6. Sale completion: Handle due diligence, legal paperwork, and finalisation with attention to healthcare-specific legal and compliance issues and the transition process for the practice and patients.

The management buyout team will typically consist of three people and is built on a foundation of trust between each other and by the sellers and funders, with the current business owners also required to be reasonable on value expectations.

ENDS

13th May: Price Bailey recognises Mental Health Awareness Week 2024

As a firm with a “people first” approach, Price Bailey is committed to its workforce. In 2023, the organisation was recognised as one of the best places to work in the UK by Best Companies, alongside being in the top 20 best employers in the Apprenticeships Top 100 Employers list.

The firm is committed to raising awareness and understanding of the importance of mental health, with 23 of its staff now trained ambassadors, equipped with the tools needed to support anyone who might be struggling.

Kelly Flack, HR Manager at Price Bailey comments: “All of our ambassadors are trained via Mental Health First Aider England and undertake the Mental Health First Aiders Training. They have also all been invited to attend additional Suicide Prevention training via Samaritans this year.

“Our ambassadors have different experiences and backgrounds which lend themselves to the role. These individuals support anyone who may need help with their wellbeing including mental health, and are trained to also recognise the symptoms and behaviours of wellbeing concerns.”

Kelly continues: “Our ambassadors then meet to discuss current topics and key issues and subsequently this helps Price Bailey to provide the right support, the right resources, at the right time.”

In addition to this, the firm offers several other mental health and wellbeing resources, including:

- two employee assistance programmes, which offer a confidential service with 24/7 access and counselling services, which is also available to family members,

- a stress and mental wellbeing at work policy, which sets out the measures in place to support wellbeing,

- a wellbeing toolkit which offers tips for effectively managing wellbeing,

- private medical care for assistant manager and above,

- time off for medical appointments,

- access to occupational health services which can provide support and assessments including helping individuals return to work after ill health

- reasonable adjustments and specialist equipment

- ICAEW members can also access support via CABA which provides well-being and mental health support and can also help family members in certain circumstances

Mental Health Awareness Week 2024 takes place from the 13th to 19th May, and this year’s theme is “Movement: Moving more for our mental health”.

According to the Mental Health Foundation:

“One of the most important things you can do to help protect your mental health is regular movement. Moving more can increase your energy, reduce stress and anxiety, and boost your self-esteem”.

Find out more about the Mental Health Ambassadors at Price Bailey here.

-Ends-

11th April: Price Bailey announces 6 new Partners will join the Partnership team in the year ahead

Accounting and advisory firm Price Bailey announces plans for six new Partners in the year ahead, including four promotions and two new external appointments, Holly Gibson and Sean McCann.

Pictured above from left to right: Martin Clapson, Howard Sears, Holly Gibson, Sean McCann and Paul Cullen

The new appointments will bolster the expertise of Price Bailey’s partnership team, directing a provision for the Healthcare sector. Holly Gibson joins the firm’s Business Team, while Sean McCann joins the Corporate team, based in Cambridge.

Lee Sharman, Mark Roach, Richard Newman and Suzanne Goldsmith will also be joining the Partnership this year, taking the number of Partners to 45.

Lee Sharman joined Price Bailey in 2006 and heads up its Outsourcing services. Mark Roach, who joined in 2012, and Richard Newman, in 1999, are both members of Price Bailey’s Corporate team. Suzanne Goldsmith, who joined the firm in 2014, is also a member of Price Bailey’s Corporate team, specialising in the Charities and Higher Education sectors.

Martin Clapson, Managing Director at Price Bailey comments:

I am pleased to welcome six new partners to our expanding partnership team this year at Price Bailey. These new appointments highlight our dedication to strong leadership within the firm and ensure we have the right structure to both drive growth and support our clients. I am proud of their accomplishments so far and confident their future achievements will significantly contribute to our firm’s continued success. I am particularly pleased that four of the six new appointments will be internal promotions to Partner.

– Ends –

11th March: Commonwealth Day 2024

Today, countries across the world are observing Commonwealth Day. An annual celebration by people in Africa, Asia, the Caribbean and Americas, as well as the Pacific and Europe.

The Commonwealth provides an abundance of economic opportunities. From access to a population of 2.5 billion, of which 60 per cent are under 30 years old and representing a billion middle-class consumers. The Commonwealth Advantage offers an average 21% lower bilateral costs for trading partners throughout the 56-strong association of countries.

Today marks the beginning of a week-long series of events including faith and civic gatherings, debates, school assemblies, flag-raising ceremonies and cultural events.

The theme for this year’s celebration is ‘One Resilient Common Future: Transforming our Common Wealth’.

As Price Bailey completes its second year as a member of the CWEIC, Simon Blake, Partner at Price Bailey comments:

As a strategic partner of the Commonwealth Enterprise and Investment Council, after another successful year, we’re looking forward to the year ahead.

We are excited to continue building on our international relationships through the opportunities the CWEIC presents, especially with our Indian and African partnerships.

Simon continues:

I’m making plans to visit Africa and we’re looking at ways we can better work with the Indian Investor market, this is especially timely, as we now have members of the partner team at Price Bailey spending longer periods in India.

The CWEIC is a great way to support these international growth ambitions, and we continue to see the benefit of this Commonwealth collaboration, for our firm and our clients.

Last year, as well as attending the third Commonwealth Trade and Investment Summit (CTIS), alongside Managing Director of Price Bailey, Martin Clapson, Simon attended the launch of the CWEIC Singapore Hub, whilst attending a series of meetings in Singapore with other CWEIC Strategic Partners and IAPA members.

Hosted by the British High Commission, the hub supports CWEIC Strategic Partners in the Singapore and ASEAN region.

Speaking back in April at the launch of the Singapore Hub, Simon said:

It was great to visit Singapore and build on our relationships within the CWEIC, supporting our clients orientated towards growth in international markets, as well as global clients looking for support with their UK business.

Simon continued:

As an organisation, Price Bailey invests heavily in its international relationships, with partners attending meetings and conferences pro-actively across the world and supporting our global clients from overseas offices such as our Dubai office.

Price Bailey has recently been appointed to act for a multijurisdictional African-based client who is looking to expand globally through a London-based holding company and ultimately, planning to list on the UK stock exchange.

This opportunity was won directly through our involvement with the CWEIC and reflects the real business value of involvement with the association, cultivating improved international relations and offering an opportunity to connect with businesses from across the Commonwealth.

To find out more about the opening of the CWEIC’s Singapore Hub, visit here.

– Ends –

8th March: Spring Budget changes look set to benefit those on middle to lower incomes

National Insurance cut of 2%, changes to the income threshold for Child Benefit and an increase in the VAT threshold. This week saw Jeremy Hunt deliver his 2024 Spring Budget, several partners at Price Bailey, shared their initial reactions to the news.

Gemma Thake, Tax Partner at Price Bailey comments:

In the Chancellor’s announcement, he quoted the lowest effective personal tax rate since 1975. With the rates of income tax and national insurance taken into consideration, this is a very favourable tax position for the median full-time worker in the UK at the moment.

It is also noteworthy that the Chancellor confirmed the cut in National Insurance will apply to self-employed individuals as well as employees. However, those who are not employed or self-employed, such as pensioners, will lose out as a result of the changes and many will be worse off from next month

Gemma continues:

Although not an immediate fix, the increase in Child Benefit thresholds should extend the benefit to more families and support working parents in addition to free childcare hours which are being increased and phased in from April 2024. Parents will however have to wait until 2026 for further reforms to the regime.

Whilst there will be some benefit to those in affluent positions, the highest earners are ultimately set to pay more tax as a result of the government’s freeze to income tax bands which have not been increased since March 2021 to keep pace with wage rises and inflation.

It seems this Budget’s changes are really designed to be more family-friendly and impact those people on middle to lower incomes

Plans to increase the VAT threshold were also announced. Greg Mayne, Tax Partner and VAT specialist comments:

The 2022 Autumn Statement effectively negated any rise in the VAT registration threshold (from £85,000) until 2026, but this week’s announcement of a £5,000 increase from 1 April could be argued to be something and nothing.

The ‘cliff edge’ of registration remains, and businesses will still be caught out by tripping over that threshold which provides only another £416.66 per month of ‘buffer’ before having to register.

At £90,000 the limit remains substantially higher than EU Member States, and only marginally above that of Switzerland. Pre-Budget gossip of a possible increase to £100,000 came to nothing so the impact on business of this small rise could be argued to be negligible.

The announcements also highlighted how wealthy UK-domiciled residents could save millions in tax under new non-dom tax regime. Nikita Cooper, Tax Director comments:

Wealthy UK-domiciled residents could make significant tax savings under the new regime. It’s possible that some UK-domiciled residents will leave and return to take advantage of the new four-year grace period, potentially saving millions in tax.

Domicile is a principle which determines which legal regime applies across a multitude of taxes. Inheritance tax is just one area where there is likely to be considerable uncertainty until the new rules are finalised.

There are some fairly optimistic assumptions about how much tax the new regime will raise but the devil will be in the detail. Many non-doms will be more concerned about wealth than income. If the new inheritance tax regime is equivalent to that which applies to UK-domiciled taxpayers, many UK resident non-doms might opt to leave or move wealth offshore.

– Ends –

2023

21st December: Local accounting firm secures prestigious Cambridge workplace training award

Accounting firm Price Bailey is awarded regional “workforce developer” by Cambridge Chambers of Commerce at the 2023 Chamber Business Awards.

A showpiece business event, The Chamber Business Awards recognise and promote the best of British business and create international networking and showcasing opportunities for the winners.

The award comes following a record year for Price Bailey, with 39 school leavers, graduates and 12-month industry placement trainees joining the firm in 2023, to begin a career in accounting.

The firm was also placed 20th in the Apprenticeships Top 100 Employers and awarded as having outstanding levels of workplace engagement, receiving 2-star accreditation in an independent survey conducted by Best Companies; an accreditation that reflects a wide range of workplace factors such as Personal Growth, Wellbeing and Leadership.

The firm is celebrating its second successful year of partnering with training academy 3Qhub, to deliver a range of “step-ahead” programmes, offering progression, management and senior leadership training.

Kelly Flack, Assistant Manager in HR at Price Bailey comments:

At Price Bailey, we recognise the importance of career development in all roles and at all stages.

Trainees make up approximately 25% of our workforce and we provide those trainees with all-round accountancy experience. We also offer a range of formal internal and CPD training for non-accountancy roles such as those in HR, IT or Marketing.

Our commitment to ongoing development helps us engage and retain individuals who can then provide their expertise in mentoring our new trainees, as well as offer an exceptional standard of service to our clients.

We are delighted to be awarded Workforce Developer by Cambridge Chambers of Commerce and have our commitment to training and development recognised.

Michael Siviter, Managing Director & Co-founder at 3QHUB comments:

We are always looking to partner with professional service firms that place value on investing in the learning and development of their teams. Price Bailey are passionate about seeing their people develop, helping team members to reach their potential.

Their ‘’step-ahead’’ programmes provide team members with practical and structured training, helping them become more confident and enabling them to provide market leading service to their clients.

This award is well deserved and is testament to the hard work and dedication that the team has.

-Ends-

19th December: Accounting firm Price Bailey comes out on top for the charities sector

Price Bailey is listed in the Top 3 for Overall Service and Charity Expertise in The Charity Finance audit survey 2023.

The audit survey included responses from almost 650 charities, who rated several firms on their charity expertise, corporate social responsibility, technical compliance and overall service, among other criteria.

The listing comes towards the end of a successful year for the firm, following an “outstanding” recognition by Best Companies in June 2023, where the firm received a 2-star accreditation for its exceptional commitment to employee engagement.

Price Bailey was also acknowledged as one of the top 50 Best Companies to Work For in the East of England and London and one of the top 75 Best Large Companies to Work For in the UK.

In the same year, the firm finished 20th in the Apprenticeships Top 100 Employers league table, and received the Workforce Developer award at the 2023 Cambridgeshire Chamber of Commerce Business Awards, recognising the “best of British business”.

2023 also marked the highest intake of trainee recruits for Price Bailey, with 39 new trainees joining the firm and brought the return of the firm’s annual in-person charity day following the pandemic.

The charity event, which was held in October, involved all four of the UK offices, with charitable activates including car washes, treasure hunts and a firm wide quiz, taking place across London, Norwich, Sawston and Bishop Stortford.

Commenting on the listing, Helena Wilkinson, Partner at Price Bailey said:

It’s great to see Price Bailey listed in the top 3 for Overall Service and Charity Expertise in The Charity Finance audit survey 2023. We are very grateful to our clients for their votes in this survey.

As a firm we’re committed to both our charitable activities and offering our clients the highest value service – it’s wonderful to see our hard work pay, and have these commitments recognised.

-Ends-

28th November: HMRC to tackle debt mountain as Chancellor announces capacity boost for debt management team

Research reveals HMRC’s debt balance at the end of March 2023 at £45.9 billion. This figure is £4.3 billion higher than the balance at the end of March 2022.

In last week’s Autumn Statement, the Chancellor announced a ‘capacity boost’, directing millions into HMRC’s debt management team.

This comes following concerns over a rising “debt mountain”, with the debt balance at the end of March 2023 at £45.9 billion. This figure is £4.3 billion higher than the balance at the end of March 2022 and includes £43.9 billion of tax debt (which equates to 5.4% of revenues) and £2.1 billion of tax credits debt.

At the end of 2022 to 2023, HMRC was managing £5.7 billion of debt through time-to-pay arrangements, in which customers pay off their debt in affordable and sustainable instalments.

Andrew Park, a Partner in Tax at Price Bailey, comments:

In a welcome move given the scale of uncollected debts facing HMRC, it’s positive to see the £163m ‘capacity boost’ directed towards HMRC’s debt management team.

Increased funding means increased focus and greater productivity; reducing the size of this enormous debt mountain with have a big impact on the UK’s fiscal health.

In the policy description, HMRC detailed that “additional funding will also enable the acquisition of new data to allow HMRC to provide a more tailored approach to debt collection for companies”.

This comes as HMRC undergoes a multi-year transformation project using digital data and technology to better tackle the problem of unmatched payments – payments sent to the department with neither the correct reference number nor customer name.

Andrew Park, Partner in Tax at Price Bailey

Park concludes:

Of course, for business owners, the importance of staying on top of financial management and cashflow is always vital but especially so when an obvious increased focus on tax debt collection is on the horizon.

-Ends-

24th November: Chancellor’s Autumn Statement highlights a positive commitment to UK-based Enterprise, Research and Development

The Chancellor announced a critical extension of VCT and EIS sunset clauses. The extension provides vital funding, without which research indicates enterprise would suffer. Changes to R&D schemes were announced, including a merger of prior SME and RDEC schemes

In September, accountancy firm Price Bailey highlighted concerning data indicating that without an extension of the sunset clause for the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCT), UK-based innovation would fall behind.

The firm’s research found that since its inception, EIS funding has flowed to over 53,000 companies, totalling nearly £30 billion. Similarly, amid the growth of AI and tech, the research found VCT subsidy to be a critical funding source, with 37% of VCT funding directed towards AI, equating to £250 million of investment in this growth sector in the tax year 2020/21.

The Chancellor’s Autumn Statement indicated positive steps towards ensuring the future of UK-based enterprise, research and development. Announcements specified an extension of the VCT and EIS sunset clauses to 2035, with the extension set to receive legislation in the Autumn Finance Bill 2023.

Changes to R&D tax relief schemes were announced, including a merged scheme, combining the existing SME and RDEC schemes, and an improvement of the scheme for R&D intensive SME’s as the R&D expenditure threshold is reduced from 40% to 30%.

Steven Butcher, Tax Director at Price Bailey, comments on the announcements:

The new merged R&D scheme should be good news for companies who make claims under the existing RDEC scheme. It has been enhanced in several respects as part of the merger, including notional corporation tax charges on credits of 19% rather than 25% for loss-makers, resulting in cash flow improvements where credits are receivable.

The changes are the conclusion of a review of R&D tax reliefs to ensure the UK remains a competitive location for cutting-edge research, the reliefs continue to be fit for purpose, and taxpayer money is effectively targeted.

Butcher continues:

HMRC has however noted that further action may be needed to reduce the unacceptably high levels of non-compliance in the R&D reliefs, a compliance action plan is due to be published in due course.

The reforms to R&D tax reliefs come following the introduction of new requirements seen earlier in the year. New claimants must notify HMRC in advance of an R&D tax relief claim and all claimants must provide additional information via a separate return to HMRC before any R&D claim may be included in their corporation tax return.

HMRC have also increased the amount of detail required in R&D claims, publishing extensive further guidance clarifying their interpretation of the relevant rules and key definitions.

Butcher concludes:

With so much HMRC focus on R&D tax reliefs, it continues to be vital for claimants to ensure that all criteria are carefully considered and that required returns and information are provided to HMRC to mitigate the risk of any disruptive and costly enquiry process.

The role of R&D funding is critical for driving UK-based innovation and entrepreneurship in key sectors, such as those in AI and manufacturing. It’s good to see these items are clearly high on the Government’s agenda, which was reflected in the recent Autumn Statement.

-Ends-

15th November: Price Bailey recognised as a Top 5 employer in the accountancy sector

Price Bailey is once again awarded as a Top 5 Best Accountancy Firm to Work For, by Best Companies 2023, securing position 4 in the league tables.

This comes following an “outstanding” recognition by Best Companies in June 2023, where the firm received a 2-star accreditation for its exceptional commitment to employee engagement.

Price Bailey was also acknowledged as one of the top 50 Best Companies to Work For in the East of England and London and one of the top 75 Best Large Companies to Work For in the UK.

In the same year, the firm finished 20th in the Apprenticeships Top 100 Employers league table, and received the Workforce Developer award at the 2023 Cambridgeshire Chamber of Commerce Business Awards, recognising the “best of British business”.

Renowned for its people-focused culture, Price Bailey continues to champion a “Smart Working” policy, recognising that all employees have a life outside of work and placing emphases on working “smarter not harder”.

The firm also prioritises well-being and mental health, with volunteer Mental Health ambassadors helping individuals who may need urgent or impartial support and signposting – with all employee volunteers trained in Mental Health First Aid.

Commenting on the culture at Price Bailey, Martin Clapson, Managing Director, said:

Our goal at Price Bailey is to ensure that every employee finds fulfilment in the role and can see how their contributions allow us to deliver excellence to our clients.

“Our team thrives in a culture that values openness, curiosity and innovation and we empower our people to challenge the norm. This allows us to continually develop our offerings and services.

It’s great to see the firm awarded by Best Companies and we are committed to continuing to nurture the Price Bailey culture, prioritising our staff welfare, as we continue to grow and develop.”

2023 also marked the highest intake of trainee recruits to date for Price Bailey, with 41 new trainees joining the firm. In July, Duncan Crooks, a Senior Manager who leads the Resourcing function and specialises in trainee recruitment commented on the intake:

“We know that diverse talent can be found from all walks of life and academic backgrounds, so we are committed to ensuring that our trainee programmes are accessible to all young people who have a passion for accountancy and an eagerness to learn.

Our trainee programmes and the young talent they attract are the future of the firm and I’m delighted to welcome our 41 new starters.”

This year also marked the return of the firm’s annual in-person charity day following the pandemic.

The event, which was held in October, involved all four of the UK offices, with charitable activates including car washes, treasure hunts and a firm wide quiz, taking place across London, Norwich, Sawston and Bishop Stortford.

The firm’s volunteers were positioned at local train stations in Cambridge, London King’s Cross, London Charing Cross, Bishop’s Stortford and Norwich, gathering support and bucket collections from members of the public.

Price Bailey are soon due to announce the total amount raised, with the firm pledging to match the charitable donations up £50,000, which will be shared between the Samaritans and other local worthwhile causes.

-Ends-

17th October: Stephenson Smart join with Price Bailey to strengthen offering in Peterborough

Award-winning accounting firm Price Bailey and Stephenson Smart combine to strengthen their offering in Peterborough.

Price Bailey, a leading independent partner and employee-owned accountancy and business advisory firm based in East Anglia, is thrilled to announce that prominent Peterborough accountants, Stephenson Smart, has joined the Price Bailey group in an exciting new partnership aimed at strengthening the offering of both firms to the Peterborough marketplace.

With shared values and complementary strengths, the merger brings together two specialist and independent organisations, fostering collaboration and knowledge sharing to further enhance Stephenson Smart’s offering to their existing client base and the wider Peterborough market.

Pictured above outside the office in Peterborough from left to right: Price Bailey Partners; Robert Burborough, Simon Blake, Martin Clapson, Kerry Hilliard, Garry Wiles and Andrew Abbott.

Both firms recognise the importance of Peterborough, as a vibrant city with a growing owner-managed business market. The move marks their combined commitment to provide existing and new clients in the area with access to an enhanced range of services via Price Bailey’s specialist advisory teams, including tax, corporate finance, valuation, restructuring and insolvency & recovery services.

Current clients of Stephenson Smart will now be advised under the banner of Price Bailey while preserving the exceptional service they have become accustomed to and maintaining long-standing relationships with their trusted Stephenson Smart advisors. Through the announced merger, Stephenson Smart anticipates that its fantastic owner-managed client base will benefit from access to a wide array of supplementary services that will foster their individual growth and development.

Stephenson Smart will continue to operate from their existing Lynchwood office while benefiting from Price Bailey’s expansive geographical reach spanning London, East Anglia and overseas.

Pictured above: Managing Partner for Price Bailey, Martin Clapson, commented:

“My fellow partners and I are delighted to welcome Stephenson Smart into the Price Bailey fold. The wealth of experience, expertise and fantastic client relationships that the team at Stephenson Smart bring to the firm will play a vital role in expanding our presence within our local regions.

“The merger marks an exciting new chapter for both firms, and we look forward to working with Garry and the entire Stephenson Smart team in making this move a resounding success.”

Pictured above from left to right: Martin Clapson and Garry Willes. Garry Wiles, Partner added:

“We are thrilled to be joining Price Bailey. It was really important to the Partners at Stephenson Smart that we joined a larger firm with the people and the infrastructure to support us and our clients, but one that was still very much independent and that shared our values.

“This move positions us to deliver even greater value to our clients, leveraging the strengths of both firms and driving growth in the Peterborough and wider East Anglian market.

“We hope our existing clients will join us in celebrating this exciting new step for the firm, and I, my fellow partners and colleagues across Stephenson Smart look forward to discussing the new venture with our client base in the coming days.”

– Ends –

11th September: Launch of Influence 100 Financial Benchmarking Report 2023/24

Thursday 19th October 2023 / Novotel London West Hotel

www.membershipexcellence.com

We’re pleased to announce that Price Bailey will once again partner with the MemberWise Network to launch the Influence 100 Financial Benchmarking Report at Membership Excellence 2023 (19th October / London). The report is sponsored by ClearCourse.

This year the conference will focus attention on driving membership growth via optimised member retention, recruitment, value provision and engagement enhancement. This year’s report will be launched by Author and Price Bailey Partner, Helena Wilkinson in a dedicated session:

How the Largest Membership Bodies in the UK are performing against an Accelerating Measurable Growth objective

In this Official Financial Benchmarking Report (2023/24) Launch session, Helena will introduce the report, provide an overview of the largest and most influential membership bodies in the UK, and explore the similarities between/amongst sub-sectors that are achieving accelerated membership growth and those that are not.

Helena will also share some considerations/musings as to why and provide a commentary on financial/operational trends emerging during challenging times and consider potential approaches to ensure a robust, strategic and structured way forward.

30+ senior membership and association professional speakers will also present at the event, including the RSPB, The ET Foundation, CIPD, APM, The Ramblers, RIBA, CIHT and 24 other high-profile membership bodies.

Helena Wilkinson commented:

“The financial analysis this year will start to capture the effects on membership organisations emerging from the pandemic and look at the effects on their membership growth strategies. Inflation, cost of living crisis and climate change have taken over as the next challenge facing these bodies and insights into finances and trends remain crucial.”

In Response, MemberWise Network Founder, Richard Gott, responded:

“We’re proud to partner with Price Bailey for the fourth consecutive year to deliver the sector’s most high-profile annual financial benchmarking report. By understanding what the largest 100 membership bodies are doing in response to the current challenging business environment we can establish trends and respond to critical strategy and operational challenges in a more robust and informed manner. Thanks to the kind sponsorship of ClearCourse, we can make the report available free to the entire Membership & Association Sector”.

You can explore Helena’s session, view the programme, meet speakers, establish educational learning outcomes, explore the trade exhibition and book your places(s) online today. You can also see the current Influence 100 Benchmarking Report (2023) launch.

Price Bailey clients can enjoy 20% off the Standard ticket price (saving £59 per person) via this discount code (‘SECRET20’), or our group/delegation pass offer (saving up to 40%) is available via the official conference website.

Visit: www.membershipexcellence.com and book your place(s) today!

-Ends-

7th July: Price Bailey introduces more trainee opportunities

- Price Bailey is set to welcome 41 trainees in 2023, with the firm receiving nine new graduates and school leavers onto their trainee programmes in June.

- The firm will soon begin recruitment for its inaugural winter intake. This comes amid continued year on year growth in new trainees and a continued commitment to investing in talent at the early careers level.

Price Bailey’s trainee programmes offer opportunities for school leavers and graduates, which are funded by the Apprenticeship Levy, as well as those looking for shorter term industry placements.

To be considered for a place, school leavers must hold a minimum of 112 UCAS points, with graduates requiring a minimum of a 2:2 in any undergraduate degree subject.

Duncan Crooks, a Senior Manager who leads our Resourcing function and specialises in trainee recruitment said:

At Price Bailey, we know that diverse talent can be found from all walks of life and academic backgrounds, so we are committed to ensuring that our trainee programmes are accessible to all young people who have a passion for accountancy and an eagerness to learn.

“The biggest quality we look for in our trainee candidates, is the right attitude and a good level of numerical aptitude.

“Our trainees begin working with clients from day one, so having a good level of communication skills is also beneficial, as well as time management and a willingness to embody the PB way; being a team player, working hard and supporting their colleagues.”

Price Bailey’s trainee programmes run for between three and five years, with candidates sponsored to do their ACA qualifications and ultimately become a qualified accountant on completion of the programme.

Trainees have the opportunity to experience and ultimately specialise in numerous areas of expertise including Audit, Accounting, Tax and more.

Crooks continues:

“Our trainee programmes and the young talent they attract are the future of the firm, I’m delighted to welcome our 41 new starters and announce the launch of our new trainee winter intake programme.

“I wish all new starters every success in their future careers.”

Price Bailey will begin its February 2024 trainee recruitment at the end of July.

-Ends-

2nd May: Greg Mayne, international VAT specialist, joins Price Bailey

Price Bailey appoints new international VAT partner Greg Mayne who joins on 2 May 2023, as part of the firm’s continued investment into its tax services.

Greg has particular expertise in international VAT , supply chain and cross-border trade, and complex VAT issues, including assisting clients with international customs duty.

Greg’s appointment marks further investment into the Price Bailey Tax team and follows the appointment of tax partner Andrew Park and the promotion of Gemma Thake to partner last month. Greg will work alongside Richard Grimster, Head of Tax and the other tax partners as the firm further enhances its tax offering to clients.

Pictured from left to right: Martin Clapson, Managing Director, Greg Mayne, VAT Partner and Rich Grimster, Head of Tax

Commenting on his new appointment, Greg said:

“I am delighted to join Price Bailey and look forward to supporting clients and colleagues as we grow our international VAT service offering.

“There is already a wealth of talent within Price Bailey, and I am excited by the prospect and opportunity to add to this.”

Price Bailey Managing Director, Martin Clapson, added

“The Board and I are pleased to welcome Greg to the Price Bailey Tax team as we move to further strengthen our range of tax services.”

“Greg will play a crucial role in us offering an even greater breadth of service as we continue to support our clients through growth, expansion and development both nationally and overseas.”

“We have seen a significant investment in our partnership team over the last few months, and with Greg joining, we now have 36 partners across Price Bailey all committed to the long-term success of the firm.”

-Ends-

6th April: Price Bailey attends the opening of the CWEIC’s Singapore Hub

April marks the opening of The Commonwealth Enterprise and Investment Council’s Singapore Hub, with the launch event hosted by the British High Commission in Singapore, uniting business leaders from across the globe.

06 April 2023

The Hub is now expected to provide on-going support for CWEIC Strategic Partners in the Singapore and ASEAN region, through in-market activities and facilitating introductions and opportunities.

Simon Blake, Partner in the Strategic Corporate Finance team at Price Bailey Chartered Accountants attended the launch event alongside international focussed UK law firm Irwin Mitchell.

Simon comments: “The launch of the Singapore Hub reflects the CWEIC’s on-going commitment to increase global awareness of the Commonwealth advantage.

“The Commonwealth represents the world’s largest emerging markets, in Africa and the Indian sub-continent as well as in Asia.

“Many of our clients already operate across these regions with opportunities for many more clients in the future.

“It was great to visit Singapore and build on our relationships within the CWEIC, supporting our clients orientated towards growth in international markets, as well as global clients looking for support with their UK business”.

Pictured from right to left: Rob Cowling and Bryan Blesto from Irwin Mitchell, Niro Cooke and Tulsi Wallooppillai from the CWEIC, Simon Blake from Price Bailey, Guy Dru Drury, Chief Representative for the CBI in China, NE & SE Asia.

Simon continues: “As an organisation, Price Bailey invests heavily its international relationships, with partners attending meetings and conferences pro-actively across the world and supporting our global clients from overseas offices such as our Dubai office.

“Recently, Price Bailey has been appointed to act for a multijurisdictional African based client who is looking to expand globally through a London based holding company and ultimately, to go on to list on the UK stock exchange.